Premium Only Content

The Best Strategy To Use For "Diversifying Your Investment Portfolio with Bitcoin"

https://rebrand.ly/Goldco3

Sign up Now

The Best Strategy To Use For "Diversifying Your Investment Portfolio with Bitcoin", bitcoininvest

Goldco aids customers safeguard their retired life savings by rolling over their existing IRA, 401(k), 403(b) or other certified retirement account to a Gold IRA. ... To learn just how safe haven precious metals can aid you build and safeguard your wide range, as well as also secure your retired life telephone call today bitcoininvest.

Goldco is just one of the premier Precious Metals IRA firms in the United States. Secure your riches and income with physical precious metals like gold ...bitcoininvest.

The Pros and Cons of Investing in Bitcoin

Putting in in Bitcoin has come to be progressively popular over the past many years. Along with its swift growth in market value and the ability for considerable gains, numerous people are brought in to this electronic unit of currency. Having said that, as along with any type of expenditure, there are both pros and disadvantages to consider prior to leaping into the world of Bitcoin. In this blog blog post, we are going to discover the perks and downsides of putting in in Bitcoin.

Pros:

1. Possible for High Returns: One of the principal main reasons people spend in Bitcoin is the possibility for high gains. Over the years, Bitcoin has experienced substantial rate boost, creating very early clients rather well-off. For instance, if you had invested $100 in Bitcoin back in 2010, it would have been worth over $28 million through December 2020.

2. Decentralization: Unlike standard money that are controlled by main banks or governments, Bitcoin operates on a decentralized system gotten in touch with blockchain innovation. This indicates that no single entity has actually command over the money or can easily control its worth. For those who favor freedom from authorities requirements and monetary policies, spending in Bitcoin offers an alternative choice.

3. Convenience of Access: Investing in Bitcoin is relatively simple compared to various other assets possibilities like supplies or actual estate. All you need is a smartphone or pc along with web get access to to buy and offer Bitcoins with on the web systems recognized as exchanges.

4. Assets: Another benefit of committing in Bitcoin is its liquidity. Unlike some expenditures that may take time to turn into money when required, Bitcoins can be conveniently marketed on different exchanges within moments.

5. Variation: Featuring Bitcoin as part of your investment collection may offer variation advantages since it's not directly linked to traditional property lessons like stocks or connects.

Cons:

1.Volatility: The volatility of Bitcoin is possibly one of its greatest disadvantages for real estate investors seeking stability and safety and security. The rate of Bitcoin can vary considerably within a quick time period, which might lead to sizable increases or losses. This dryness produces it a high-risk assets, especially for those with a low-risk endurance.

2. Regulative Concerns: Bitcoin functions outside the traditional economic body, which has elevated worries one of regulators worldwide. Authorities are still struggling with how to moderate cryptocurrencies successfully, which could possibly lead to possible regulations or also bans in certain legal systems.

3. Safety Threats: While Bitcoin itself is safe due to its blockchain modern technology, putting in in Bitcoin reveals people to protection risks. Cyberpunks might target cryptocurrency swaps or wallets, leading to fraud of funds.

4. Shortage of Regulation and Protection: Unlike conventional investments that are backed through regulative bodies like the Securities and Exchange Commission (SEC), Bitcoin investments do not possess the very same degree of security. In the celebration of fraudulence or loss, capitalists might have limited legal choice.

5. Limited Acceptance: Although Bitcoin has obtained attraction over the years, it is still not widely allowed as a type of repayment reviewed to fiat currencies. The restricted recognition may limit its power and potential for mainstream adoption.

In verdict, spending in Bitcoin happens with both pros and drawbacks that real estate investors need to properly take into consideration just before producing any kind of choices. While there is actually possible for substantial returns and decentralized command, financiers need to likewise be consciou...

-

1:08:49

1:08:49

Kim Iversen

3 hours agoEpstein Island: What's With The Creepy Medical Chair and Masks?

30.9K28 -

23:54

23:54

Jasmin Laine

4 hours agoCarney’s WORST Day EVER—BOOED, Fact-Checked, and Forced to FLEE the House

12.9K13 -

1:59:47

1:59:47

Redacted News

4 hours agoDeep State Coup Coming for Trump? New JFK Files Released and NATO Preparing Attack on Russia

151K81 -

7:31:43

7:31:43

Dr Disrespect

9 hours ago🔴LIVE - DR DISRESPECT'S TRIPLE THREAT CHALLENGE - ARC RAIDERS • BF6 • FORTNITE

91.1K6 -

1:00:57

1:00:57

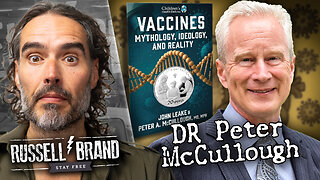

Russell Brand

6 hours agoThe Vaccine Ideology Unmasked | Dr Peter McCullough - SF658

117K37 -

1:11:25

1:11:25

vivafrei

5 hours agoKash Patel's Jacket-Gate! Pfizer Whistleblower Qui Tam on Appeal! Meanwhile in Canada! AND MORE!

64.2K44 -

16:30

16:30

Clintonjaws

9 hours ago $7.32 earnedEntire Room Speechless as Pete Hegseth Snaps Destroying All Media To Their Face

38.6K15 -

22:12

22:12

Dad Saves America

5 hours ago $0.71 earnedHow Greek Philosophers Created Western Civilization: The Death of Debate - Pt 2

19.3K3 -

LIVE

LIVE

LFA TV

21 hours agoLIVE & BREAKING NEWS! | WEDNESDAY 12/03/25

890 watching -

1:05:46

1:05:46

The Quartering

6 hours agoNew Epstein Video Drops! The US Economy Has SCARY Numbers Released & More

131K35