Premium Only Content

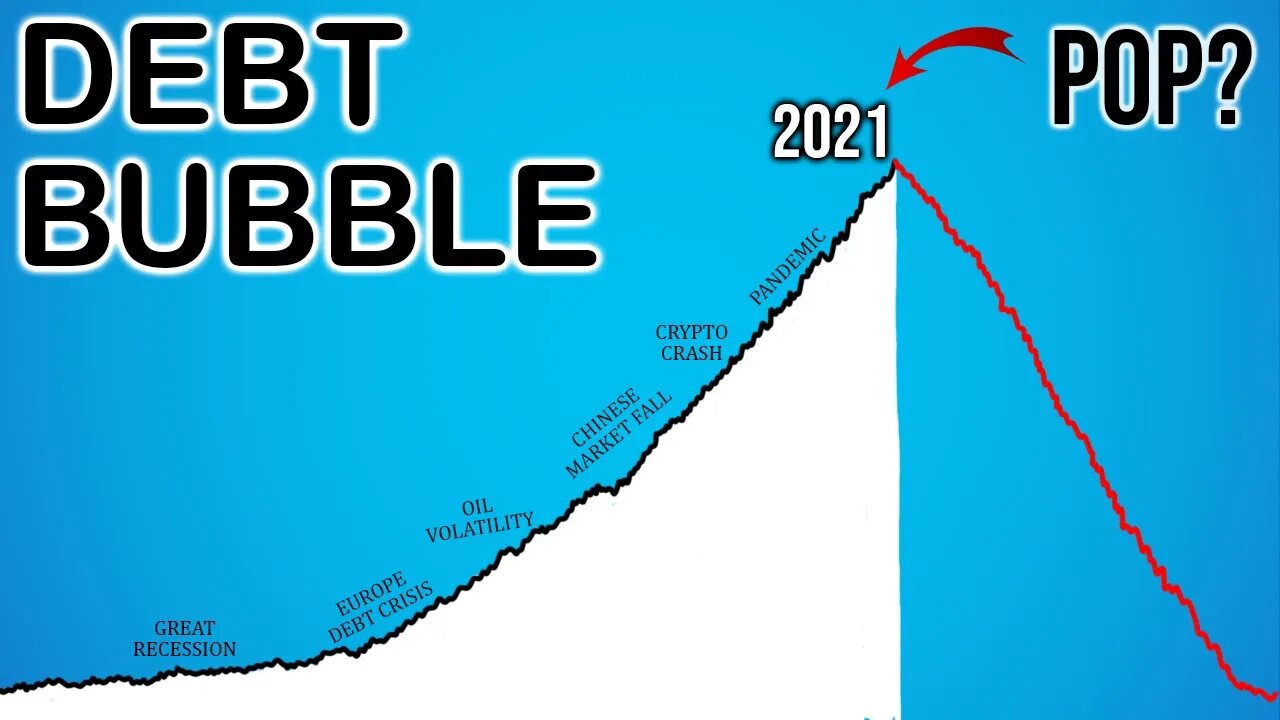

Is The United States In Too Much Debt? (2021 Bubble)

See My Portfolio & Where Opportunity Is In The Market (Discount): https://theinvestingacademy.teachable.com/p/theinvestingacademy?coupon_code=SALE&product_id=4455382

Is The United States in too much debt? $27.5 trillion dollars is the total sum at the time of making this video. Can we handle this debt or will the debt bubble explode/pop? Let's discuss...

__________________________________

The United States is currently in $27.5 trillion dollars worth of debt. No that wasn’t a mistake, that wasn’t a slip of the tongue, $27.5 trillion!

13 years ago, that amount was only 10 trillion dollars! So what’s happened? Why have we almost tripled the amount of debt in such a short period of time and what are the potential ramifications of this?

So one of the obvious reasons at least for the recent spike in debt is we’ve had a pandemic. I don’t know if that’s breaking news to any of you guys, but yes, it’s been pretty big! We’ve had businesses shut down, we’ve had people stay at home and not work, there’s been less eating out, less shopping etc. So what did all of this mean it meant people needed money. No I can’t work my job can I have some stimulus checks. No my business is failing, I need some liquidity.

One of the ways that the government has got this money is borrowing. If we look at the start of 2020, we were in $23 trillion dollars worth of debt. End of the year that numbers almost at $28 trillion.

