Premium Only Content

Rumored Buzz on "Understanding the Factors that Influence the Price of Gold"

https://rebrand.ly/Goldco2

Join Now

Rumored Buzz on "Understanding the Factors that Influence the Price of Gold", to invest in gold

Goldco assists customers safeguard their retirement cost savings by rolling over their existing IRA, 401(k), 403(b) or various other qualified pension to a Gold IRA. ... To find out how safe house rare-earth elements can assist you construct as well as secure your wealth, as well as even protect your retirement telephone call today to invest in gold.

Goldco is just one of the premier Precious Metals IRA firms in the United States. Shield your wealth and also income with physical precious metals like gold ...to invest in gold.

Understanding the Variables that Affect the Price of Gold

Gold has constantly stored a special glamor for mankind. Its thrilling appeal, one of a kind, and resilience have created it one of the most sought-after precious metallics throughout past history. But beyond its cosmetic beauty, gold likewise offers as an crucial establishment of market value and a hedge against rising cost of living. Capitalists and traders carefully check its cost fluctuations, as they can give useful understandings right into the overall health and wellness of the global economic condition.

The cost of gold is influenced by a great deal of variables, ranging from economic clues to geopolitical celebrations. Understanding these factors is vital for clients who wish to produce informed decisions about buying or offering gold. In this write-up, we will definitely explore some of the essential factors that affect the cost of gold.

1. Supply and Requirement

Like any kind of various other product, gold's price is predominantly steered through source and requirement dynamics. The total supply of gold happens from exploration functions, core banking company reserves, and recycled fragment. On the requirement edge, precious jewelry production, expenditure demand (consisting of exchange-traded funds or ETFs), main banking company acquisitions, and commercial usage play substantial jobs.

Improvements in either the source or demand can affect gold prices dramatically. For instance, if there is actually an boost in fashion jewelry requirement in the course of joyful seasons in certain countries like India or China – two major consumers of gold – it may steer up costs due to enhanced competition for minimal supplies.

2. Central Bank Policies

Central banks keep significant amounts of gold as component of their international books. Their purchase or selling activities can easily have a significant effect on gold prices. When central financial institutions are web customers (i.e., acquiring even more than they market), it suggests assurance in their corresponding economic climates and can easily lead to much higher costs.

Alternatively, when core banks become internet vendors (i.e., selling even more than they purchase), it may signal a shortage of peace of mind in potential financial ailments and might placed descending stress on costs.

3. Inflation Desires

Gold has long been taken into consideration a hedge against inflation. When inflationary stress are higher, investors often switch to gold as a shop of market value. This improved requirement can drive up costs.

Moreover, the requirements of potential rising cost of living may also influence gold prices. If financiers foresee higher rising cost of living in the future, they may purchase gold as a preventative solution, leading to an increase in prices.

4. Financial and Political Uncertainty

Gold has generally grown throughout times of economic and political unpredictability. When there are problems concerning the security of monetary markets or geopolitical pressures arise, real estate investors usually tend to seek safe-haven possessions like gold.

For instance, throughout the worldwide monetary dilemma in 2008, the rate of gold skyrocketed as clients found refuge coming from inconsistent sell markets and falling home values. In a similar way, during the course of political situations or wars, gold costs tend to rise due to increased need for a dependable resource.

