Premium Only Content

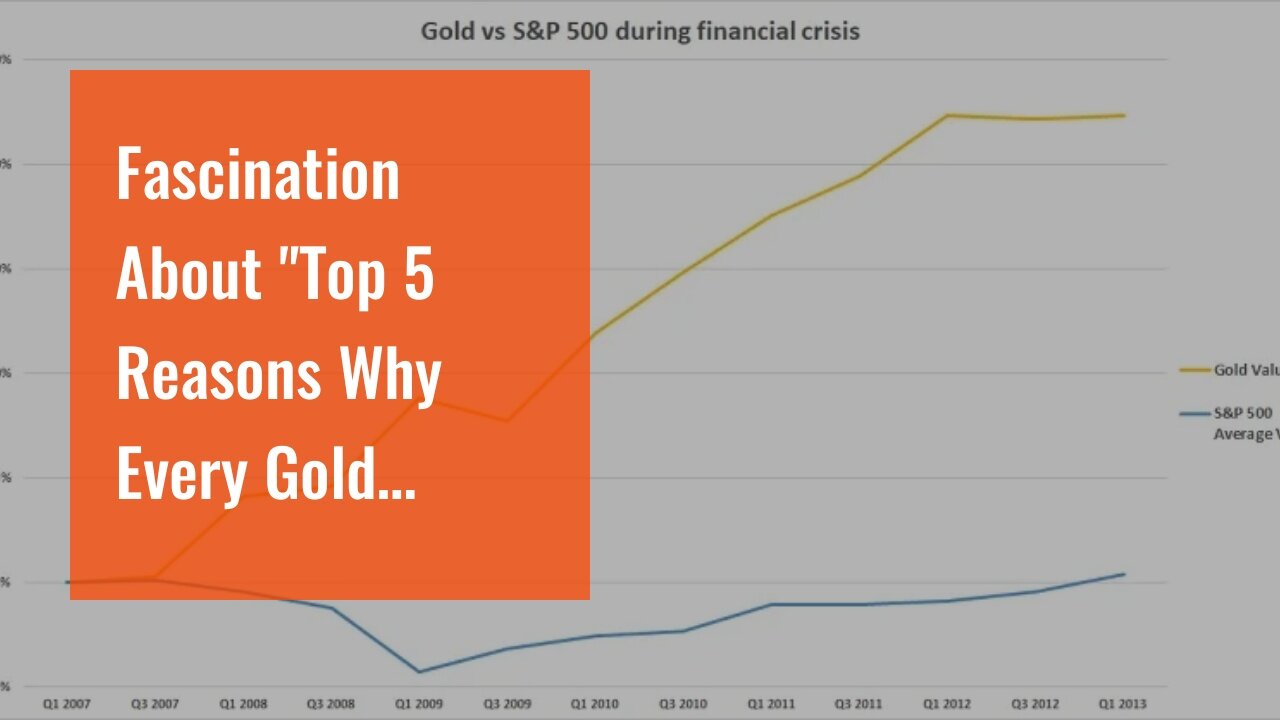

Fascination About "Top 5 Reasons Why Every Gold Investor Should Diversify Their Portfolio"

https://rebrand.ly/Goldco2

Sign up Now

Fascination About "Top 5 Reasons Why Every Gold Investor Should Diversify Their Portfolio", gold investor gold

Goldco aids customers shield their retired life financial savings by rolling over their existing IRA, 401(k), 403(b) or various other competent pension to a Gold IRA. ... To discover exactly how safe house rare-earth elements can assist you construct and also safeguard your wealth, as well as also secure your retired life call today gold investor gold.

Goldco is one of the premier Precious Metals IRA companies in the United States. Protect your wide range and source of income with physical rare-earth elements like gold ...gold investor gold.

Committing in gold supplies may be a lucrative expenditure chance if performed appropriately. Having said that, determining the greatest chances for putting in in gold sells may be challenging. In this article, we are going to review the essential aspects that you need to consider to identify the finest chances for spending in gold inventories.

