Premium Only Content

Ethereum Staking Is Highly Centralized: How to Address the Risks

Lido’s dominance in the Ethereum staking market should raise serious concerns about Ethereum’s centralization, say the heads of the decentralized autonomous organization Asymmetry Finance. The potential impact of centralization on Ethereum could be catastrophic, leading to market crashes and protocol failures. Will regulators and community members wake up in time?

Since the Bitcoin Whitepaper in 2008, centralization has been the dream and driving force behind cryptocurrency. However, like many good things, it is easier said than done. Ethereum’s upgrade to proof-of-stake (PoS) last year brought many benefits. But, if you ask many in the liquid staking community, it also had serious downsides. Although, to first understand the problem, you need to understand Lido (LDO).

What Is Lido?

Lido (LDO) solves one of the biggest issues with staking tokens on a PoS blockchain like Ethereum: illiquidity. Essentially, in traditional staking, your tokens become locked up in the staking process—the consensus mechanism that secures the blockchain.

Instead of completely locking up your crypto assets, liquid staking allows you to receive tokenized versions of your deposited funds.

Launched in 2020, Lido supports Ethereum 2.0 liquid staking, as well as other layer-1 PoS blockchains like Solana, and Polkadot. Lido makes staking on Ethereum easier by allowing users to stake smaller amounts of Ether and still earn rewards. However, the minimum barrier for staking Ethereum is 32ETH (or about $60,000 at the time of writing).

An intimidating amount of money, to be sure. Although Lido Finance presents a solution. It lowers the financial barrier to staking ETH by enabling users to pool their ETH and stake any amount. So what’s the problem?

