Premium Only Content

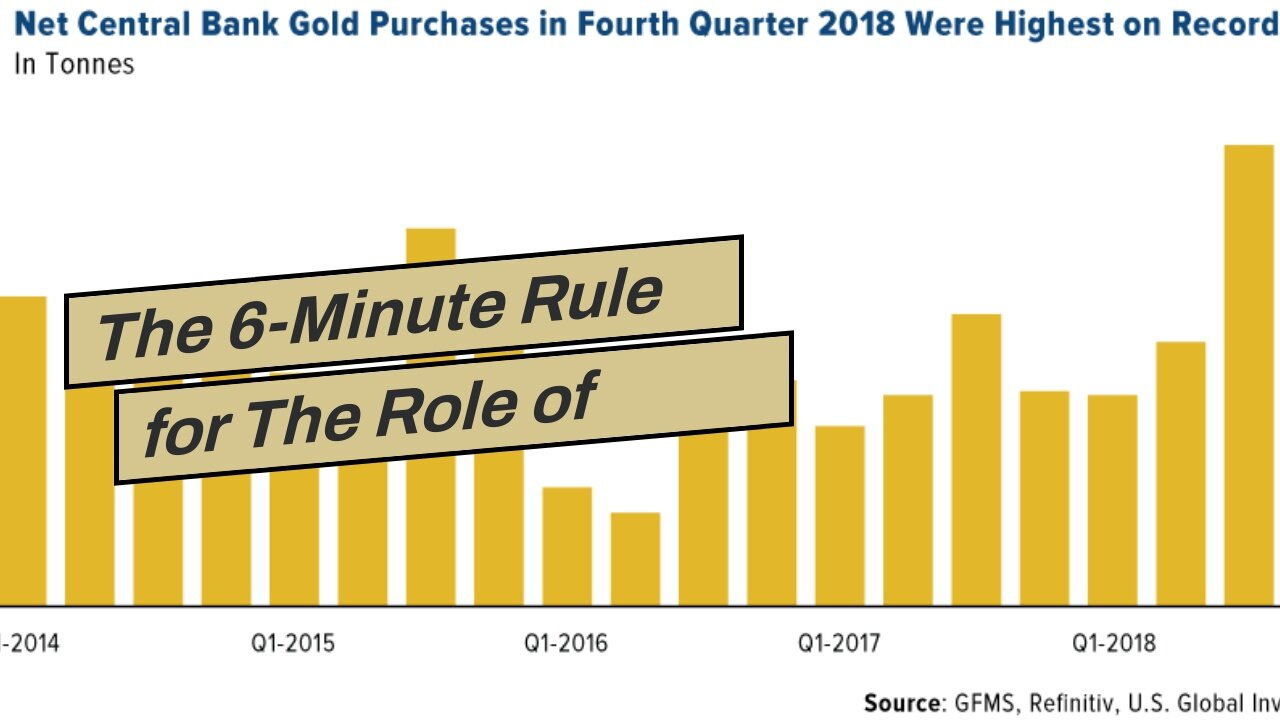

The 6-Minute Rule for The Role of Central Banks in the Gold Market and Its Impact on Gold Inves...

https://rebrand.ly/Goldco3

Get More Info Now

The 6-Minute Rule for The Role of Central Banks in the Gold Market and Its Impact on Gold Investors, gold investor gold

Goldco helps clients safeguard their retirement savings by surrendering their existing IRA, 401(k), 403(b) or other certified pension to a Gold IRA. ... To find out just how safe haven precious metals can assist you develop and also protect your wide range, and even safeguard your retirement telephone call today gold investor gold.

Goldco is among the premier Precious Metals IRA firms in the United States. Protect your wealth as well as livelihood with physical precious metals like gold ...gold investor gold.

The Psychology of a Successful Gold Investor: Understanding Market Sentiment and Producing Informed Choices

Gold has been a important commodity for centuries, and its appeal as a risk-free shelter investment has just grown more powerful in recent years. Entrepreneurs switch to gold throughout times of economic anxiety, political irregularity, and inflationary stress. Nonetheless, spending in gold is not without risks, and understanding the psychological science responsible for prosperous gold investing is vital for making informed choices in this market.

