Premium Only Content

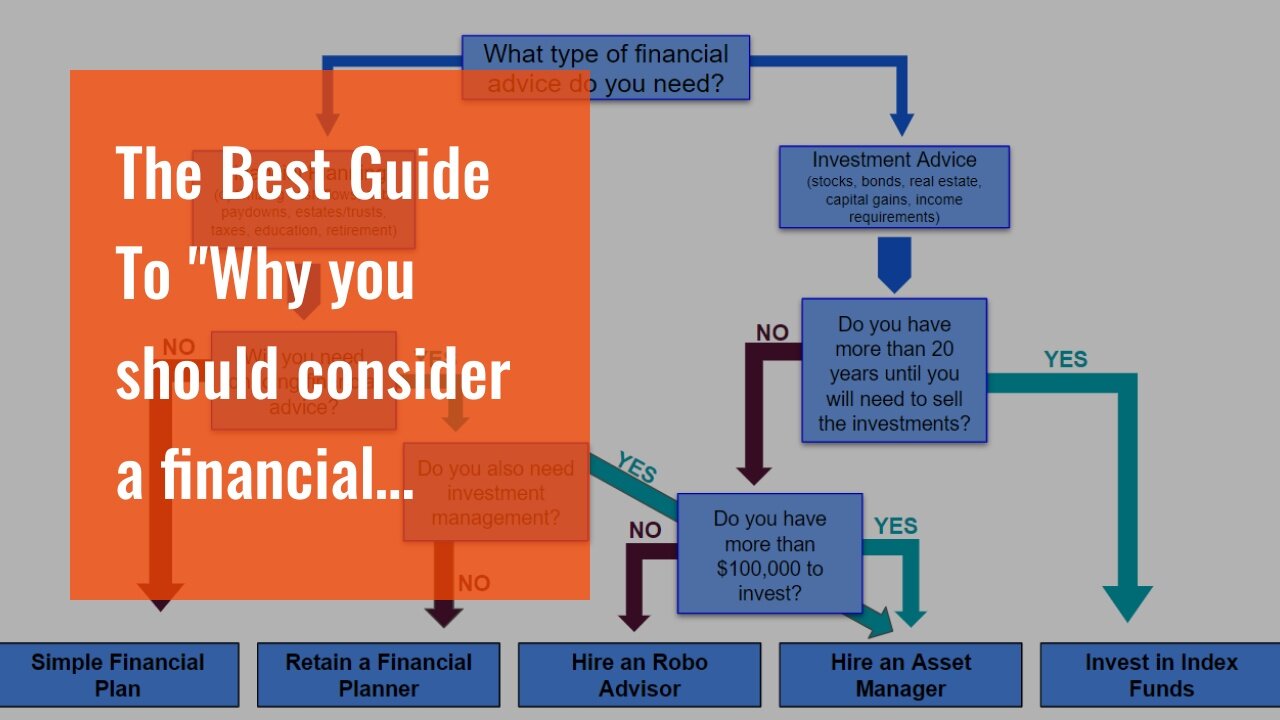

The Best Guide To "Why you should consider a financial advisor for your retirement investments"

https://rebrand.ly/Goldco4

Get More Info Now

The Best Guide To "Why you should consider a financial advisor for your retirement investments", retirement investing basics

Goldco aids clients safeguard their retired life savings by rolling over their existing IRA, 401(k), 403(b) or various other qualified pension to a Gold IRA. ... To find out how safe haven precious metals can help you construct as well as shield your wealth, and even safeguard your retirement phone call today retirement investing basics.

Goldco is just one of the premier Precious Metals IRA companies in the United States. Protect your riches and also income with physical precious metals like gold ...retirement investing basics.

5 Retirement Investing Oversights to Prevent

Retirement is a opportunity of your life that you must be capable to delight in, without worrying concerning your finances. Nevertheless, if you make mistakes along with your retirement investing, it could lead to monetary stress and anxiety and prevent you coming from residing the retirement life lifestyle that you constantly imagined. In this short article, we will definitely highlight 5 usual retirement investing blunders that you must steer clear of:

1. Neglecting to start early

One of the biggest errors people create is failing to begin saving for their retired life early enough. The previously you start sparing and committing for retirement life, the additional time your cash has to develop. Standing by till eventually in lifestyle means much less opportunity for compounding rate of interest and growth capacity.

