Premium Only Content

Not known Factual Statements About "Making the Most of Fluctuating Gold Rates: Tips for Savvy I...

https://rebrand.ly/Goldco6

Get More Info Now

Not known Factual Statements About "Making the Most of Fluctuating Gold Rates: Tips for Savvy Investors" , gold rate investing

Goldco helps customers secure their retired life cost savings by rolling over their existing IRA, 401(k), 403(b) or various other competent pension to a Gold IRA. ... To learn exactly how safe haven rare-earth elements can aid you construct and also shield your wide range, as well as even safeguard your retired life call today gold rate investing.

Goldco is among the premier Precious Metals IRA companies in the United States. Protect your wide range and also source of income with physical rare-earth elements like gold ...gold rate investing.

Putting in in Gold ETFs vs Physical Gold: Which One is Appropriate for You?

Gold has been a beneficial item for centuries and has been utilized as a money, an financial investment, and a shop of value. Along with the rise of exchange-traded funds (ETFs), financiers currently have the option to commit in gold without physically having it. However, owning physical gold also has actually its advantages. In this short article, we will certainly review spending in gold ETFs compared to physical gold and help you find out which one is right for you.

What are Gold ETFs?

Gold ETFs are exchange-traded funds that track the cost of gold. They supply real estate investors along with exposure to the price movement of gold without actually owning it. When you spend in a gold ETF, you are generally purchasing shares that work with a certain amount of physical gold stored through the fund.

Perks of Investing in Gold ETFs

1. Easy Access to Assets: Putting in in a gold ETF is easy as it may be carried out with any type of brokerage account. This makes it available to entrepreneurs who may not have access to acquiring bodily gold or do not want the problem of storing it.

2. Variation: A solitary system of a gold ETF offers visibility to several inventories involved with mining and refining activities related to priceless metallics worldwide.

3. Assets: Marketing your investment in a gold ETF is easy as they trade on stock substitutions like any type of other protection, helping make them very fluid expenditures.

4. Low Cost: Investing in a Gold-ETF is more affordable than getting physical Gold because there are no additional expense linked with storing or insurance policy.

Drawbacks of Investing in Gold ETFs

1. High-risk Assets: Investing in an ETF means that you are taking on market risk along along with other threats such as political weakness or natural calamities impacting exploration procedures and refineries worldwide.

2. No Physical Ownership: As an investor, when you buy reveals coming from an exchange-traded fund (ETF), you do not possess the physical gold. This shortage of ownership might result in a reduction of peace of mind in the financial investment.

3. No Genuine Asset: When you put in in Gold ETFs, you're investing in a newspaper possession rather than a genuine asset like bodily gold.

What is Physical Gold?

Physical gold recommends to real gold pubs or pieces that financiers purchase and keep themselves. It may be obtained coming from banking companies, suppliers, or exclusive sellers and may be saved at residence or in a bank vault.

Perks of Investing in Physical Gold

1. Concrete Asset: Bodily gold is a concrete property that can easily be kept, touched, and saved properly through the entrepreneur.

2. Inflation Hedge: Gold has a tendency to hold its market value over time and acts as an rising cost of living bush versus money changes.

3. Safe Haven Investment: In times of economic anxiety or political weakness, financiers often tend to gather to safe-haven financial investments like physical gold.

4. No Counterparty Risk: Owning bodily gold implies that there is actually no counterparty threat involved as there are no intermediaries between the client and their expenditure.

Disadvantages of Investing in Physical Gold

1. Storage Costs: Saving bodily gold securely can be pricey as it requires secure storing such as banking company vaults which require expenses for rental area and insurance expense.

2. Not Conveniently Obtainable: Purchasing bodily gold requires seeing a dealership or dealer which might not constantly be quickly available for some clients.

3. High Premiums on Coins/Bars: Pieces/clubs will certainly have higher costs on best of their p...

-

LIVE

LIVE

meleegames

4 hours agoMelee Madness Podcast #58 - They Changed What ‘It’ Was & It’ll Happen to You

113 watching -

2:32:46

2:32:46

megimu32

6 hours agoOn The Subject: Why K-Pop Demon Hunters Feels Like 90s Disney Again

23.2K9 -

1:38:28

1:38:28

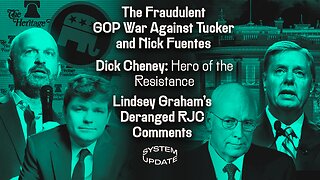

Glenn Greenwald

9 hours agoThe Fraudulent GOP War Against Tucker and Nick Fuentes; Dick Cheney: Hero of the Resistance; Lindsey Graham's Deranged RJC Comments | SYSTEM UPDATE #544

103K115 -

LIVE

LIVE

ThePope_Live

4 hours agoRedsack with the boys Cheap, Jah and Nova!

541 watching -

LIVE

LIVE

Hernandez2787

8 hours agoArc Raiders - 1st Playthrough/ Celebrating My Anniversary as Sergeant First Class in the US Army

57 watching -

48:42

48:42

Donald Trump Jr.

9 hours agoCommunism vs Common Sense, What's Next for NYC? | TRIGGERED Ep.289

144K283 -

LIVE

LIVE

JahBlessCreates

4 hours ago🎉Lil Music Ting

20 watching -

1:31:25

1:31:25

The Charlie Kirk Show

8 hours agoTHOUGHTCRIME Ep. 104 — Post-Election Palette Cleanser + Tucker/Fuentes Interview Reaction

105K43 -

4:22:59

4:22:59

tminnzy

7 hours agoSmooth Moves Only 💨 | Naraka: Bladepoint Chill Gameplay | !gx

34.3K5 -

1:04:33

1:04:33

BonginoReport

9 hours agoWill The LA Dodgers Dodge WH Visit?! - Nightly Scroll w/ Hayley Caronia (Ep.172) - 11/06/2025

66.4K80