Premium Only Content

The Basic Principles Of How to Maximize Your Returns with Diversification in Retirement Investm...

https://rebrand.ly/Goldco3

Get More Info Now

The Basic Principles Of How to Maximize Your Returns with Diversification in Retirement Investments , retirement investing basics

Goldco aids customers protect their retirement financial savings by rolling over their existing IRA, 401(k), 403(b) or other certified retirement account to a Gold IRA. ... To find out how safe haven precious metals can help you build and safeguard your riches, as well as even safeguard your retirement call today retirement investing basics.

Goldco is among the premier Precious Metals IRA companies in the United States. Shield your wide range and livelihood with physical precious metals like gold ...retirement investing basics.

How to Make the most of Your Yields with Diversity in Retirement Investments

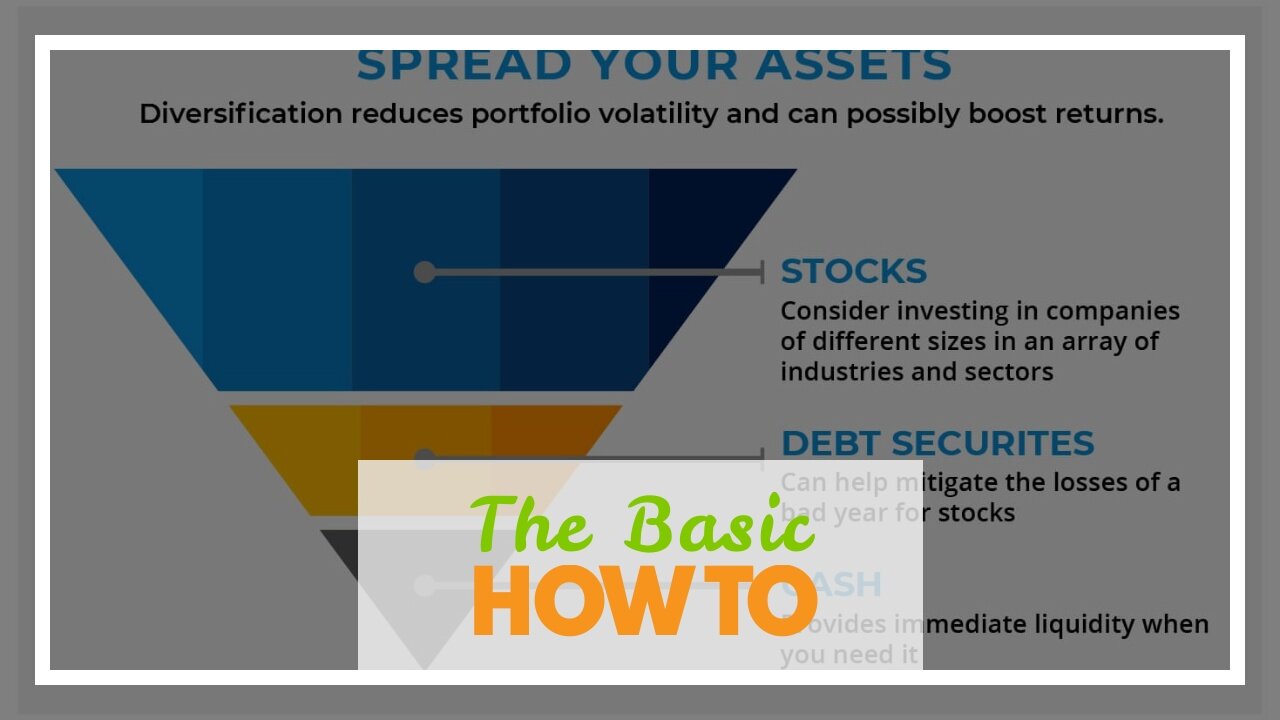

Diversification is a essential tactic for optimizing your profits in retirement financial investments. It entails dispersing your expenditures around various property training class, such as supplies, connections, and real estate, to minimize danger and improve the potential for much higher yields. Through transforming your collection, you can shield yourself coming from the volatility of private financial investments and take benefit of various market chances.

