Premium Only Content

Why you need to know about the inverted yield curve

Why you need to know about the inverted yield curve

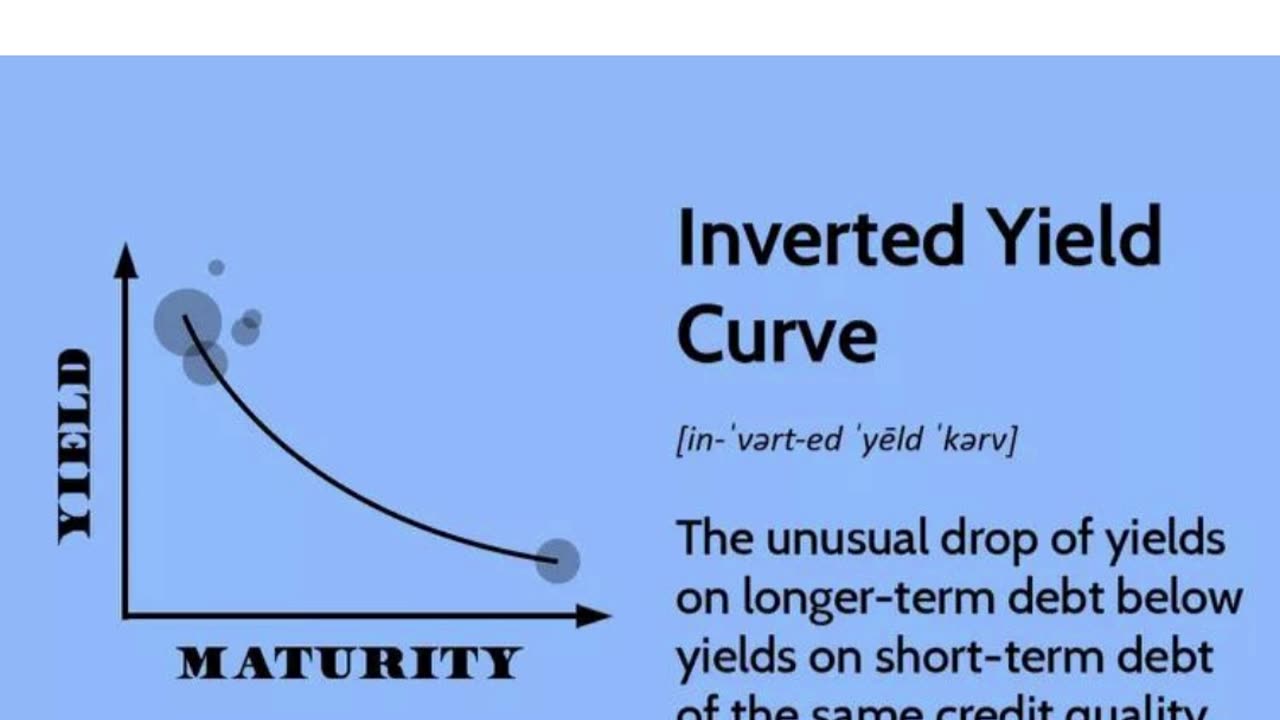

Typically, long term government bonds have higher yields than short term bonds to compensate for the added risk of tying up investor money for a longer period. This normal, upward sloping yield curve, reflects the expectation that the economy will grow over time, and inflation will increase.

An inverted yield curve occurs when short term interest rates on government bonds are higher than long term interest rates. This indicates a negative outlook on the economy. Inverted yield curves are historically associated with economic recessions. The expectation is that central banks will be forced to lower interest rates to counter an economic downturn. The expectation for interest rates being decreased in the future results in the long term yields dropping and this creates the inverted yield curve.

Economists, policymakers, investors, and regular people like you and me should monitor and consider an inverted yield curve as a potential indication that the economy will contract. While it does not guarantee a recession, it is a warning sign, and an important tool to be considered.

Tags:

inverted yield curve, yield curve, yield curve inversion, inverted yield curve explained, inverted yield curve recession, yield, flat yield curve, yield curve recession, bond yield curve inversion, yield curve inversion chart, bond yield curve, yield curve inverted, yield curve explained, inverted yield curve 2018, inverted yield curve 2022, inverted yield curve 2023, inverted yield curve 2019, the yield curve, flattening yield curve, yield curve and interest rates

-

4:21

4:21

The Last Capitalist in Chicago

1 year agoWhat is the Hume-Cantillon Effect?

2591 -

2:04:27

2:04:27

TimcastIRL

6 hours agoAntifa CONVICTED Of TERRORISM, Fears Of CIVIL WAR Grow | Timcast IRL

197K51 -

2:16:43

2:16:43

TheSaltyCracker

3 hours agoIt's Over Zelensky ReeEEStream 11-21-25

53.7K102 -

LIVE

LIVE

Drew Hernandez

20 hours agoMIKE HUCKABEE EXPOSED FOR OFF RECORD MEETING WITH CONVICTED ISRAELI SPY?

1,030 watching -

LIVE

LIVE

SynthTrax & DJ Cheezus Livestreams

13 hours agoFriday Night Synthwave 80s 90s Electronica and more DJ MIX Livestream SYNTHWAVE / ANIME NIGHT

199 watching -

14:25

14:25

Tactical Advisor

11 hours agoReal Life John Wick Suit | Grayman & Company

3.84K1 -

LIVE

LIVE

I_Came_With_Fire_Podcast

11 hours agoAlien Enemies Act | Dismantling the Department of Education | Valhalla VFT & America First

167 watching -

19:53

19:53

MetatronHistory

2 hours agoRome VS Greece - Ultimate Clash of Civilizations Explained

5 -

33:09

33:09

Exploring With Nug

4 hours ago $2.81 earnedThey Weren’t Ready for Nightfall on Blood Mountain… So I Helped Them Down

21K1 -

1:16:42

1:16:42

Sarah Westall

3 hours agoBoardroom and Government Infiltration: The Silent Erosion of American Power w/ Mike Harris

11.6K1