The Centralization of Ethereum Staking

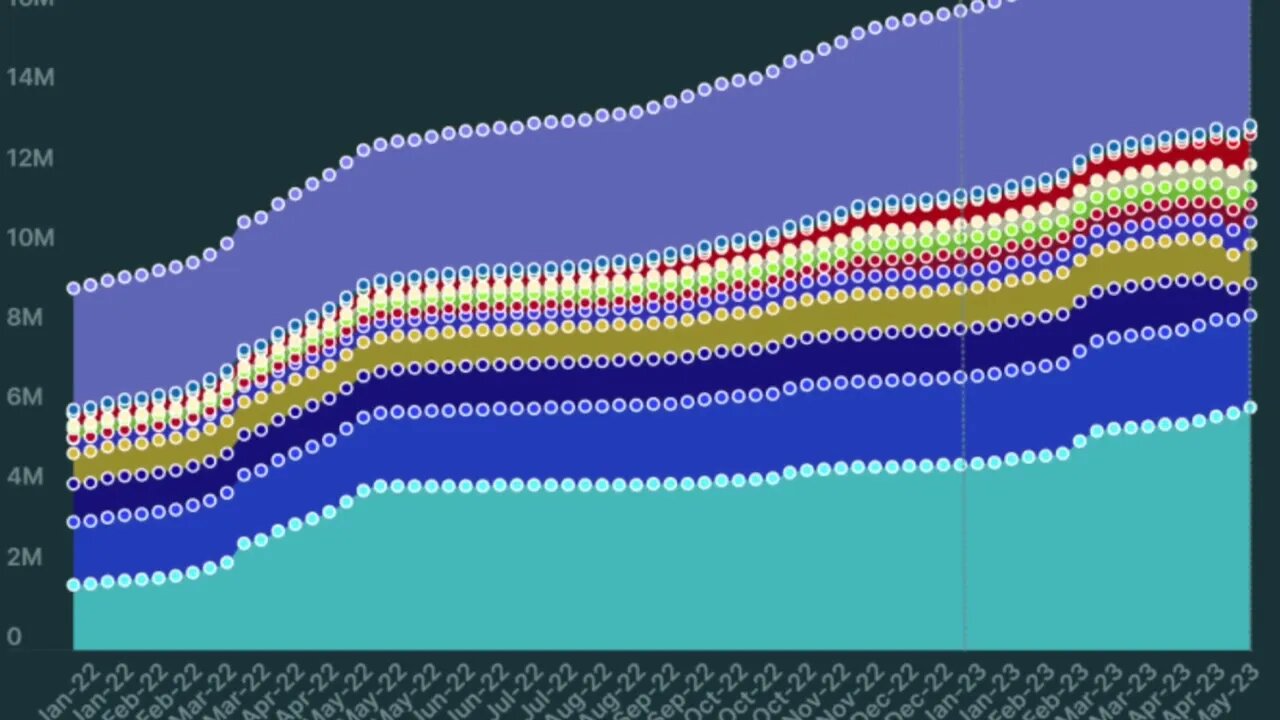

Unfortunately, Lido’s popularity has been a double-edged sword. It dominates the Ethereum ecosystem’s liquid staking derivatives and raises concerns about its impact on Ethereum’s decentralization as it experiences rapid and exponential growth. Even Vitalik Buterin, Ethereum’s founder and mastermind, has acknowledged the risk it poses.

“Lido running 38% of validators is more than double that of which Vitalik said is too much for any single entity to control,” Justin Garland, co-founder of Asymmetry Finance, said in a discussion with BeInCrypto.

“Additionally, only 18% of ETH is currently staked. In Solana, more than 80% of the native token supply is staked and securing the network. In Avalanche, that number is above 60%. More ETH must be staked, as it further secures the entire network.”

Learn more about liquid staking with Lido:

The Ultimate Guide to Lido Staked ETH (stETH)

Asymmetry was founded to address the centralization of the Liquid staking tokens and derivatives market. When you deposit into Asymmetry, you receive a share of multiple staked Ethereum derivatives, which helps decentralize the staked Ethereum market. They plan to launch their flagship product afETH in the fall of this year.

One Attack Away From Disaster

Should the centralization vis-a-vis Lido keep you up at night? If you build or operate on Ethereum, maybe. For Hannah Hamilton, Asymmetry Finance’s other co-founder, the potential outcome is catastrophic.

“[It] means mass chaos. Crash of markets. Potentially the loss of everything that is on Ethereum. DeFi protocol failure for those integrated with Lido. It would be the worst crash within DeFi we’ve ever seen – nearly incomprehensible,” Hamilton told BeInCrypto.

“One protocol’s failure should not ever be allowed to obtain enough reach such that it would have an impact of this magnitude on the entire industry. This is why it is imperative that we decentralize this market,” she added.

It’s not entirely clear that everyone understands these risks, added Garland. Which calls for more education on what exactly decentralization means in practice.

“To note, 66% of the nodes on the Ethereum network must agree on the state of the network to reach consensus,” Garland explained.

“According to Rated Network, Lido has 32.9% ‘network penetration’ or the amount of stake that maps under one entity. Meaning if Lido gets to 33% and there was an attack or bug, Lido could single handedly stop the Ethereum network from reaching consensus. This means Ethereum itself stops functioning properly.”

#ethereum #crypto #cryptocurrency #lido #staking #stakingcryptocurrency #stakingrewards #stakingcrypto

-

LIVE

LIVE

The Bubba Army

2 days agoF1'S NEWEST DRIVER? - Bubba the Love Sponge® Show | 11/24/25

524 watching -

19:15

19:15

Nikko Ortiz

19 hours agoOstrich Gets A Taste For Human Blood

35.6K15 -

32:42

32:42

MetatronHistory

1 day agoWas FASCISM Left wing or Right wing?

5.58K23 -

2:13:31

2:13:31

The Connect: With Johnny Mitchell

1 day ago $17.36 earnedIs Garth Brooks A Serial Killer? Exposing The Dark Secrets Of Country Music's Biggest Star

29.8K13 -

9:52

9:52

MattMorseTV

13 hours ago $12.91 earnedTrump just GAVE the ORDER.

14.3K48 -

19:19

19:19

GritsGG

15 hours agoINSANE Trio Match! Most Winning Warzone Player IGLs to Victory!

9.52K1 -

32:24

32:24

Forrest Galante

1 day agoHunting and Eating The World's WORST Fish (Everglades At Night)

128K9 -

11:37

11:37

The Pascal Show

1 day ago $14.45 earnedTHEY WANT TO END HER?! Candace Owens Claims French President & First Lady Put A H*t Out On Her?!

49.6K51 -

LIVE

LIVE

Lofi Girl

3 years agolofi hip hop radio 📚 - beats to relax/study to

265 watching -

35:40

35:40

The Why Files

5 days agoPsyops: From Dead Babies to UFOs - The Same Pattern Every Time

114K106