Premium Only Content

How "Retirement Planning for Freelancers and Self-Employed Individuals" can Save You Time, Stre...

https://rebrand.ly/Goldco

Join Now

How "Retirement Planning for Freelancers and Self-Employed Individuals" can Save You Time, Stress, and Money., retirement savings investment plan

Goldco aids customers shield their retired life financial savings by rolling over their existing IRA, 401(k), 403(b) or other qualified pension to a Gold IRA. ... To learn just how safe house rare-earth elements can assist you build as well as safeguard your wide range, and also even protect your retirement call today retirement savings investment plan.

Goldco is among the premier Precious Metals IRA companies in the United States. Protect your wide range and also income with physical precious metals like gold ...retirement savings investment plan.

When it comes to preparing for retired life, lots of individuals take into consideration employing a economic specialist to assist them get through the complicated world of financial investments, taxes, and various other monetary factors to consider. While there are actually definitely perks to working with a professional, there are likewise some possible setbacks that need to be thought about. In this blog post, we'll explore the pros and cons of tapping the services of a economic specialist for your retirement life program.

Pros:

1. Competence and know-how: One of the biggest advantages of working with a monetary consultant is their proficiency and know-how in the industry. A great expert will certainly have years of experience in aiding clients plan for retired life and will definitely be up-to-date on the most up-to-date styles and ideal techniques.

2. Customized insight: Every person has various goals, concerns, threat tolerance levels, and economic situations. A financial advisor may give customized guidance tailored to your specific necessities and goals.

3. Access to expenditure options: Financial specialists usually have get access to to a wide array of expenditure possibilities that may not be available to individual clients. This can easily include alternate financial investments such as exclusive equity or real property.

4. Tax obligation strategy: Retirement program entails additional than just conserving cash; it also requires mindful factor to consider of tax ramifications at several phases in lifestyle. A good financial specialist can easily help you decrease income taxes while optimizing profits.

5. Calmness of thoughts: Planning for retirement life may be taxing, especially if you're not familiar with all the ins-and-outs of investing and financial resources. Working along with an experienced specialist can supply tranquility of mind understanding that your retirement planning is in good palms.

Downsides:

1. Cost: Monetary experts demand fees for their companies which can add up over time, specifically if you're working along with them for several years leading up to retirement.

2. Disagreements of rate of interest: Some experts operate on commission or obtain motivations coming from specific investment products which can develop disputes of interest when making recommendations.

3. Minimal control: When working with an advisor, you might possess limited management over your expenditures and economic selections. While they might supply advice, inevitably the last selection is up to them.

4. Risk of poor guidance: Not all economic advisors are generated identical. Some may not possess your ideal passions at soul or might lack the required knowledge to supply sound recommendations.

5. Misleading sense of surveillance: Only because you have a monetary advisor doesn't indicate that your retirement program is ensured to prosper. There are regularly risks and unpredictabilities included in investing, no matter of who is managing your portfolio.

In verdict, tapping the services of a economic consultant for your retired life strategy may be helpful for lots of factors, but it's crucial to very carefully weigh the pros and disadvantages prior to creating a selection. Look at aspects such as price, disagreements of rate of interest, and possible dangers before committing to a professional connection. Eventually, the ideal retirement strategy is one that lines up along with your private goals and concerns, whether or not you decide on to operate along with an advisor.

When it happens to planning for retirement life, numerous folks think about working with a financial advisor to assist them browse the intricate world of expenditures, tax o...

-

6:36:44

6:36:44

StoneMountain64

7 hours ago#1 WARZONE TACTICIAN + New Battlefield Trailer

61.3K7 -

LIVE

LIVE

LFA TV

13 hours agoLFA TV ALL DAY STREAM - THURSDAY 8/28/25

802 watching -

LIVE

LIVE

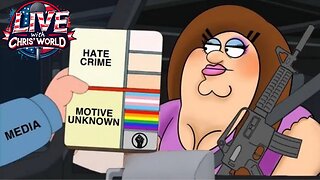

LIVE WITH CHRIS'WORLD

4 hours agoLIVE WITH CHRIS’WORLD - YOU DON’T HATE THE MEDIA ENOUGH!

174 watching -

LIVE

LIVE

SavageJayGatsby

1 day agoFirst Rumble Exclusive Stream?! | Let's Play: Prey | $300 Weekly Goal for Spicy Bite Saturday

154 watching -

11:42:24

11:42:24

GritsGG

12 hours agoWin Streaking! Most Wins 3485+ 🧠

36.9K1 -

LIVE

LIVE

Quite Frankly

6 hours ago"Mixed News, RFK Pull-up Challenge, Calls" ft. J Gulinello 8/28/25

507 watching -

1:14:52

1:14:52

TheCrucible

4 hours agoThe Extravaganza! EP: 29 (8/28/25)

93.8K8 -

1:09:58

1:09:58

Kim Iversen

5 hours agoTrans. Russian. Anti-Israel. Anti-Trump. Are You Buying This Story?

41.8K81 -

1:51:08

1:51:08

Redacted News

5 hours agoEMERGENCY! BILL GATES CULT MEMBERS FOUND PLANTED INSIDE MULTIPLE FEDERAL AGENCIES, RFK FURIOUS

140K110 -

31:02

31:02

Kimberly Guilfoyle

5 hours agoFull Breaking News Coverage: Live with John Nantz & Steve Moore | Ep250

33.8K13