Premium Only Content

"The Pros and Cons of Investing in Gold Rates" Fundamentals Explained

https://rebrand.ly/Goldco2

Sign up Now

"The Pros and Cons of Investing in Gold Rates" Fundamentals Explained, gold rate investing

Goldco helps customers safeguard their retirement savings by surrendering their existing IRA, 401(k), 403(b) or various other competent pension to a Gold IRA. ... To discover just how safe house precious metals can help you construct and shield your wealth, and even protect your retirement call today gold rate investing.

Goldco is just one of the premier Precious Metals IRA companies in the United States. Protect your wealth and also income with physical precious metals like gold ...gold rate investing.

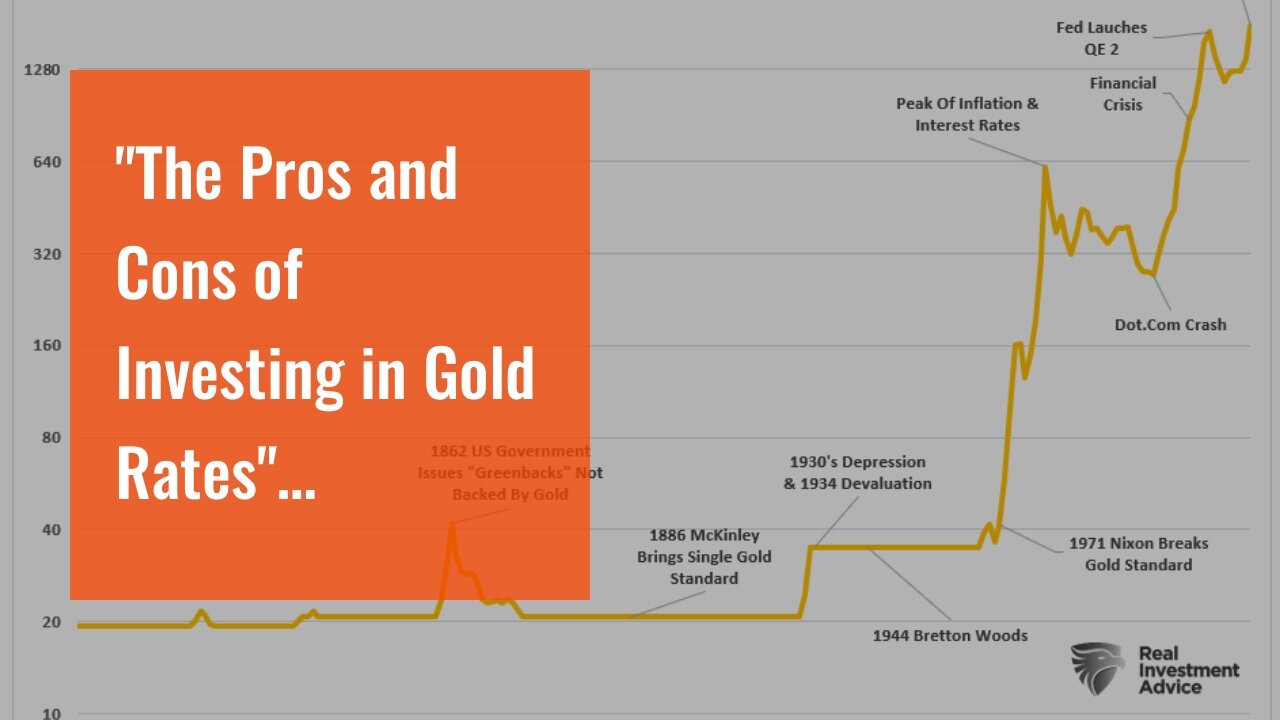

The Pros and Cons of Investing in Gold Prices

Gold has been a well-liked assets alternative for centuries, and for great cause. It is a positive asset that has stood the examination of time, providing security and security in an ever-changing financial landscape. Nevertheless, like any investment, there are actually pros and downsides to investing in gold rates. In this article, we will certainly discover the advantages and negative aspects of spending in gold fees.