2. Not expanding your portfolio

An additional typical mistake is not diversifying your financial investment profile. Putting all of your funds right into one kind of financial investment or sector can easily be risky because if that particular market doesn't carry out effectively, then all of your expenditures can suffer.

3. Disregarding rising cost of living

Inflation erodes the value of funds over opportunity, so it's vital to variable in inflation when organizing for retired life. If you don't take into account inflation when specifying up a budget or figuring out how a lot profit you'll need to have throughout retirement life, at that point it's most likely that you'll function out of amount of money earlier than expected.

4. Undervaluing healthcare costs

Medical care expense are very likely to be one of the greatest expenditures throughout your retirement life years. As clinical costs carry on to increase year after year, it's necessary not to undervalue how much healthcare are going to set you back throughout your golden years.

5. Taking as well a lot risk

While taking dangers along with expenditures may lead to more significant incentives, there is actually additionally a more significant odds of losing loan as properly. As folks approach retirement grow older they must think about shifting their financial investments towards more conservative choices such as connects and fixed income protections so as not take too a lot danger with their savings.

In final thought, steering clear of these usual mistakes may assist make sure that you have a relaxed and financially safeguard retired life. Begin conserving early, expand your portfolio, variable in inflation and healthcare costs, and don't take also a lot threat. Keep in mind that it's certainly never too late to start planning for your future, therefore start believing about your retired life goals today.

By staying away from these blunders, you can easily prepared yourself up for a effective retired life and take pleasure in peace of thoughts recognizing that your finances are safe and secure.

5 Retirement Investing Blunders to Prevent

Retirement life is a time of your life that you should be capable to delight in, without worrying about your financial resources. Nevertheless, if you create blunders along with your retirement life investing, it could possibly lead to financial anxiety and protect against you coming from residing the retirement lifestyle that you consistently thought of. In this post, we will certainly highlight 5 common retirement investing blunders that you need to steer clear of:

1. Failing to start early

One of the most significant oversights individuals create is falling short to begin saving for their retirement early sufficient. The earlier you begin conserving and committing for retired life, the even more opportunity your money has to grow...

-

23:54

23:54

Jasmin Laine

4 hours agoCarney’s WORST Day EVER—BOOED, Fact-Checked, and Forced to FLEE the House

4.64K11 -

1:59:47

1:59:47

Redacted News

3 hours agoDeep State Coup Coming for Trump? New JFK Files Released and NATO Preparing Attack on Russia

151K76 -

7:31:43

7:31:43

Dr Disrespect

9 hours ago🔴LIVE - DR DISRESPECT'S TRIPLE THREAT CHALLENGE - ARC RAIDERS • BF6 • FORTNITE

91.1K5 -

1:00:57

1:00:57

Russell Brand

6 hours agoThe Vaccine Ideology Unmasked | Dr Peter McCullough - SF658

117K36 -

1:11:25

1:11:25

vivafrei

4 hours agoKash Patel's Jacket-Gate! Pfizer Whistleblower Qui Tam on Appeal! Meanwhile in Canada! AND MORE!

64.2K42 -

16:30

16:30

Clintonjaws

8 hours ago $5.50 earnedEntire Room Speechless as Pete Hegseth Snaps Destroying All Media To Their Face

38.6K14 -

22:12

22:12

Dad Saves America

4 hours ago $0.37 earnedHow Greek Philosophers Created Western Civilization: The Death of Debate - Pt 2

12K3 -

LIVE

LIVE

LFA TV

21 hours agoLIVE & BREAKING NEWS! | WEDNESDAY 12/03/25

940 watching -

1:05:46

1:05:46

The Quartering

6 hours agoNew Epstein Video Drops! The US Economy Has SCARY Numbers Released & More

131K35 -

1:07:11

1:07:11

The White House

8 hours agoPresident Trump Makes an Announcement, Dec. 3, 2025

44K42