1. Comprehend the Gold Market

The very first measure to recognizing the ideal chances for putting in in gold sells is to know the gold market. Gold prices are affected by many aspects featuring international economic disorders, geopolitical occasions, and source and demand mechanics.

For example, in the course of opportunities of financial anxiety or political vulnerability, capitalists tend to flock towards safe-haven properties such as gold. This enhanced need usually leads to an boost in price.

Similarly, improvements in supply and need mechanics such as increased development or reduced consumption of gold can likewise influence its price. For that reason, it's crucial to maintain monitor of these factors when looking at investing in gold inventories.

2. Examine Gold Mining Companies

Yet another crucial variable that you need to have to consider when pinpointing the absolute best chances for investing in gold supplies is examining specific exploration companies. Not all exploration firms are made equivalent; some might have better monitoring staffs, much more significant books of gold or work with lower expense than others.

Some of the essential metrics that you should consider when analyzing exploration business consist of:

- Manufacturing degrees: The amount of gold created by a business are going to impact its profits and earnings.

- Cost per ounce: The cost per oz is an essential metric as it calculates how much it sets you back a company to produce each oz of gold.

- Reserves: The volume of confirmed reserves a firm has are going to figure out how long they may continue creating at their existing cost.

- Financial obligation degrees: High levels of financial debt may suggest financial weakness and might create a business riskier to spend in.

Through examining these metrics meticulously, you can determine which providers are most likely to conduct properly over time and avoid those that might struggle due to inadequate management or various other concerns.

3. Look at ETFs and Mutual Funds

Spending in gold inventories can easily be high-risk, as specific providers may be impacted through a range of variables that are beyond your management. One way to alleviate this risk is to put in in exchange-traded funds (ETFs) or common funds that concentrate on gold exploration firms.

These funds normally commit in a variety of mining providers, which means that your investment is diversified throughout several stocks. This reduces the influence of any singular business's efficiency on your general investment.

Nevertheless, it's significant to keep in mind that not all ETFs and common funds are generated equivalent. Some may have greater fees than others or may put in a lot more heavily in specific types of mining providers. For that reason, it's essential to carry out your as a result of carefulness just before investing in any sort of fund.

4. Monitor Market Trends

The gold market is compelling and may modify quickly due to a range of variables such as financial conditions, political instability, or also improvements in technology. Therefore, it's crucial to remain up-to-date along with market styles and information related to the gold market.

Through keeping an eye on market fads thoroughly, you may pinpoint possible chances for investing in gold stocks before they ended up being extensively recognized.

For instance, if there is news...

-

1:22:13

1:22:13

Michael Franzese

3 hours agoPablo Escobar’s Son Breaks Silence About His Father, Narcos, and The Cartel

23.5K6 -

LIVE

LIVE

SpartakusLIVE

41 minutes agoThe $1,000 Spartakus Gauntlet || Huskerrs and Twitty

74 watching -

9:02

9:02

Hollywood Exposed

2 hours agoPiers Morgan's Guests ROAST DC's New Superman - It’s A Trainwreck!

4.08K1 -

LIVE

LIVE

GSLouise

2 hours agoFIRST RUMBLE STREAM go easy on me

50 watching -

LIVE

LIVE

Spartan

3 hours agoSpartan - Pro Halo Player for OMiT | Scrims vs Unreal Nightmare

41 watching -

17:23

17:23

Preston Stewart

3 hours ago $0.39 earnedSyria's Fragile Truce

5.76K1 -

1:00:00

1:00:00

BEK TV

20 hours agoOpen Range

3.12K -

57:24

57:24

CharLee Simons presents DO NOT TALK

19 hours agoSteve Hilton with CharLee Simons on DO NOT TALK

743 -

StoneMountain64

6 hours agoBattlefield 6 CONFIRMED + Delta Force Escaping PRISON with PROS

25.2K1 -

LIVE

LIVE

LFA TV

21 hours agoLFA TV ALL DAY STREAM - TUESDAY 7/22/25

864 watching