The Basic Principles Of "Why Diversification is Essential in Retirement Investing"

https://rebrand.ly/Goldco2

Get More Info Now

The Basic Principles Of "Why Diversification is Essential in Retirement Investing" , retirement investing basics

Goldco aids customers secure their retired life savings by rolling over their existing IRA, 401(k), 403(b) or other professional retirement account to a Gold IRA. ... To learn how safe haven rare-earth elements can aid you construct and also safeguard your wide range, and also also safeguard your retired life telephone call today retirement investing basics.

Goldco is just one of the premier Precious Metals IRA companies in the United States. Protect your wide range and also resources with physical precious metals like gold ...retirement investing basics.

Why Variation is Essential in Retirement Investing

Retirement is one of the most vital turning points in life, and it's necessary to possess the correct financial investment technique to make certain a comfortable future. One of the essential elements in effective retirement program is diversity. Variation is an investment technique that entails spreading your funds throughout a range of different properties. In this short article, we'll discover why variation is crucial in retirement investing.

Variation decreases threat

The major cause for transforming your financial investments is lessening risk. By spreading your money around various asset courses, you can easily lower the impact of any single property's efficiency on your total profile. For instance, if you just put in in supplies and one provider experiences a significant decrease in worth, it could clean out a huge section of your financial savings. But if you had likewise invested in bonds or real real estate, those possessions would help made up for the losses coming from stocks.

Variation helps take full advantage of gains

While lessening threat is important, diversification can additionally help make best use of returns. Various resource classes execute in a different way over opportunity; some may be up while others are down. By putting in around various property courses, you're more likely to grab increases coming from whichever possessions are carrying out effectively at any type of provided opportunity.

For instance, during the course of time frames of high inflation, real property investments tend to perform properly as rental costs improve along with residential property market values. In comparison, during economic downturns or economic crises, connects normally execute better as entrepreneurs find safe-haven possessions to protect resources.

Variation can deliver revenue

One target for many retirees is creating revenue from their investments to supplement Social Security and other resources of retirement life earnings like pensions or allowances. Transforming your collection along with dividend-paying inventories or service properties can easily provide stable flows of profit that might improve over opportunity.

Also, some substitute investments like private capital or bush funds may give much higher turnouts than conventional investments but happen with greater threats and fees.

How to Expand Your Retirement Portfolio

Currently that we've talked about the benefits of diversification let's look at how to execute a diversified retirement life assets tactic.

Resource allowance: The very first action in expanding your profile is finding out the suitable mix of property training class located on your threat resistance and financial investment objectives. A economic advisor can help you identify the appropriate allotment for your circumstance.

Capital expenditures: Sells are one of the most usual methods to put in in capitals. Look at putting in in a mix of large-cap, mid-cap, small-cap, and worldwide stocks to spread threat throughout different locations and sectors.

Fixed-income financial investments: Connects are one type of fixed-income investment that may provide stable revenue along with reduced dryness than supplies. Look at spending in connections from a assortment of companies with varying maturations.

Actual real estate financial investments: Genuine estate can easily provide earnings by means of rental homes or recognition by means of building worths. Think about committing in true estate financial investment depends on (REITs) or rental homes straight.

Alternative financial investments: Alternative investments such as exclusive equity or bush funds might give higher profits but hap...

-

6:18

6:18

Website with WordPress

1 year ago"Why Diversification is Essential in Retirement Investing" Fundamentals Explained

8 -

7:14

7:14

Website with WordPress

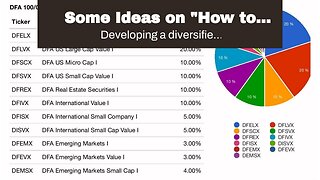

1 year agoSome Ideas on "How to Create a Diversified Retirement Portfolio with Multiple Investment Plans"...

46 -

2:24

2:24

Financial Corners

10 months agoPlease click on link provided! Beyond Diversification: What Every Investor Needs to Know About...

101 -

28:07

28:07

RetireSharp

1 year agoStrategies for Retirement Income

89 -

7:55

7:55

Daftplanet

1 year ago18 Essential Wealth Building Strategies for Long Term Financial Success

10 -

13:18

13:18

Peak Financial Planning

8 months agoInvestment Risk for Dummies #retirementplan #financialadvice

6 -

1:17

1:17

wealthontap

1 year agoInvestment Portfolio Options | Portfolio Diversification | Investment and Retirement Portfolio

10 -

6:15

6:15

smartwealtheducation

9 months agoBuilding A Diversified Investment Portfolio

70 -

5:50

5:50

JazzWealth

3 months ago $0.09 earnedPersonal Finance 101: Things To Know Before Investing For Retirement

361 -

11:00

11:00

IPOMarketWatch

9 months agoHow To Easily Build Wealth For The Rest Of Your Life | Invest In Your Future!

38