Premium Only Content

Does the 4% withdrawal rule still make sense today?!

Are you ready to question the financial norms? We're uncovering the fascinating resilience of the 4% rule since its inception in the early 90s, challenging its journey through constant global disruptions. The concept of this rule isn’t the only thing we dissect. We're also asking hard questions about the assumptions behind investment growth rates - how reliable are they in our rapidly changing world? This episode is designed to make you think, to question, and to challenge financial norms.

But wait, we're not stopping there. We're also investigating the impact of global events on our investment portfolios. From the rise of cryptocurrencies to the impact of COVID on the global supply chain, we're examining it all. In addition, we're exploring the psychology behind investing. Why is index investing so widely accepted, and are investment firms really the powerhouse they're made out to be? This episode is more than just economics, it's about breaking down barriers and encouraging you to think beyond the norm. So, sit back and get ready for a thought-provoking discussion that will leave you questioning everything you thought you knew about finance.

________________________________________________________________

Thanks to our sponsor, S.E.E.D. Planning Group! S.E.E.D. is a fee-only financial planning firm with a fiduciary obligation to put your best interest first. Schedule your free discovery meeting at www.seedpg.com

📧 For more information or to get in touch with us, visit https://www.ditchthesuits.com/ or email us at info@ditchthesuits.com

👍🏼 You can also follow us on social media at @ditchthesuits

✅ Facebook - https://www.facebook.com/DitchTheSuits

✅ Instagram - https://www.instagram.com/ditchthesuits/

✅ Twitter - https://twitter.com/DitchtheSuits

⭐⭐⭐⭐⭐ We'd also love for you to subscribe to this podcast and leave a 5-star rating and review

-

LIVE

LIVE

GussyWussie

6 hours agoReturning to one of the Best Zelda Games - Breath of the Wild

495 watching -

LIVE

LIVE

Wahzdee

2 hours agoMorning Grind: Arena Breakout vs Tarkov Showdown 🎮 - Wahzvember Day 25

440 watching -

0:41

0:41

World Nomac

17 hours agoThe side of Las Vegas they don't want you to know about

6.89K -

LIVE

LIVE

Film Threat

7 hours agoVERSUS: WICKED VS GLADIATOR II | Film Threat Versus

265 watching -

2:06:30

2:06:30

Barstool Yak

7 hours agoThe Yak with Big Cat & Co. Presented by Rhoback | The Yak 11-25-24

16.2K3 -

1:43:44

1:43:44

The Quartering

5 hours agoDr Disrespect Leaves Youtube For Rumble! With Rumble CEO Chris Pavlovski

102K54 -

50:55

50:55

Grant Stinchfield

3 hours ago $0.99 earnedMy Trip To The Emergency Room Exposed the Our Joke of a Health Care System

10.2K3 -

DVR

DVR

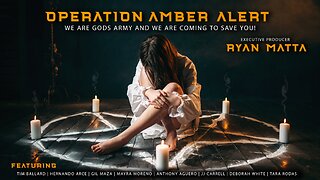

RyanMatta

1 day ago $1.82 earnedOPERATION AMBER ALERT | CHILD TRAFFICKING DOCUMENTARY | EXECUTIVE PRODUCER RYAN MATTA

9.07K12 -

14:14

14:14

TimcastIRL

1 day agoJoe Rogan ROASTS The View For Saying He BELIEVES IN DRAGONS In HILARIOUS MOCKERY

48.4K81 -

2:17:04

2:17:04

Side Scrollers Podcast

6 hours agoDoc Disrespect ON RUMBLE, PlayStation To Rival Nintendo | Side Scrollers

44.5K6