Right here are some crucial steps to aid you make best use of your profits along with diversity in retired life investments:

1. Know Your Risk Resistance: Before you start expanding your retirement financial investments, it's important to assess your risk tolerance. This will definitely assist you calculate the ideal mix of possessions that line up along with your monetary targets and convenience level. If you possess a higher danger endurance, you may be much more inclined to spend in sells and various other high-growth resources. However, if you have a reduced risk resistance, you might choose for additional traditional possibilities like bonds or genuine real estate.

2. Allot Your Possessions: Once you recognize your danger endurance, it's time to assign your properties appropriately. This entails identifying how much of your financial investment portfolio need to be assigned to each property training class. A often made use of regulation of finger is the "100 minus grow older" rule, where deducting your age coming from 100 gives you the percentage that need to be put in in supplies. The rest may be allocated to connections or various other fixed-income safeties.

3. Commit in Different Sectors: Within each possession course, it's necessary to further expand through committing in different markets or fields. For instance, if you choose to commit in supplies, think about assigning funds all over fields such as modern technology, medical care, buyer goods or energy. Through spending in various markets that are not very associated along with each other (implying they don't relocate up or down with each other), you may possibly decrease overall collection dryness.

4. Consider International Investments: An additional means to branch out is by putting in worldwide. This can deliver visibility to different economic situations and unit of currencies, reducing your dependence on a single market. It's important to look into and comprehend the threats affiliated with global financial investments, such as political instability or money variations. Consider putting in in reciprocal funds or exchange-traded funds (ETFs) that center on international markets to get vast exposure.

5. Rebalance Frequently: Variation is not a "specified it and fail to remember it" approach. It needs normal display and rebalancing of your collection to keep the wanted resource allotment. Over opportunity, certain resources may conduct better than others, creating your collection to come to be uneven. Through rebalancing, you sell some of the exceeding assets and get even more of the underperforming ones, maintaining your portfolio straightened along with your intended allowance.

6. Find Professional Advice: If you're uncertain concerning how to effectively transform your retired life expenditures or if you don't possess the opportunity or expertise to handle it yourself, look at looking for advice from a economic advisor. They may aid evaluate your personal circumstance, recommend suited expenditure possibilities, and give recurring support to help optimize your profits while managing threat.

In conclusion, diversification is an important method for making best use of gains in retirem...

-

16:38

16:38

Nikko Ortiz

13 hours agoVeteran Tactically Acquires Everything…

12.5K -

20:19

20:19

MetatronHistory

2 days agoThe Mystery of Catacombs of Paris REVEALED

7.29K -

21:57

21:57

GritsGG

17 hours agoBO7 Warzone Patch Notes! My Thoughts! (Most Wins in 13,000+)

11.6K -

2:28:08

2:28:08

PandaSub2000

11 hours agoMyst (Part 1) | MIDNIGHT ADVENTURE CLUB (Edited Replay)

8.02K -

1:12:43

1:12:43

TruthStream with Joe and Scott

5 days agoJason Van Blerk from Human Garage: Reset your life with Fascial Maneuvers,28 day reset, Healing, Spiritual Journey, Censorship, AI: Live 12/3 #520

17.1K4 -

24:21

24:21

The Pascal Show

1 day ago $8.98 earned'CHALLENGE ACCEPTED!' TPUSA Breaks Silence On Candace Owens Charlie Kirk Allegations! She Responds!

38.1K21 -

17:41

17:41

MetatronGaming

2 days agoI should NOT Have taken the elevator...

12.4K1 -

LIVE

LIVE

Lofi Girl

3 years agolofi hip hop radio 📚 - beats to relax/study to

522 watching -

1:20:23

1:20:23

Man in America

14 hours agoHow Epstein Blackmail & FBI Cover-Ups Are Fracturing MAGA w/ Ivan Raiklin

199K37 -

2:13:49

2:13:49

Inverted World Live

9 hours agoSolar Storms Ground 1000 Planes | Ep. 151

115K10