Pros:

1. Diversification: One of the largest advantages of investing in gold is that it offers diversification to your collection. As an asset lesson, it is not associated along with various other standard investments such as inventories or connects. This indicates that when the stock market falls or enthusiasm rates increase, gold can easily act as a hedge versus losses.

2. Safe Haven: Gold has always been taken into consideration a secure haven asset in the course of financial unpredictability or political irregularity. In the course of times of problems or inflationary pressure, financiers transform to gold as a retail store of market value that may shield their riches coming from money decrease and other economic risks.

3. Inflation Hedge: Gold is commonly made use of as an inflation bush because its rate has a tendency to increase when rising cost of living raises. This develops because when inflation climbs, the acquisition electrical power of newspaper currency minimize; therefore, entrepreneurs switch to gold as an substitute retail store of value.

4. Liquidity: Unlike some various other alternate investments such as real real estate or craft, gold is very liquid which means that it can easily be simply bought or sold at any sort of opportunity without losing a lot market value.

5. Substantial Asset: Gold is also eye-catching because it is a substantial asset that entrepreneurs can easily actually hold onto which provides them with a sense of safety and security recognizing they have ownership over something beneficial.

Cons:

1. Dryness: One negative aspect of spending in gold rates is its volatility reviewed to various other assets such as stocks or connections which usually tend to have more dependable yields over time.

2. Storage space Expense: One more disadvantage to possessing bodily gold is storage price connected along with it. Clients who select to purchase physical gold requirement to locate a safe and safe place to store their gold which may be expensive.

3. Restricted Returns: Gold does not possess an earnings stream like supplies or connections, so the yields on financial investment are limited to the gratitude in the price of gold over opportunity.

4. Federal government Assistance: The rate of gold is also subject to federal government intervention which can easily impact its worth. For example, if a federal government decides to offer off its gold gets, this may lead to a reduction in the cost of gold.

5. Price Changes: Gold prices can rise and fall substantially over brief periods of time due to market requirement and source elements, creating it hard for capitalists who are appearing for stable long-term profits.

Final thought:

In verdict, committing in gold costs has actually each advantages and negative aspects that capitalists ought to consider before producing any kind of investment choices. While it provides diversification, a safe place in the course of economic uncertainty, an rising cost of living hedge and substantial property ownership; it is additionally unpredictable along with restricted returns, storing costs and subject to government intervention and price variations. Essentially, whether spending in gold fees is correct for you relies on your investment goals, risk resistance and general economic situation., gold rate investing

#investbit...

-

LIVE

LIVE

DeVory Darkins

1 hour agoNewsom SUFFERS MAJOR SETBACK after Trump revokes 17,000 Commercial Drivers Licenses

12,475 watching -

1:07:32

1:07:32

Timcast

2 hours agoDemocrats CAUGHT Framing Trump On Epstein, Leaked Emails Show Journalist COLLUSION :+1: 1

119K113 -

LIVE

LIVE

Dr Disrespect

3 hours ago🔴LIVE - DR DISRESPECT - ARC RAIDERS - NORTH LINE UPDATE

1,706 watching -

2:11:09

2:11:09

Steven Crowder

4 hours ago🔴 Just Release the Damn Epstein Files - End It Once and For All

362K252 -

LIVE

LIVE

Sean Unpaved

1 hour agoMike Vrabel Has Restored The Patriot Way! | UNPAVED

84 watching -

LIVE

LIVE

Side Scrollers Podcast

3 hours agoHasan Piker Goes FULL Propaganda + Kirsche & Craig Make “The List” + More | Side Scrollers

708 watching -

LIVE

LIVE

Nerdrotic

2 hours ago $1.64 earnedNerdrotic Nooner 533

378 watching -

LIVE

LIVE

GritsGG

2 hours ago#1 Most Warzone Wins 3987+!

43 watching -

1:08:44

1:08:44

The Rubin Report

3 hours agoPress Goes Silent When Told Ugly Facts of Damage Done by Democrat Shutdown

31K33 -

2:04:14

2:04:14

Nikko Ortiz

3 hours agoVETERAN DAY FAILS... | Rumble LIVE

30.4K3