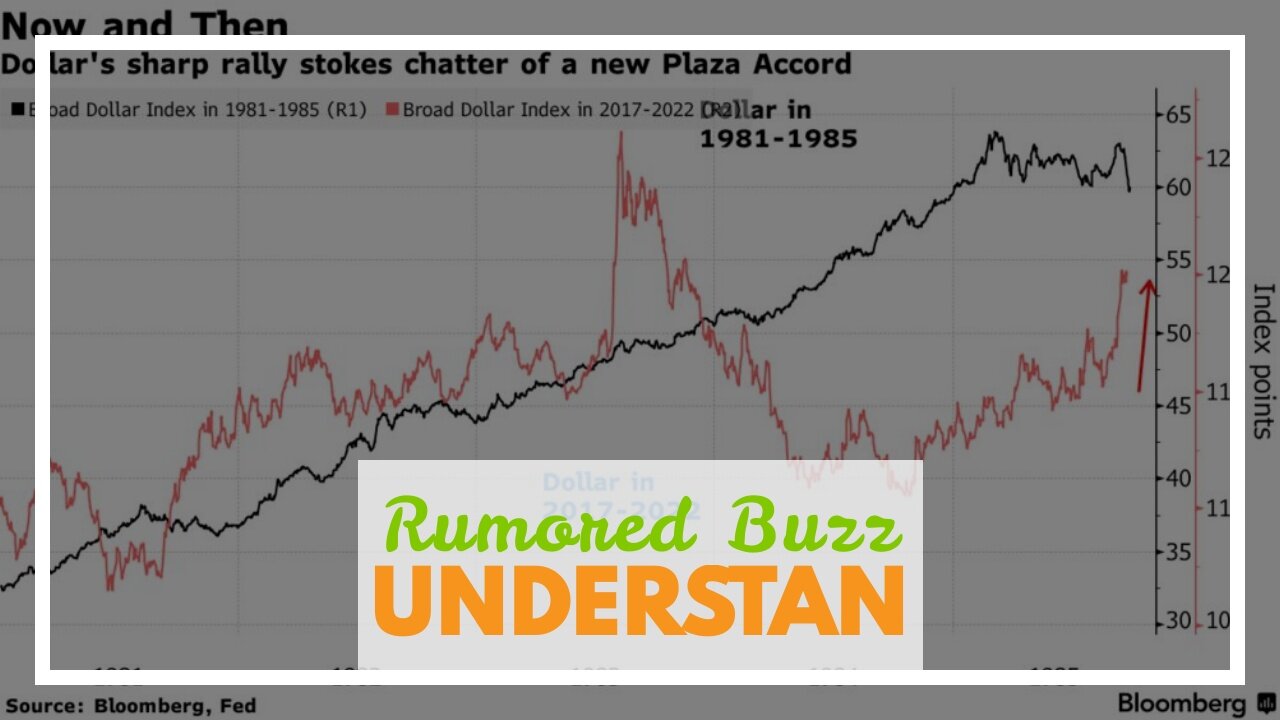

5. Money Activities

Gold is priced in US dollars on international markets. As a end result, changes in currency substitution fees may have an impact on its price. When the US dollar damages against other significant money, it normally leads to greater gold costs because it takes even more dollars to acquire the very same amount of gol...

-

LIVE

LIVE

Matt Kohrs

10 hours agoCPI Inflation Report, Stocks Skyrocket & Bitcoin Cools || Live Trading

1,069 watching -

LIVE

LIVE

Wendy Bell Radio

5 hours agoSH*T Is About To Get Real

10,364 watching -

4:01:10

4:01:10

The Bubba Army

1 day agoGhislaine Maxwell: Ready to TALK?! - Bubba the Love Sponge® Show | 7/15/25

177K12 -

9:16

9:16

Zoufry

22 hours ago $1.23 earnedThe Evil Design of Mcdonald's Drive Thru

6.54K9 -

LIVE

LIVE

GritsGG

2 hours agoWe Are Winning Every Game!!!! Most Wins 3040+! 🔥

110 watching -

1:57:28

1:57:28

Gary Cardone

1 day ago $1.22 earnedLIVE With Gary Cardone

10.6K3 -

8:01

8:01

MattMorseTV

19 hours ago $12.35 earnedTrump just DROPPED a BOMBSHELL.

75.9K85 -

LIVE

LIVE

FyrBorne

12 hours ago🔴Warzone M&K Sniping: Is The Overlook OP or Bait?

307 watching -

2:00:53

2:00:53

MG Show

22 hours agoTrump Stops the Epstein Nonsense & Exposes FAKE MAGA; Victory Lap

106K98 -

39:21

39:21

MattGaetz

1 day agoThe Anchormen Show with Matt Gaetz | Feeding the Dragon

44.1K28