Premium Only Content

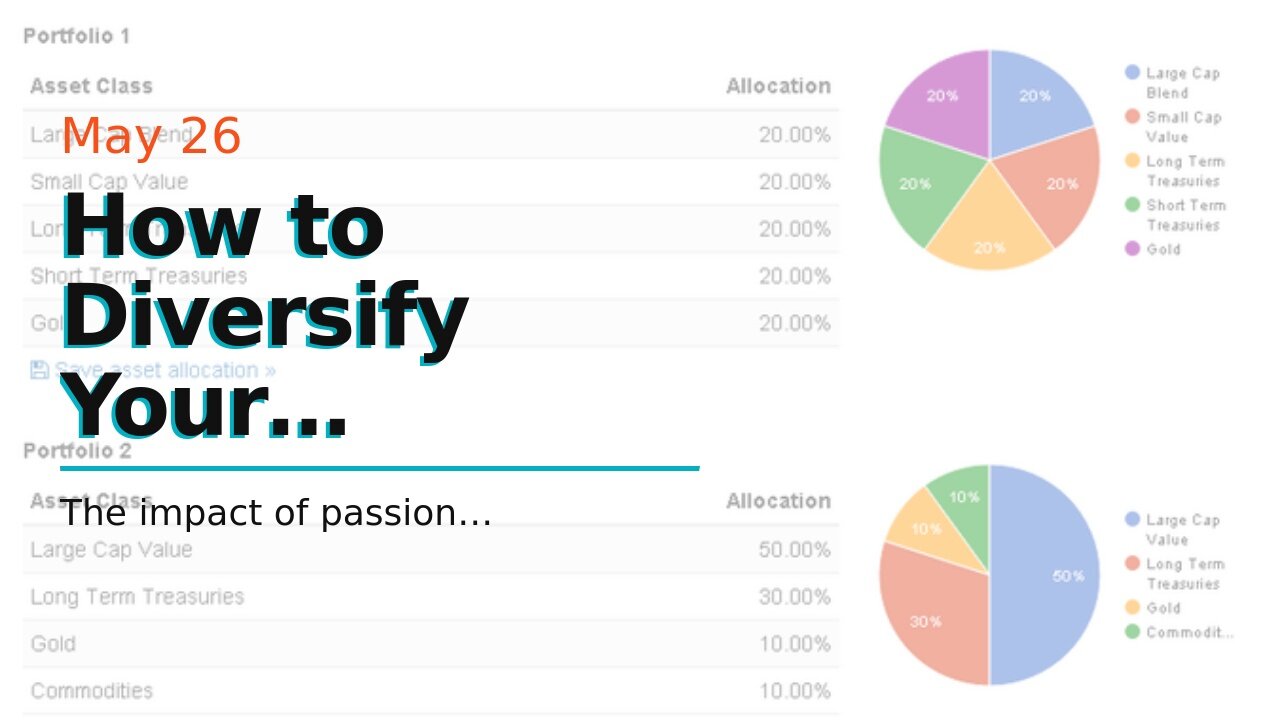

How to Diversify Your Investment Portfolio with Gold - An Overview

https://rebrand.ly/Goldco5

Get More Info Now

How to Diversify Your Investment Portfolio with Gold - An Overview, gold and investment

Goldco helps clients secure their retired life savings by rolling over their existing IRA, 401(k), 403(b) or various other qualified pension to a Gold IRA. ... To learn just how safe haven rare-earth elements can assist you construct and also safeguard your riches, and also secure your retirement call today gold and investment.

Goldco is among the premier Precious Metals IRA firms in the United States. Secure your wealth as well as livelihood with physical precious metals like gold ...gold and investment.

The impact of passion prices on the market value of gold investments is a subject that has been gone over for a lot of years. Gold financial investments are usually viewed as a safe shelter assets, specifically during the course of opportunities of financial uncertainty. Enthusiasm rates, on the various other hand, are controlled through core banks and can have a substantial effect on the value of financial investments. In this blog post, we will certainly check out the connection between enthusiasm rates and gold financial investments.

