Premium Only Content

BTC Implied Volatility brings Chaos at Short Expiry

BTC Implied Volatility brings Chaos at Short Expiry

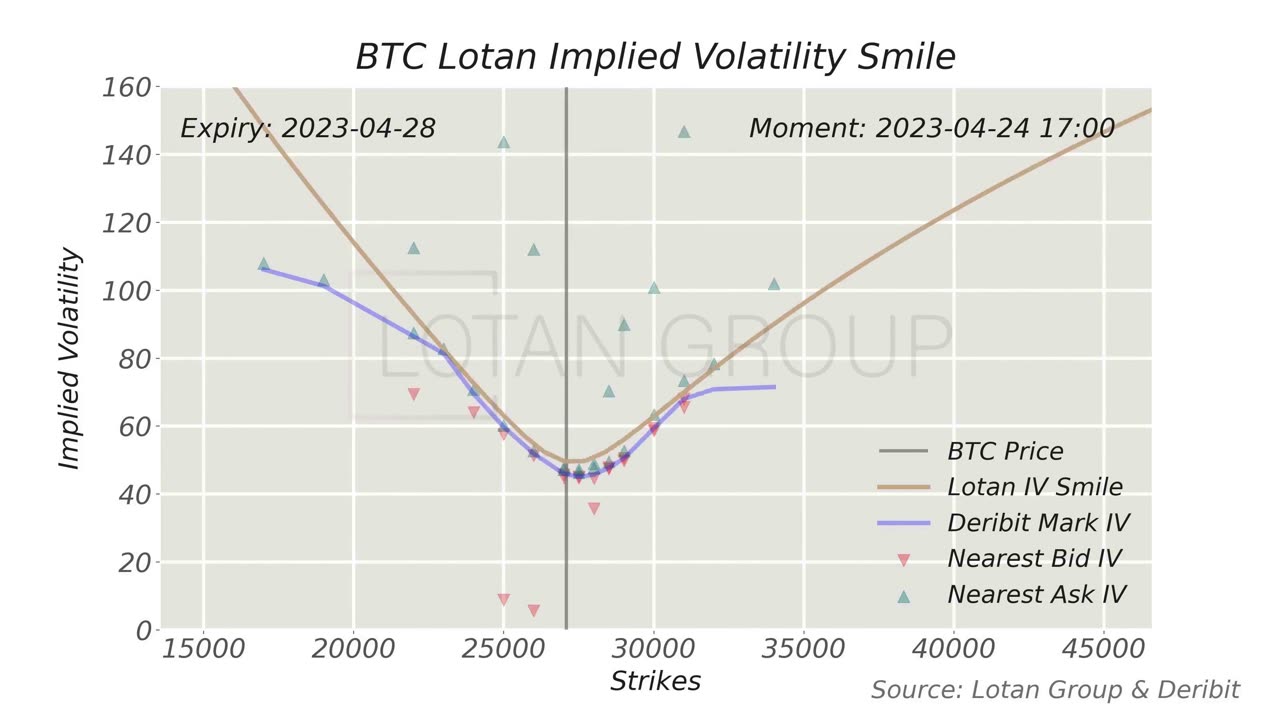

BTC options very liquid and well established. However at short expiry volatility smile is a challenge to be modeled.

Modelling short-term expiry options can be challenging, and this can result in less accurate volatility smile modelling, leading to chaos during option expiry. Despite these challenges, the BTC option market has matured significantly in recent years, increasing confidence in the market.

At Lotan SABR (Stochastic Alpha Beta Rho) model is used, which takes into account the volatility of the underlying asset, time to expiration, and strike price. The volatility smile is a commonly observed phenomenon in the financial market that describes the relationship between the implied volatility of an option and its strike price.

-

4:22:33

4:22:33

Due Dissidence

9 hours agoGaza STARVATION Hits Tipping Point, Flotilla CAPTURED, Bongino BREAKS SILENCE, Maxwell MEETS DOJ,

37.8K97 -

LIVE

LIVE

GritsGG

10 hours agoWin Streaking! Most Wins 3180+! 🔥

1,902 watching -

LIVE

LIVE

This is the Ray Gaming

2 hours agoSunday Night LIVE | Rumble Premium Streamer

161 watching -

2:42:31

2:42:31

Barry Cunningham

8 hours agoPRESIDENT TRUMP IS SAVING AMERICA ONE DEAL AT A TIME! UNBELIEVABLE!

72.2K40 -

5:12:47

5:12:47

EricJohnPizzaArtist

5 days agoAwesome Sauce PIZZA ART LIVE Ep. #56: Bret “The Hitman” Hart Tribute with SoundBoardLord!

37.3K7 -

1:38:08

1:38:08

HELMETFIRE

3 hours ago🟢GAMING WITH FIRE EP4🟢RUMBLE TAKEOVER!🟢

18K -

LIVE

LIVE

iCheapshot

4 hours agoCheap Plays Warzone Again? What!?

176 watching -

2:30:14

2:30:14

PandaSub2000

6 hours agoCHAOS & FURY | Episode 27: Attack Of The Cranks (Edited Replay)

12.9K1 -

Spartan

3 hours agoSpartan - Pro Halo Player for OMiT | Ranked for a little bit

12.7K1 -

15:15

15:15

Adam Does Movies

1 day ago $3.00 earnedHappy Gilmore 2 - Movie Review

25.9K16