Premium Only Content

Internal Colonialism, Land Maps and Land Value Taxation

A functional democracy needs truth in order to fulfill the promises of a just and fair society. A fundamental truth necessary to understand how to reverse the play of power that has led us to gross wealth inequality and the near demise of democracy is to know who owns what land where (and the assessed value) in our neighborhoods, towns and cities. Transparent and detailed digital land maps give us this important information, tell us who pays what property taxes, and can model tax reform approaches that will keep our wealth in our communities.

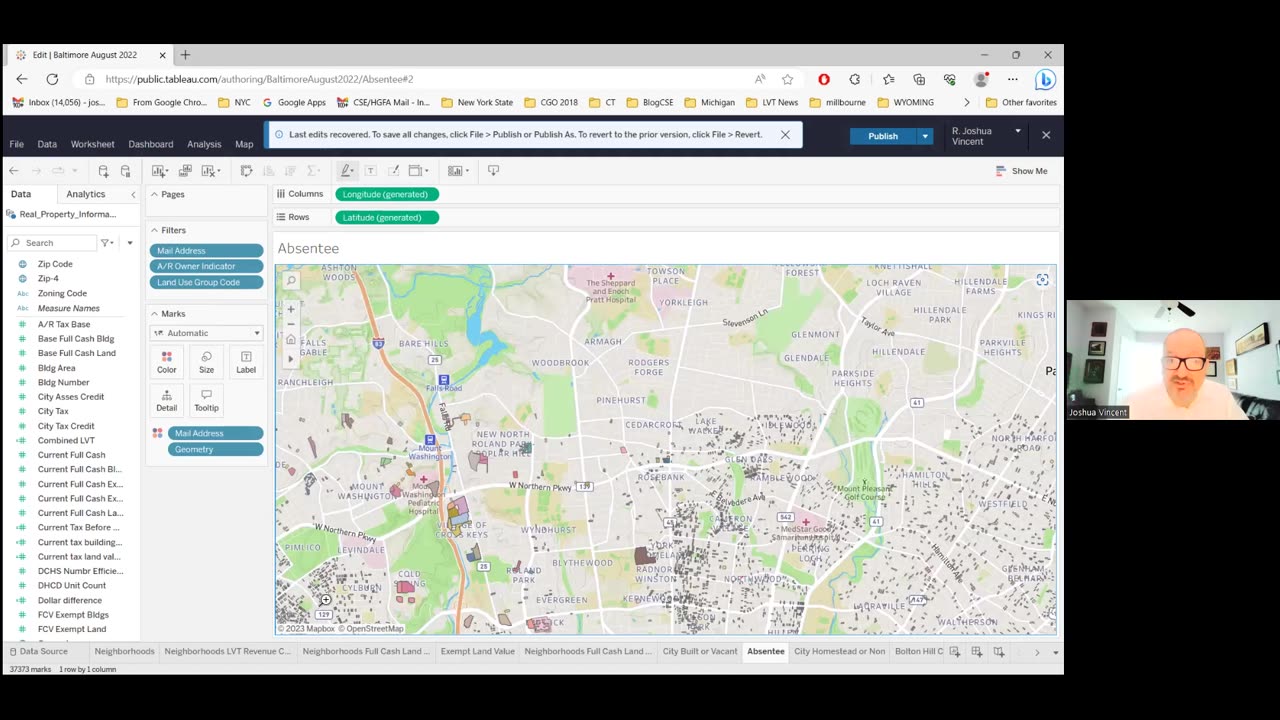

In this video Joshua Vincent, Director of the Center for the Study of Economics, presents land value maps of the City of Baltimore to an executive meeting of the International Union for Land Value Taxation attended by people from Ireland, UK, Germany, India, the Philippines, Nigeria, Costa Rica, Canada, Australia and the US. The presentation impressed everyone with the power and potential of this information technology to build movements for what I call “earth rights democracy” – a new form of democracy based on the equal right by birth to the earth’s land and natural resources. Land mapping gives exact and specific details of how land rent – the unearned income from land – currently flows out of low-income and impoverished areas where much of the land is owned by absentees and speculators and into the pockets of those who live in high income areas or to private corporations.

The land value maps that Josh presented show in precise and stark detail the workings of a predatory economic system that can be viewed as “internal colonialism” and understood as a root cause of gross wealth inequality. This technology also easily enables us to determine what areas and which people would pay more or less when the tax base is shifted OFF OF housing and other buildings, wage income and small business and ONTO the wealth extracting and privileged absentees and speculators.

We can recover democracy and create a healthy society of fair wealth distribution by using the information of land value maps to build movements for earth rights democracy right where we live. As we restore our neighborhoods, towns and cities with the shift to land value taxation, which stops the predation and exploitation and keeps the wealth in our communities, we can work on regional and even global levels to claim the commons rent of natural resources, water, the oceans, the electromagnetic spectrum and the overall environment in order to build a world that works for everyone based on the perennial truth that The Earth Belongs to Everyone.

You can join our worldwide movements for land value tax implementation at Common Ground USA, (https://commonground-usa.net), the International Union for Land Value Taxation https://theiu.org, and for our Baltimore Thrive effort contact Vanessa Beck here: BaltimoreThriveVanessa@gmail.com

Strong Towns https://www.strongtowns.org is also actively promoting land value tax throughout the US. The mayor of Detroit and the governor of Michigan are advocates for implementation. There are several articles you can find on the internet about Detroit’s movement for land value taxation.

-

3:55:42

3:55:42

STARM1X16

12 hours agoMerry Christmas Fortnite

91K11 -

2:45:33

2:45:33

Sgtfinesse

12 hours agoMerry Christmas Night

71.1K19 -

3:51:18

3:51:18

tacetmort3m

1 day ago🔴 LIVE - (MERRY CHRISTMAS) TIME TO SPREAD DEMOCRACY - HELLDIVERS 2 OMENS OF TYRANNY

41.2K2 -

2:46

2:46

BIG NEM

16 hours agoDiscovering RAKIJA: The Holy Liquer of the Balkans

29.2K3 -

1:11:38

1:11:38

Film Threat

20 hours agoCHRISTMAS DAY CHILL STREAM WITH CHRIS GORE | Hollywood on the Rocks

148K33 -

14:22:40

14:22:40

The Quartering

1 day agoYule Log Christmas MAGA Edition With Memes! Come Hang Out!

236K32 -

38:41

38:41

MYLUNCHBREAK CHANNEL PAGE

1 day agoTimeline Begins in 1800? - Pt 1 & 2

115K71 -

1:23:41

1:23:41

Game On!

1 day ago $13.99 earnedNetflix NFL Christmas Games Preview and Predictions!

98.9K13 -

2:05:07

2:05:07

Darkhorse Podcast

1 day agoWhy Trump Wants Greenland: The 257th Evolutionary Lens with Bret Weinstein and Heather Heying

327K906 -

8:50:58

8:50:58

Right Side Broadcasting Network

1 day ago🎅 LIVE: Tracking Santa on Christmas Eve 2024 NORAD Santa Tracker 🎅

423K71