Premium Only Content

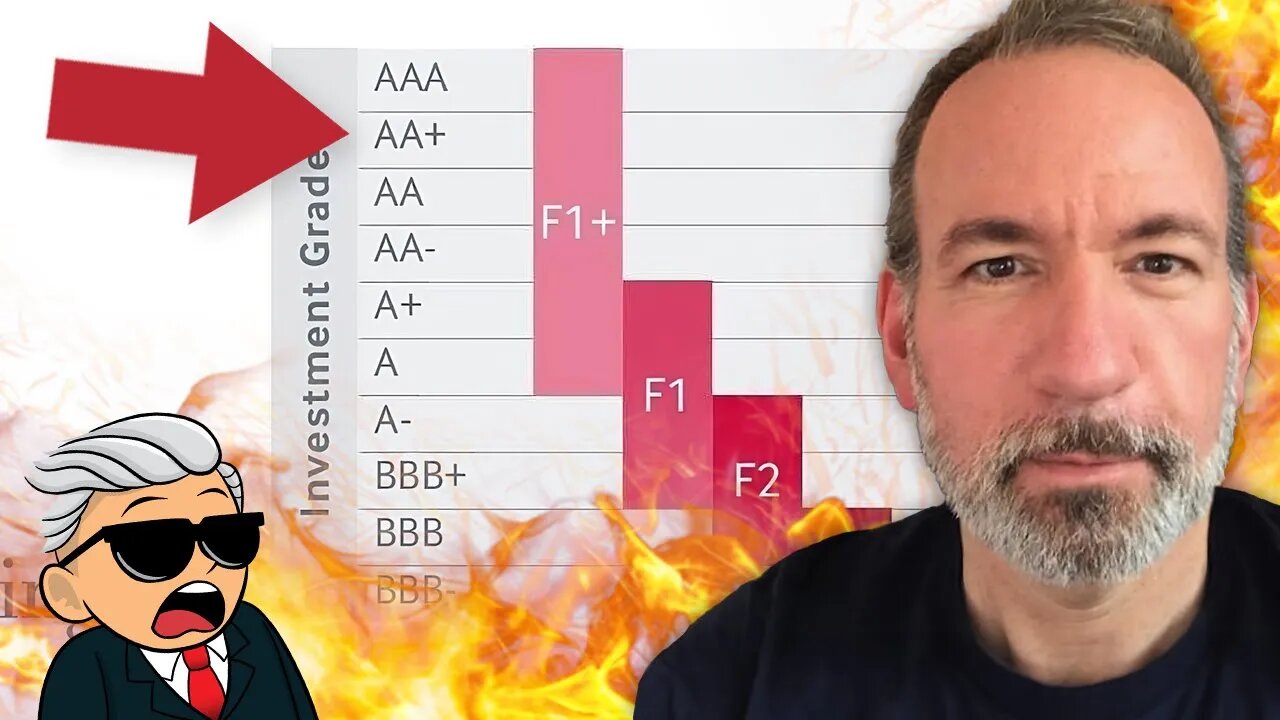

US Government Credit Rating Downgraded | Impact on Economy Explained! ft. Peter St Onge

In this video, Peter talks about the impact of Fitch's recent federal debt downgrade. With rising deficits and a risky debt-to-GDP ratio, the US faces higher interest rates on government debt, potentially pushing debt service to a staggering $2 trillion. Are we heading towards an economic crisis? Find out now!

Peter St Onge from @Profstonge has granted us permission to upload this video for our audience.

Peter's Twitter: https://twitter.com/profstonge?s=20

Peter's Substack: https://stonge.substack.com/

Peter's Website: https://peterstonge.com/

Twitter - https://twitter.com/WallStreetSilv

Instagram - https://www.instagram.com/wallstreetsilver/

Telegram - https://t.me/s/WallStreetSilver

Facebook - https://www.facebook.com/Wall-Street-Silver-103206701843254

Hey guys! Let’s try and break 1,000 likes on this video!

Don’t forget to SUBSCRIBE to the channel if you enjoy the video, and don’t forget to hit the bell so you don’t miss any future uploads!

DISCLAIMERS/TERMS/RULES:

► I am not a professional financial adviser, nor do I offer financial advice. This video is for entertainment only. Please consult your investment and tax experts for financial advice.

#silver #wallstreetsilver #gold #preciousmetals #silvergoldbull #Wall #Street #Reddit #Platinum #CurrencyReset #Reset #Silversqueeze #Fed #November2021 #2021 #worse #restart #financecommunity #stockexchange #inflation #preciousmetals #finance #banks #financecrash #gold #economy #money #economiccrisis #broke #credit #inflation #purchasingpower #systemchange #crisis #crash #marketing #insolvency #profit #bitcoin #Cryptocurrency #politics #media #stockmarket #stocks

-

15:21

15:21

Wall Street Silver

1 year ago $0.28 earnedGold & Silver Prices About To BURST! What's Next?

1.1K3 -

1:02:30

1:02:30

VINCE

3 hours agoGavin Newsom Is A Major Trump Fan | Episode 114 - 08/29/25

141K87 -

1:32:10

1:32:10

Nikko Ortiz

2 hours agoPainful Life Experiences

17.2K5 -

1:42:16

1:42:16

Dear America

3 hours agoThe Left Chooses TRANS Over Christianity!! WOKE Mayor Is Doubling Down!!

88.1K53 -

LIVE

LIVE

Caleb Hammer

1 hour agoGaslighting. Toxic. B*tch. | Financial Audit

121 watching -

LIVE

LIVE

Viss

1 hour ago🔴LIVE - Positioning, Tactics, Strategy How To PUBG! - PUBG 101

113 watching -

LIVE

LIVE

The Big Mig™

3 hours agoThe Return Of Law & Order w/ Sheriff Mack

5,166 watching -

LIVE

LIVE

Major League Fishing

7 days agoLIVE! - Fishing Clash Team Series: Challenge Cup - Day 6

193 watching -

46:02

46:02

Barry Cunningham

17 hours agoWhat Are They Not Telling Us About These Drugs?

8.02K3 -

1:49:51

1:49:51

Badlands Media

10 hours agoBadlands Daily: August 29, 2025

24.5K6