Premium Only Content

Beneath the Bull Market: Unpacking The Data The Stock Market Is Ignoring

🟢 BOOKMAP DISCOUNT (PROMO CODE "BM20" for 20% off the monthly plans): https://bookmap.com/members/aff/go/figuringoutmoney?i=79

🟢 TRADE IDEAS & DISCORD: https://www.patreon.com/figuringoutmoney

🟢 TRADE WITH IBKR: http://bit.ly/3mIUUfC

___________________________________________________________________________________________

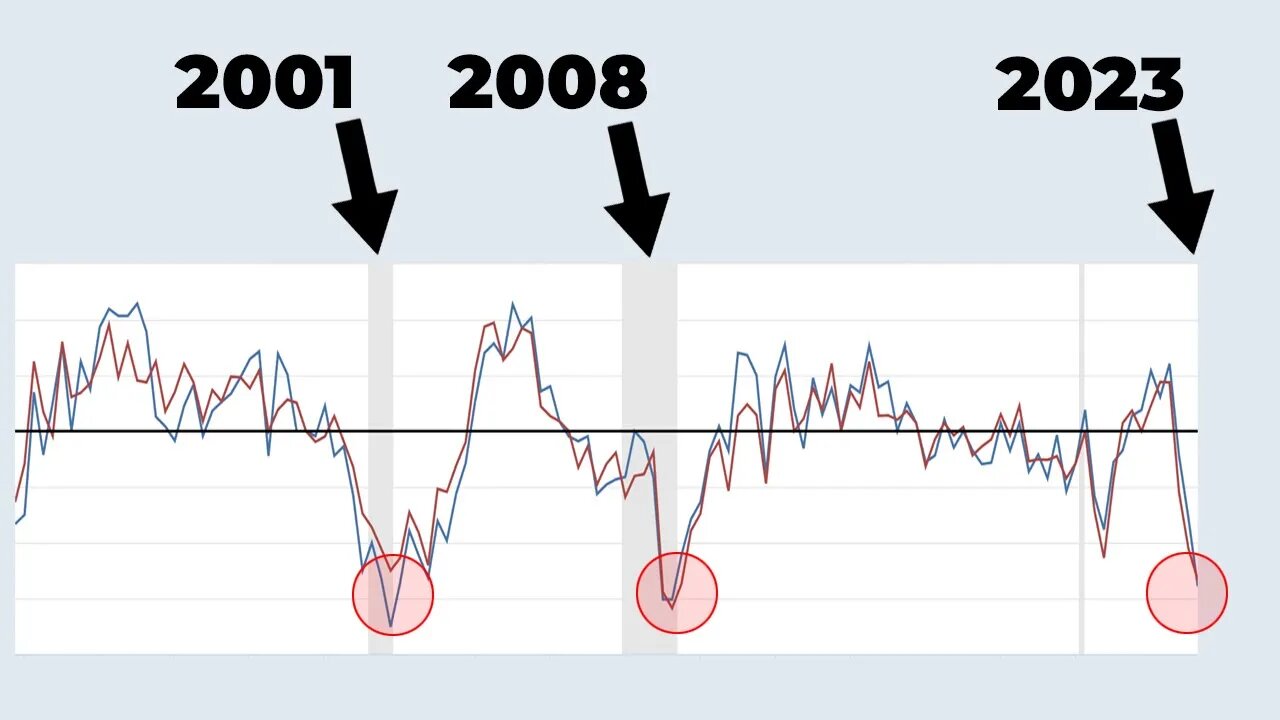

In this video, Michael Silva discusses the intriguing contrast between the seemingly bullish behavior of the stock market and the underlying economic data. Despite numerous claims of a new bull market, largely influenced by the advent of zero DTE options since 2022, there's uncertainty about how these might shape the future of bear markets. Amid the volatility, we have seen sectors such as tech making significant moves, underpinning the market’s fluctuation.

Silva dives deeper into the macroeconomic indicators that often fly under the radar. One of the key points he highlights is the impact of Federal Reserve's tightening on the economy. He emphasizes Marty Zweig's rule: "Don't fight the Fed." In line with this rule, Silva explores the Fed's balance sheet, indicating that despite a short-lived spike during the banking crisis, it’s now back to tightening.

