Premium Only Content

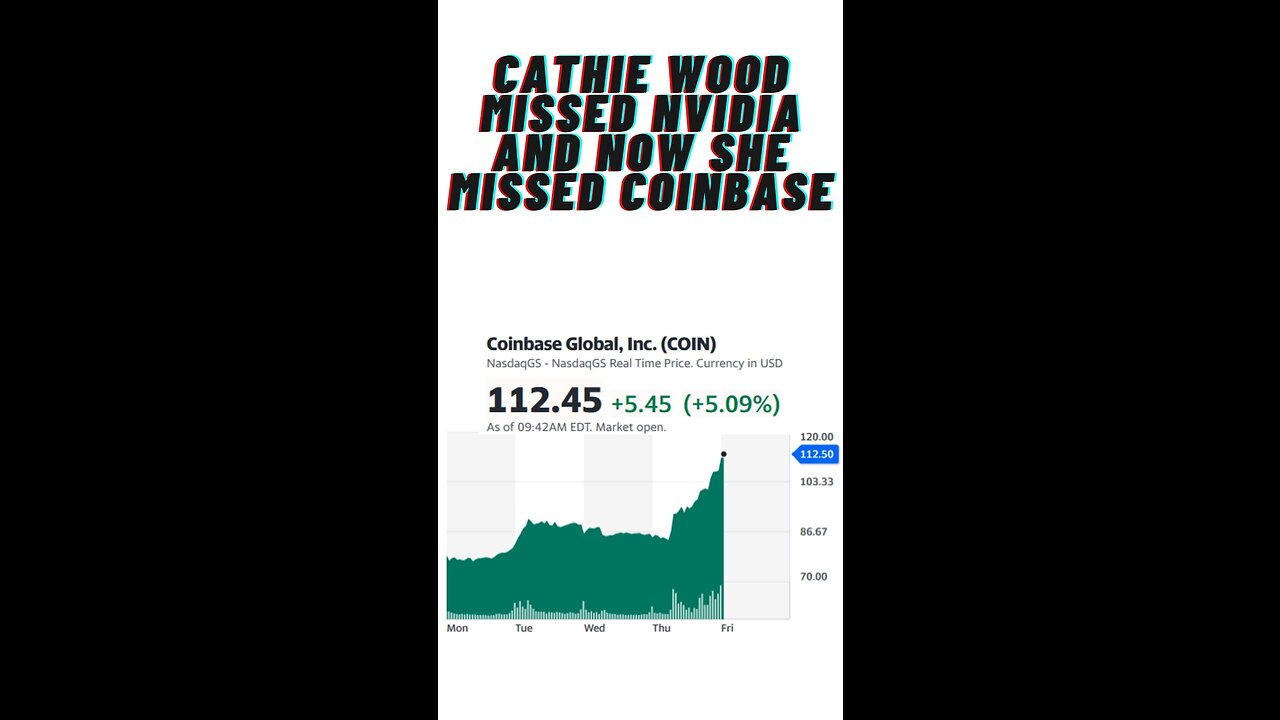

Cathie Wood missed Nvidia and now she missed Coinbase

Cathie Wood missed Nvidia and now she missed Coinbase

ARKK is an ETF that invests in “disruptive innovation” that could potentially change the way the work works. However, ARKK, and its CEO Cathie Wood, seem to continuously make bad bets and miss the most disruptive and world changing technology time after time.

I told your previously how Cathie Wood sold Nvidia stock before its enormous surge in stock price. How could ARKK and Wood not predict that artificial intelligence would need the chips Nvidia sells?

Recently, Cathie Wood sold 135,000 shares of Coinbase around the time the price hit $90.

On July 13th, a US Judge ruled that Ripple XRP was not a security. This sent Coinbase shares surging to above $110 a share. This strikes a blow to the idea that securities are being traded on exchanges like Coinbase.

Currently Coinbase is fighting the SEC over whether or not crypto assets are securities that would give the SEC jurisdiction to police them.

I would argue that the SEC has refused to work with Coinbase and other firms.

Coinbase is listed as a custodian for several spot Bitcoin ETFs, which is fueling a lot of the its share price appreciation.

Tags:

coinbase, coinbase lawsuit, coinbase sec, sec coinbase, coinbase news, coinbase ceo, coinbase sec lawsuit, coinbase vs sec, coinbase sues sec, brian armstrong coinbase, coinbase wells notice, coinbase and sec, sec vs coinbase, coinbase stock, coinbase crypto, sec sues coinbase, coinbase app, coinbase v sec, security and exchange commission, coinbase judge, coinbase vs sev, coinbase sue sec, coinbase sec news, coinbase files sec, coinbase security

-

3:46

3:46

The Last Capitalist in Chicago

1 year ago $0.06 earnedReturn to office policies are not working

174 -

LIVE

LIVE

Sm0k3m

3 hours agoNew Years Eve | Good bye 2024

328 watching -

2:01

2:01

Steven Crowder

3 hours agoCROWDER CLASSICS: Seasons of Trump (RENT Parody)

51.7K8 -

27:27

27:27

SB Mowing

3 days agoMessaging me was their LAST RESORT

26.1K10 -

2:22:07

2:22:07

Matt Kohrs

12 hours agoFarewell 2024! || The MK Show

33.8K5 -

33:50

33:50

Grant Stinchfield

3 hours ago $5.53 earnedFlying Vaccinators are Very Real... Bill Gates's Mosquito Army Exposed

25.3K16 -

48:16

48:16

Out & About

7 hours agoNew Year's Eve Special: The Ins & Outs of 2025 | Out & About Ep. 337

34.2K6 -

1:14:10

1:14:10

2 MIKES LIVE

3 hours agoTHE MIKE SCHWARTZ SHOW with DR. MICHAEL J SCHWARTZ 12-31-2024

28.9K5 -

4:46:32

4:46:32

SoundBoardLord

5 hours ago🟢 LIVE - THE BEST TEAM ON RUMBLE DOMINATING MARVEL RIVALS!!

38.3K5 -

2:04:22

2:04:22

AP4Liberty

5 hours ago $2.82 earned2024: The Year of Political Circus

27.7K