Market sentiment plays a substantial function in the rate fluctuations of gold. Sentiment recommends to the general feeling or perspective that entrepreneurs have in the direction of an asset class. When market view is favorable, investors are confident regarding the future performance of gold and are more eager to purchase it. However, when feeling turns bad, real estate investors become afraid and tend to sell their gold holdings.

Understanding market view requires assessing various aspects that influence investor behavior. Financial clues such as GDP development costs, rising cost of living costs, interest costs, and lack of employment bodies all play a duty in shaping feeling. Geopolitical events such as battles, vote-castings, business issues, or organic disasters can easily also considerably influence market sentiment.

Psychological biases likewise influence investor actions when it comes to gold investing. Intellectual biases are fundamental psychological quick ways that people use when making selections under health conditions of uncertainty or restricted information. These biases can overshadow judgment and lead to illogical decision-making.

One popular prejudice among clients is the herd mentality or complying with the crowd. When everyone else is purchasing gold due to positive belief or rising prices, investors might experience urged to carry out the very same out of anxiety of skipping out on potential increases. This herd mentality may produce cost bubbles where valuations become removed coming from fundamentals.

Another bias is loss hostility - the propensity for individuals to really feel the ache of reductions a lot more acutely than they appreciate gains. This bias commonly leads financiers to keep onto dropping settings a lot longer than they ought to out of hope that costs will recoup instead than cutting their reductions early.

Verification prejudice is an additional psychological catch that financiers should be mindful of. This prejudice occurs when individuals look for out information that confirms their existing opinions while dismissing or dismissing conflicting documentation. Gold real estate investors who are high on the steel may simply spend interest to information or study that supports their positive outlook, thereby skipping out on important alternative perspectives.

Productive gold financiers recognize these emotional prejudices and job to conquered them. They realize the value of performing detailed investigation and study before making investment decisions. They do not count exclusively on market feeling but likewise evaluate basic factors such as supply and demand characteristics, central financial institution policies, and macroeconomic fads.

In addition, prosperous gold entrepreneurs preserve a long-term standpoint. They understand that short-term cost changes are unavoidable and do not allow short-lived market dryness shake their conviction in the worth of gold as a risk-free sanctuary asset. Through keeping emotional states in examination and focusing on long-term objectives, they prevent producing rash selections based on short-term market conviction.

Furthermore, productive gold capitalists expand their collections...

-

LIVE

LIVE

Redacted News

39 minutes agoArrest Hillary Clinton!?! Here we go! | Redacted News Live

14,573 watching -

LIVE

LIVE

Kimberly Guilfoyle

33 minutes ago"Burns Bags" at FBI, What's Next? Interview with Former Agent John Nantz | Ep242

383 watching -

1:15:42

1:15:42

vivafrei

1 hour agoPelosi Doth Protest Too Much! "Trans" Athlete Plot to Harm Female? Crooked hillary Cooked & MORE

21K13 -

LIVE

LIVE

RalliedLIVE

1 day ago $0.60 earnedBattlefield 6 REVEAL w/ Ral

438 watching -

LIVE

LIVE

The White House

57 minutes agoPresident Trump Signs an Executive Order, July 31, 2025

653 watching -

1:42:17

1:42:17

The Quartering

3 hours agoHillary Clinton FINALLY BUSTED, Nancy Pelosi MELTDOWN, Kamala Harris Admits Defeat & More

84.2K30 -

3:10:42

3:10:42

Barry Cunningham

8 hours agoMUST SEE: KAROLINE LEAVITT HOSTS WHITE HOUSE PRESS CONFERENCE ( AND MORE NEWS)

31.8K13 -

53:03

53:03

Sean Unpaved

4 hours agoSchlereth Unplugged: 3x Champ Talks TV, Football, & 2025 Season Expectations

14.9K -

1:03:28

1:03:28

Russell Brand

4 hours agoCan You Really Take an Unbiased Look at Hitler? - SF624

118K86 -

12:39

12:39

Michael Button

6 hours ago $0.84 earnedAn Entire Civilization Might Be Buried Under the Sahara

10.4K6