He further illustrates how increasing interest rates typically discourage spending, an effect that can be clearly seen in retail sectors. Silva also brings to light contraction in credit growth, an indicator that has historically been linked with recessions. Data from various sectors, such as domestic banks' willingness to provide consumer loans and the demand for commercial and industrial loans, also signal a tightening market. In spite of this, he points out that people are taking more home equity lines of credit (HELOC), often for high-risk activities like stock market investment, indicative of potential economic strain.

In conclusion, Silva suggests that despite the market's bullish surface, deeper economic indicators point towards tightening and potential future challenges. These hidden aspects of the economy have yet to significantly impact the stock market, but awareness and understanding of these signals are essential for informed investment decisions.

🔔 Subscribe now and never miss an update: https://www.youtube.com/c/figuringoutmoney?sub_confirmation=1

📧 For business inquiries or collaboration opportunities, please contact us at FiguringOutMoney@gmail.com

📈 Follow us on social media for more insights and updates:

🟢 Instagram: https://www.instagram.com/figuringoutmoney

🟢 Twitter: https://twitter.com/mikepsilva

______________________________________________________________________________________________

How To Predict How Far Stocks Can Go (EXPECTED MOVES):

○ https://youtu.be/JT32L89ZpEk

Saylor To Schiff Bitcoin Indicator:

○ https://youtu.be/zuG9Tjnud9k

Show Me The Money Scan:

○ https://youtu.be/dzRjEuUUb5g

Party Starter Scan:

○ https://youtu.be/zzaN91gcJOI

Bouncy Ball Scan:

○ https://youtu.be/7xKOo6vNaq8

Dark Money Scan:

○ https://youtu.be/ZUMuHaSg1ro

Sleepy Monster Scan:

○ https://youtu.be/C9EQkA7uVU8

High Volatility Scan:

○ https://youtu.be/VC327ko8DfE

______________________________________________________________________________________________

DISCLAIMER: I am not a professional investment advisor, nor do I claim to be. All my videos are for entertainment and educational purposes only. This is not trading advice. I am wrong all the time. Everything you watch on my channel is my opinion. Links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel :)

#Stockmarket #StockMarketAnalysis #DayTrading

#CPIReport

#Macroeconomics

#MarketAnalysis

#ImpliedVolatility

#SPY

#QQQ

#IWM

#TechnicalAnalysis

#TradeIdeas

#Investing

#Trading

#StockMarket

#FinancialNews

-

11:07

11:07

Figuring Out Money

1 year agoGet A Closer Look At This Stock Market Rally!

71 -

LIVE

LIVE

LFA TV

11 hours agoLFA TV ALL DAY STREAM - TUESDAY 8/19/25

1,011 watching -

2:11:18

2:11:18

The Quartering

4 hours agoToday's Breaking News! Disgusting Grocery Shopping "Haul" Goes Viral, Las Vegas Collapse & More

85.4K31 -

LIVE

LIVE

StoneMountain64

5 hours agoBest Extraction shooter is FINALLY on Console (+CoD Reveal Today)

191 watching -

3:04:51

3:04:51

Due Dissidence

7 hours agoZelensky RETURNS To DC, HUGE Protests In Israel, Gal Gadot Blames Palestine For Flop, MSNBC Rebrands

31.4K18 -

1:19:29

1:19:29

The HotSeat

3 hours ago🚨 Dems Swear Mail-In Voting Is “Secure”… Trump Says HELL NO 🚨

14.2K9 -

Reidboyy

9 hours ago $0.71 earnedNEW FREE FPS OUT ON CONSOLE TODAY! (Delta Force = BF6 Jr.)

27K -

29:20

29:20

Stephen Gardner

3 hours ago🔥YES! Trump unleashes Democrats’ worst nightmare!

16.9K10 -

![[Ep 731] Trump Leading the World | Islam NOT Compatible with West | Guest Sam Anthony [your[NEWS](https://1a-1791.com/video/fww1/93/s8/1/c/n/K/a/cnKaz.0kob-small-Ep-731-Trump-Leading-the-Wo.jpg) LIVE

LIVE

The Nunn Report - w/ Dan Nunn

3 hours ago[Ep 731] Trump Leading the World | Islam NOT Compatible with West | Guest Sam Anthony [your[NEWS

92 watching -

2:05:30

2:05:30

Side Scrollers Podcast

7 hours agoEveryone Hates MrBeast + FBI Spends $140k on Pokemon + All Todays News | Side Scrollers Live

84.9K4