And you know there’s no denying that this was a worthy cause to get in more debt, people needed the money, but the question is can we afford it?

You know at the end of the day someone has to pay the debt back whether you like it or not. Whether that be us, or we leave it to our kids, or they kick the can down the road and they leave it to their kids that they have.

Someone’s got to pay it. And how this generally get’s paid is either through higher taxes or reduced government spending…

So that gives you a bit of an overview of the debt situation that we’re looking at. How much debt the government is in. But who are the people that they the owe money to? That’s a good question to ask…

So I’ve got a graph that explains it pretty simply. The biggest group is U.S investors. They own 32.5% of the debt. So that’s people who have bought long and short-term treasury bills or treasury inflation protected securities.

Whether it’s in their 401k or they’ve directly bought it themselves, it doesn’t matter they are the largest holders of government debt.

The next biggest group is foreign investors who own 29% of that debt. This is led by the Chinese and Japanese investors. They’re by far the largest holders of foreign debt. But then you got countries like Brazil, Ireland, the U.K, Belgium, India, and the interesting one is the Cayman islands. Those in the know will understand why this is. Cough tax!

The next largest holder of U.S debt is actually the U.S government themselves. Bit of a weird one they own 27% of their own debt. You might ask how, it’s actually mostly done through social security and federal pension funds.

Lastly 11.2% of that debt is owned by the federal reserve, aka the fed, making up the 4th and smallest holder of the debt that we are in.

So that was interesting to know who we owe the debt to but, big but coming. Can we afford this. $27.5 trillion dollars. Tripled in 13 year from just $10 trillion. Is this too much are we in over our heads?

Well there’s a couple of ways that we can measure this.

One of the main ways is to compare debt to our gross domestic product. GDP. Aka how is debt contrasted with how much we are producing every single year. So let’s start by looking at GDP on it’s own...

GDP has done extremely well over the past 12 or so years. It’s gone from from just over $14 trillion to $21.7 trillion dollars. Obviously we’ve had a bit of a dip this year and it went down slightly to $21.1 trillion!

https://fred.stlouisfed.org/series/GDP

However, GDP has not grown nearly as much relative to how much debt is growing by. Just remember I’ve said this before debt has almost tripled in the same amount of time.

Subscribe Here: https://bit.ly/2Y1kNq8

___

DISCLAIMER: It's important to note that I am not a financial adviser and you should do your own research when picking stocks to invest in. These are just some of my viewpoints, by no means would I recommend watching one YouTube video and then immediately buying that stock. This video was made for educational and entertainment purposes only. Consult your financial adviser.

-

LIVE

LIVE

TimcastIRL

24 minutes agoTrans Shooter Targets Catholic Kids In Mass Shooting, Leftists Reject Prayers | Timcast IRL

16,005 watching -

LIVE

LIVE

SpartakusLIVE

2 hours ago#1 Birthday Boy Celebrates with MASSIVE and HUGE 4.8-Hour Stream

345 watching -

LIVE

LIVE

Glenn Greenwald

2 hours agoGlenn Takes Your Questions on the Minneapolis School Shooting, MTG & Thomas Massie VS AIPAC, and More | SYSTEM UPDATE #506

11,227 watching -

LIVE

LIVE

Barry Cunningham

53 minutes agoBREAKING NEWS: PRESIDENT TRUMP THIS INSANITY MUST END NOW!

4,559 watching -

LIVE

LIVE

Armadillofather

1 hour agoEspionage Action in the Den! | Metal Gear Solid Delta | You being here means so much!

26 watching -

LIVE

LIVE

ABD

55 minutes agoCyberpunk 2077 | EP 2 - The Opening Act Pt.2 | 4K UHD

10 watching -

11:11

11:11

Michael Button

8 hours agoMy Joe Rogan Experience: Behind the Scenes

171 -

LIVE

LIVE

Charlotte Winslow

5 hours agoplaying GTA 5 for the First Time Ever in 2025 | OPEN WORLD WEDNESDAY

12 watching -

LIVE

LIVE

Dragoon_B

2 hours agoDragoon - Counter Strike - Noob to Pro Grind

22 watching -

8:26

8:26

WhaddoYouMeme

6 hours ago $0.02 earnedThe Internet Lied. He Just Destroyed His Life

1802