Premium Only Content

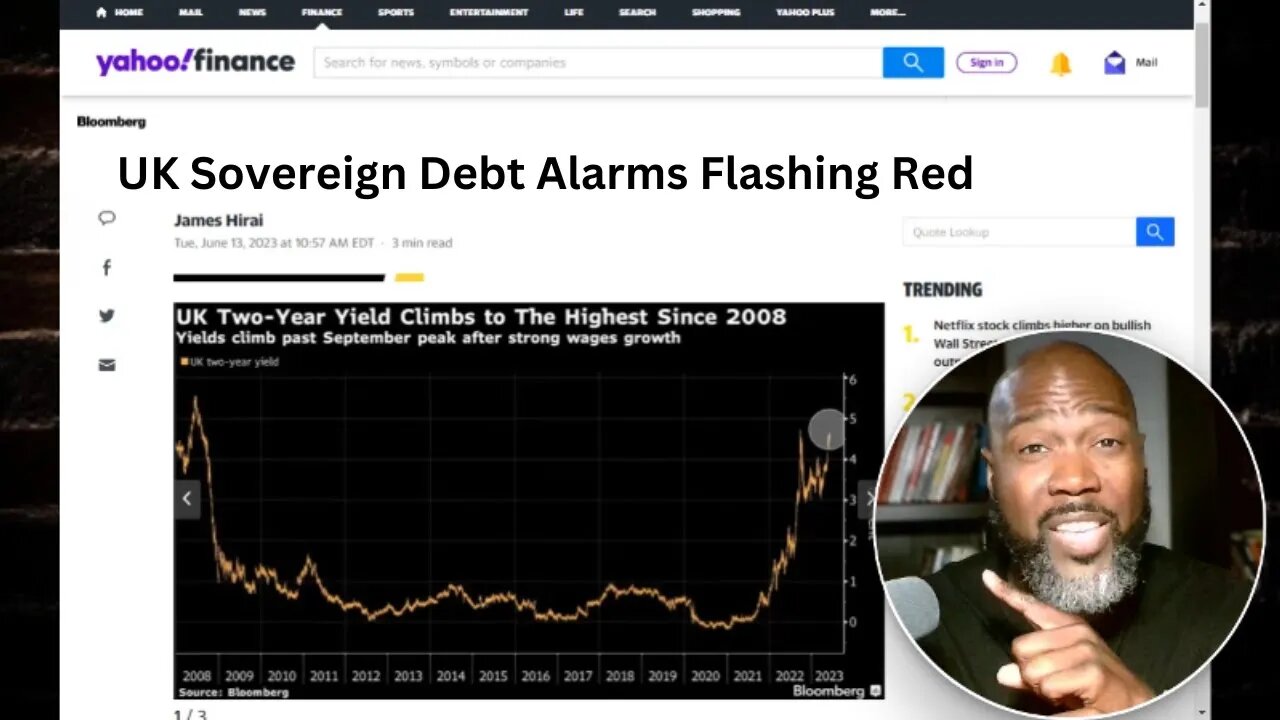

UK Yields Jump to Highest Since 2008 With 6% Peak Rate in Play

The UK government bond market is experiencing significant turmoil, with bond levels falling to those last seen during the global financial crisis, due to traders predicting that the Bank of England will continue to raise interest rates into the next year to counter inflation.

🛑 PLEASE CONSIDER SUPPORTING THE RTD CHANNEL. All gifts add up to make a difference. I appreciate any help you can provide.

📲 One-time donation through PayPal: https://www.paypal.com/paypalme/RTDeducation

📲 Become a monthly sponsor on Patreon: https://www.patreon.com/rtd

📲 Cryptocurrency - https://www.rethinkingthedollar.com/donate/

📲 CashApp: $RTDtv

Connect with RTD on social media here:

Locals: https://rtd.locals.com/

BitChute: https://www.bitchute.com/channel/BVAoAbP1udUc/

Gab: https://gab.com/rethinkingthedollar

Telegram: https://t.me/rethinkingthedollar

Flote: https://flote.app/user/RTD

Minds: https://www.minds.com/RethinkingtheDollar/

Twitter: https://twitter.com/RethinkinDollar

Rumble: https://rumble.com/user/rethinkingthedollar

TikTok: https://www.tiktok.com/@rethinkingthedollar

📢 Disclaimer: The opinions expressed in this video are for educational and entertainment purposes only. They should not be used for investment decisions or tax advice and do not constitute personalized investment advice. Thank you for watching!

#UKGovernmentBonds, #GlobalFinancialCrisis, #BankOfEngland, #InterestRates, #Inflation, #MoneyMarkets, #BOE, #MonetaryTightening, #LizTruss, #TwoYearNotes, #Pound, #GroupOf10, #PersistentInflation, #2PercentTarget, #Gilts, #NatWestMarkets, #UKBondMarket, #QuantitativeEasing, #YieldCurve, #AllianzGlobal, #BlackRock, #Finance, #Economy, #Investment

-

LIVE

LIVE

SpartakusLIVE

3 hours agoSaturday SPARTOONS || WZ to Start - REDSEC or ARC Later???

154 watching -

19:23

19:23

Clintonjaws

20 hours ago $2.05 earnedKaroline Leavitt STOPS Trump's Meeting & Grills Reporters Leaving Them Speechless

4.04K7 -

LIVE

LIVE

Mally_Mouse

10 hours ago🌶️ 🥵Spicy BITE Saturday!! 🥵🌶️- Let's Play: Shift Happens

997 watching -

4:43:40

4:43:40

GamerGril

7 hours ago🎉 Birthday Stream 💞Until Dawn: Final Gril💞

8.5K4 -

LIVE

LIVE

SilverFox

2 hours ago🔴LIVE - Arc Raiders Solo DOMINATION

72 watching -

LIVE

LIVE

Putther

2 hours ago $1.34 earned🔴LIVE BOUNTY HUNTING PLAYERS!!

135 watching -

32:53

32:53

SouthernbelleReacts

3 days ago $3.51 earnedNO WAY THEY SHOWED THAT! 😳 | Welcome to Derry S1E2 Reaction

14K3 -

LIVE

LIVE

Reolock

3 hours agoWoW Classic Hardcore | Ultra Blackfathom into Shadowfang?

42 watching -

![[LIVE] POST-SHOW: Battlefield 6 | Sgt. Wilky's WARZONEPALOOZA II | Team: Helljumpers | #RumbleGaming #RumbleTakeover](https://1a-1791.com/video/fww1/75/s8/1/8/r/W/x/8rWxz.0kob-small-LIVE-Sgt.-Wilkys-WARZONEPAL.jpg) LIVE

LIVE

Joke65

6 hours ago[LIVE] POST-SHOW: Battlefield 6 | Sgt. Wilky's WARZONEPALOOZA II | Team: Helljumpers | #RumbleGaming #RumbleTakeover

17 watching -

25:00

25:00

marcushouse

14 hours ago $4.63 earnedNext Starship Flight – Sooner Than You Think! 🚀

11.6K6