First of all, it is significant to comprehend how passion fees influence the economy. When interest costs are low, borrowing ends up being cheaper and more available. This may promote financial growth as businesses and consumers may borrow funds at reduced rates to invest in new projects or investment goods and services. On the other hand, when passion prices are higher, borrowing comes to be a lot more pricey which can slow down economic growth.

When it happens to gold expenditures, there is actually an inverted relationship between gold prices and interest rates. This implies that when rate of interest prices rise, gold prices have a tendency to fall and vice versa. The cause for this is that much higher interest costs help make alternative expenditures such as bonds a lot more appealing to financiers who find turnout or income from their investments.

Gold does not pay out any type of income or rewards which indicates that it becomes much less eye-catching when real estate investors look for return coming from their expenditures. As a outcome of this inverted connection between gold prices and passion costs, real estate investors commonly check out gold as a bush versus rising cost of living rather than an expenditure that uses income or yield.

In addition to this inverted partnership between gold prices and interest costs, there are actually other factors that can easily affect the market value of gold investments:

1) Central Bank Policies: Central banking company policies such as quantitative easing (QE) may have an effect on the market value of gold financial investments. QE involves injecting money right into the economic condition which can easily lead to inflationary tensions over opportunity. Gold is frequently looked at as a hedge against inflation which suggests that QE policies may lead to enhanced requirement for gold as an investment.

2) Geopolitical Risks: Another factor that may affect the market value of gold financial investments is geopolitical dangers. When there is actually uncertainty or vulnerability in the international economy, investors commonly transform to safe shelter financial investments such as gold. This can easily lead to improved requirement for gold which may drive up its rate.

3) Demand and Supply: The standard principles of source and demand likewise apply to gold investments. If there is actually higher need for gold but limited supply, this can easily push up its price. On the other hand, if there is actually low demand for gold but high source, this can easily lead to a decline in its cost.

In final thought, the impact of enthusiasm costs on the worth of gold financial investments is an significant factor to consider for investors. While there is an inverse partnership between gold prices and rate of interest fees, various other elements such as central financial institution policies and geopolitical threats may additionally impact the market value of gold financial investments. As along with all financial investment decisions, it is important to consider a array of elements just before creating any kind of investment decisions., gold and investment

#goldco#howtoinvestingold#goldinvestment

gold and investment

North Dakota, Northern Mariana Islands, Ohio, Oklahoma,...

-

LIVE

LIVE

StoneMountain64

4 hours agoBattlefield REDSEC UNSTOPPABLE WIN Squad

46 watching -

1:40:36

1:40:36

The Quartering

4 hours agoKimmel Pulls Show Mysteriously, Youtube Collapse? & Much MOre

98.5K56 -

LIVE

LIVE

cosmicvandenim

4 hours agoCOSMIC VAN DENIM | OFF CHARACTER | WARZONE PRACTICE

51 watching -

2:08:06

2:08:06

The Robert Scott Bell Show

4 hours agoMike Adams, Brian Hooker, Live From Brighteon Studios in Austin Texas, Kids Triple Vaccinated, Blood Sugar and Autism, Candy Fed to Cows, Nutrition Reform - The RSB Show 11-7-25

20.4K1 -

LIVE

LIVE

GritsGG

3 hours ago#1 Most Warzone Wins 3943+!

23 watching -

1:15:58

1:15:58

DeVory Darkins

5 hours agoLIVE NOW: Democrats SABOTAGE GOP effort to reopen Government

108K56 -

1:21:21

1:21:21

Tucker Carlson

4 hours agoThe Global War on Christianity Just Got a Whole Lot Worse, and Ted Cruz Doesn’t Care

63.2K252 -

10:50

10:50

Dr. Nick Zyrowski

2 days agoDoctors Got It Wrong! This LOWERS CORTISOL In Minutes!

27.7K4 -

24:14

24:14

Verified Investing

2 days agoBiggest Trade As AI Bubble Begins To Burst, Bitcoin Flushes Through 100K And Gold Set To Fall

23.2K -

1:12:28

1:12:28

Sean Unpaved

4 hours agoAB's Dubai Drama: Extradited & Exposed + NFL Week 10 Locks & CFB Week 11 Upsets

29.9K