The "Understanding the Relationship Between Inflation and Gold Prices" Ideas

https://rebrand.ly/Goldco5

Get More Info Now

The "Understanding the Relationship Between Inflation and Gold Prices" Ideas, gold and investment

Goldco helps customers shield their retired life financial savings by surrendering their existing IRA, 401(k), 403(b) or various other qualified retirement account to a Gold IRA. ... To learn exactly how safe house rare-earth elements can help you construct and also shield your wide range, and also even safeguard your retired life telephone call today gold and investment.

Goldco is one of the premier Precious Metals IRA firms in the United States. Secure your riches and livelihood with physical rare-earth elements like gold ...gold and investment.

Gold has been a valuable product for centuries, prized for its elegance and rarity. In modern-day times, it has likewise come to be a prominent investment choice due to its capability to provide variation perks to a portfolio. Integrating gold into your expenditure profile can be an efficient technique to manage danger and likely improve returns. In this article, we will definitely cover how to include gold right into your assets portfolio for diversity.

Before we dive into the specifics of how to invest in gold, it is essential to recognize why you would desire to include it in your portfolio. Gold has traditionally possessed a low connection with other resource classes such as inventories and bonds. This indicates that when the supply market is down, gold may go up in market value, supplying a hedge versus market volatility.

Gold is likewise considered a safe-haven possession. During the course of times of economic uncertainty or political chaos, real estate investors typically flock to gold as a establishment of worth. This can easily help safeguard your portfolio coming from significant reductions throughout turbulent opportunities.

Right now that we have developed the advantages of putting in in gold let's look into some means you can integrate it in to your financial investment portfolio:

1. Physical Gold

One way to commit in gold is by buying bodily gold or coins. This may be done with suppliers who specialize in priceless steels or on the web retail stores like APMEX or JM Bullion.

When buying physical gold, it's significant to consider storage and insurance coverage costs as well as the fees asked for through dealers over the place cost of gold. It's likewise essential to note that physical gold may not be as fluid as other forms of investments such as supplies or bonds.

2. Exchange-Traded Funds (ETFs)

Yet another popular means financiers can add direct exposure to gold is through exchange-traded funds (ETFs). ETFs are surveillances that track an underlying index or possession course and business on an exchange like sells.

There are a number of ETFs on call that supply exposure especially to bodily gold such as SPDR Gold Shares (GLD) and iShares Gold Trust (IAU). These ETFs intend to track the price of gold through keeping bodily gold in a protected location.

ETFs supply many perks over bodily gold. They are extra fluid and can be got and marketed like supplies throughout the time. They additionally possess lower storage costs since they do not need bodily storing.

3. Gold Mining Sells

Investing in gold mining supplies is another means to acquire visibility to the precious metallic. When you commit in a gold mining business, you are practically spending in the firm's potential to remove gold coming from the ground.

Gold exploration supplies can supply additional utilize to the rate of gold than physical gold or ETFs since they are linked straight to the productivity of a certain mining function. Nonetheless, this happens along with improved threat as these providers might experience functional or monetary problem that affect their inventory costs.

4. Possibilities and Futures Contracts

For more innovative financiers, choices and futures contracts can deliver exposure to gold prices without owning bodily gold or inventories.

Options arrangements offer you the right but not the commitment to acquire or market an underlying resource at a determined rate within a specified time framework. Futures contracts, on the various other palm, bind you to buy or offer an rooting asset at a predetermined cost on a pointed out date in the future.

Each choices and futures arrangements are very leveraged equipments that can easily magnify gains or losses depending on market problems. As...

-

1:43:48

1:43:48

Bright Insight

1 day agoWhat You Must Know about Graham Hancock/Flint Dibble Debate (w/ @DeDunking)

111K86 -

47:41

47:41

Digital Social Hour

11 hours agoLiving Longer and Healthier with Gary Brecka | Digital Social Hour

43.3K15 -

19:52

19:52

The Nima Yamini Show

9 hours agoLondon Unites: Massive March Against Biased Policing

30K10 -

41:30

41:30

Standpoint with Gabe Groisman

11 hours agoEp. 33. Protecting Biblical Israel. Governor and Yesha Council Chair, Israel Ganz

55K76 -

1:06:18

1:06:18

Sports Wars

10 hours agoLakers Give In And Draft Lebron James' Son Bronny, Woke Nike IMPLODES, LGBTQ Activists Are FURIOUS

67.2K43 -

2:10:26

2:10:26

Roseanne Barr

3 days ago $85.81 earnedDanger Close with Patrick Byrne Part 2 | The Roseanne Barr Podcast #54

209K347 -

37:25

37:25

Squaring The Circle w/ Randall Carlson

1 day ago#010 The Cosmos Speaks: The Tunguska Event Pt.1 - Squaring the Circle: A Randall Carlson Podcast

78.6K27 -

3:15

3:15

scoutthedoggie

1 day agoAirsoft Sniper Silverback TAC-41

86.1K10 -

7:15

7:15

Brad Polumbo

1 day ago $0.02 earnedCommunist TikToker gets exposed 🤣 (as total hypocrite!)

82.7K48 -

23:06

23:06

Exploring With Nug

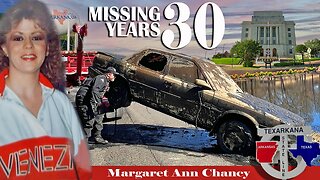

1 day ago $0.04 earned30 Years Later: The Nurse Who Vanished Without a Trace

75.4K4