Premium Only Content

The Origins of Money

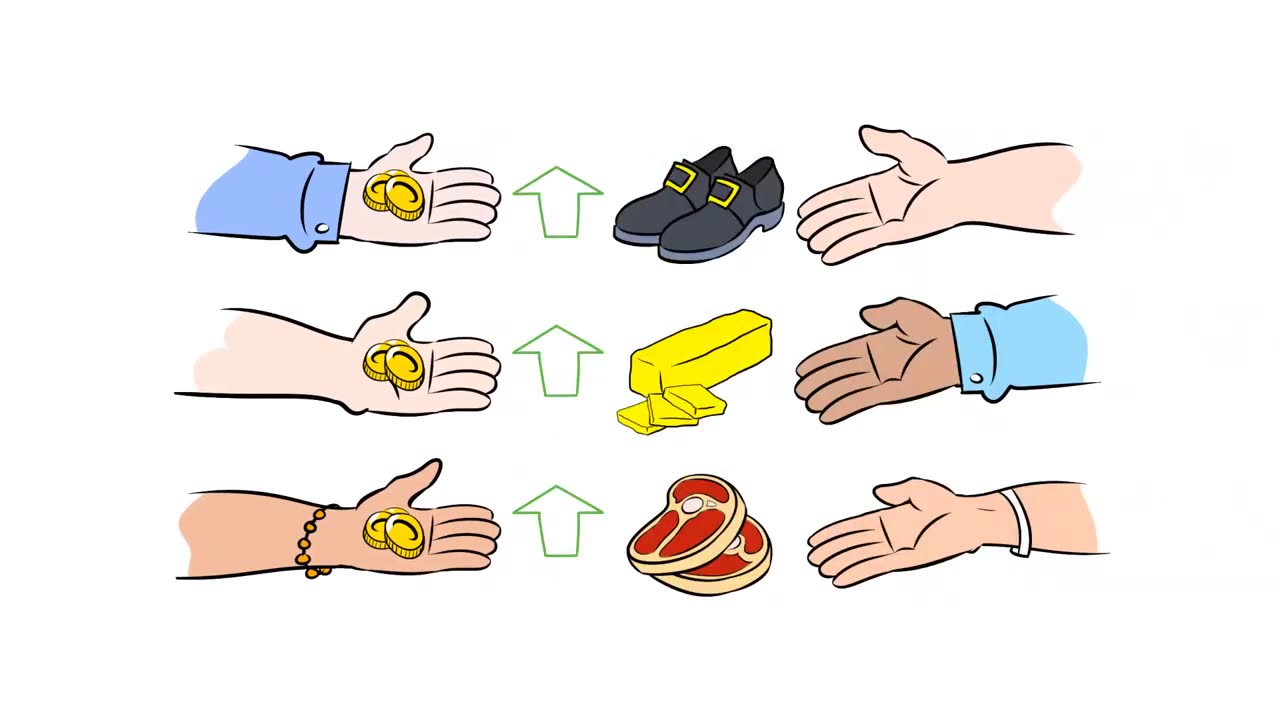

Before money, there was barter—a direct exchange of goods or services between humans. It is this economic behavior that is the foundation of civilization.

If no one could exchange, and if we were forced to be completely self-sufficient, most of us would starve to death, and the rest would barely remain alive.

Exchange is the lifeblood, not only of our economy, but of human existence.

A barter system has two basic problems: indivisibility and lack of coinciding wants.

Imagine that a farmer wants to buy a pair of shoes, but the cobbler does not want eggs. He may want beef, but the farmer is not willing to slaughter his cow for shoes. A trade where both are happy is now difficult.

Any sort of advanced economy is impossible with simple direct exchange.

But humanity adapted. How? Indirect exchange.

Consider our farmer. Instead of offering eggs, he finds what the cobbler really wants—butter. He now exchanges butter for shoes. If enough people also want butter, our farmer may buy more—not to use it, but to exchange it for other goods and services.

Many goods have played this role in the past: tobacco in colonial Virginia, sugar in the West Indies, copper in ancient Egypt. Historically, gold and silver emerged as a widely accepted medium of exchange in a free market. This is not only because metal can be converted into durable and transportable units, like coins, but also because both have long been desired for their beauty and practical use.

This process—the cumulative development of a medium of exchange on the free market—is the only way money can become established from barter.

This market process allows for prices to emerge between a medium of exchange and other goods and services—without this, it would be impossible for money to be properly valued. As we will see, government can manipulate the value of money—but it is powerless to create it from nothing.

As such, money did not begin as an abstract unit of account; it was not a useless token only good for exchanging; it was not a "claim on society." It was simply a commodity. Like commodities, its "price"—in terms of other goods—is still determined by supply and demand today.

When there is a high demand for money—perhaps because people are uncertain about the future and save more—the price of money goes up, which means the prices of goods and services go down. When the demand for money drops—perhaps because it is feared it will be worth less tomorrow—consumers will be more willing to spend, which means prices go up.

When competing currencies exist, prices may also change between different monies. In the past, consumer demand could change the value of silver to gold. Today it may change the exchange ratio of dollars to euros. These exchange rates can shift freely on the market.

But how did we go from money as gold and silver to the dollars and euros we have now?

To understand that, we must first understand the service that emerged as the result of money: banking.

-

LIVE

LIVE

MadHouseRetro

2 hours agoMadhouse Presents : Triple Warbricks Model build! Sponsored by Warbricks USA!!!!

55 watching -

LIVE

LIVE

TheItalianCEO

3 hours agoRumble is for pirates - Sea of Thieves top 250 in the world

281 watching -

10:29

10:29

Mrgunsngear

1 day ago $8.29 earnedOtter Creek OCM5: The Quietest MK12 Silencer To Date 🇺🇸

57.3K21 -

40:30

40:30

Kitco NEWS

1 day ago2030 Commodity Surge: What to Buy Before Prices Explode | Adam Rozencwajg

15K2 -

4:13:02

4:13:02

EXPBLESS

5 hours agoBig Robots Shooting Eachother Seems Pretty Fun - Steel Hunter's LIVE

16.2K2 -

25:29

25:29

The Dr. Ardis Show

2 days ago $4.24 earnedThe Dr. Ardis Show | Economic Update with Kirk Elliot | Episode 05.30.2025

17.8K3 -

10:27

10:27

Professor Gerdes Explains 🇺🇦

1 day agoEx CIA Director: This Nation is Putin's NEXT Target Urgent Warning

14.3K20 -

3:50:32

3:50:32

Biscotti-B23

4 hours ago $0.32 earned🔴 LIVE SURPRISE BETA 🏆 CUSTOM MATCHES & ELITE RANK GRIND ⚽ REMATCH

11.4K -

10:05

10:05

ARFCOM News

2 days ago $0.70 earnedCan They Track Your Prints? | CtrlPew BANNED | Short Barrels LEGALIZED | Corrupt Sheriff Sold Badges

7.86K12 -

33:39

33:39

Tactical Advisor

1 day agoNew Handguns | Vault Room Live Stream 026

49.7K7