Premium Only Content

Retirement Budget Planning

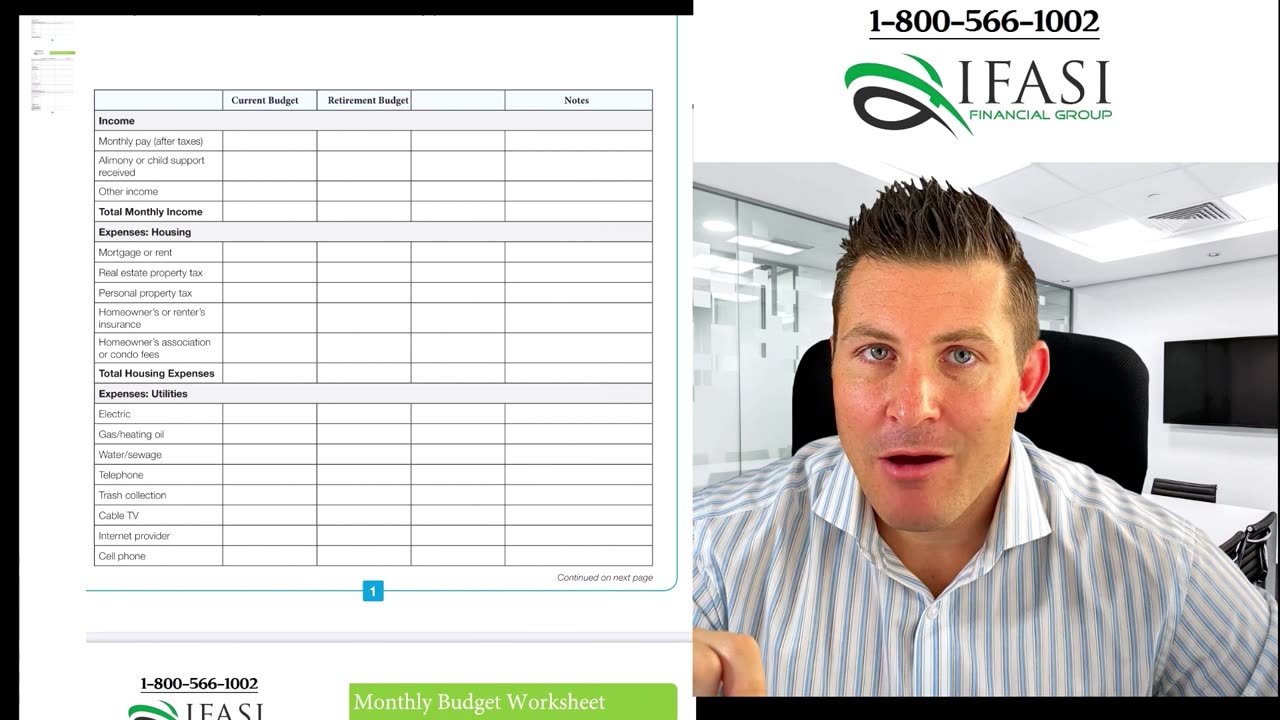

What are Retirement budgets - What is a Retirement budget? 1-800-566-1002 https://www.ifasifinancial.com, What are the best types of Retirement budget plans and learn how you can avoid the most common mistakes that individuals have made when looking to set up their retirement budget planning.

Retirement Budget Planning: Securing Your Golden Years

Retirement is a time of life that many look forward to—a time to relax, enjoy hobbies, and spend quality time with loved ones. However, to truly savor your golden years, it's essential to have a solid retirement budget plan in place. A well-crafted financial strategy can ensure a comfortable and worry-free retirement. In this article, we'll explore the importance of retirement budget planning and provide you with some practical tips to help you get started.

Why is Retirement Budget Planning Crucial?

Retirement budget planning is all about managing your finances efficiently to sustain your lifestyle during your non-working years. Without proper planning, you run the risk of outliving your savings or facing financial hardships down the road. By taking control of your finances and creating a realistic budget, you gain peace of mind and the ability to make informed decisions about your future.

Set Your Retirement Goals

To begin your retirement budget planning journey, it's crucial to define your goals. Take some time to envision your ideal retirement lifestyle. Do you want to travel the world or settle in a peaceful countryside? Are there any hobbies or activities you'd like to pursue? By clearly identifying your goals, you can estimate the funds you'll need and create a budget that aligns with your aspirations.

Assess Your Current Financial Situation

Next, evaluate your current financial situation. Determine your net worth by calculating your assets (such as savings, investments, and real estate) and subtracting your liabilities (such as debts and mortgages). Understanding your financial standing will help you make informed decisions regarding your retirement budget plan.

Estimate Your Retirement Income

Once you have a clear picture of your finances, it's time to estimate your retirement income. Consider all potential income sources, including social security benefits, pensions, investments, and rental income. Take into account any anticipated changes, such as the reduction or cessation of certain income streams. By having a comprehensive understanding of your retirement income, you can plan your budget more effectively.

Track Your Expenses

To create a realistic retirement budget, it's essential to track your current expenses. Analyze your monthly spending habits and categorize them into essentials (such as housing, healthcare, and groceries) and discretionary expenses (such as dining out, entertainment, and vacations). Identifying areas where you can potentially cut back will help you allocate your resources wisely in retirement.

Consider Inflation and Healthcare Costs

When planning for retirement, it's crucial to factor in inflation and rising healthcare costs. Inflation erodes the purchasing power of your money over time, so it's essential to consider how it may impact your retirement savings. Likewise, healthcare expenses tend to increase with age, so ensure that your budget accounts for potential medical costs.

Review and Adjust Regularly

Retirement budget planning is an ongoing process. As life evolves, your financial situation may change. Regularly review your budget, reassess your goals, and make adjustments as necessary. Stay informed about new investment opportunities and changes in tax laws that may affect your retirement plan. By staying proactive and adaptable, you can ensure that your retirement budget remains robust and resilient.

#Retirementbudget

#Retirementbudgets

#Retirementbudgetplanning

-

2:32:43

2:32:43

FreshandFit

11 hours agoAndrew Wilson VS Gary The Numbers Guy Astrology & Numerology Debate!

69K43 -

LIVE

LIVE

Dr Disrespect

9 hours ago🔴LIVE - DR DISRESPECT - TRIPLE THREAT CHALLENGE - RIVALS, PUBG, WARZONE

2,469 watching -

1:15:03

1:15:03

Dad Dojo Podcast

8 hours ago $0.03 earnedEP16: Parenting: Then vs Now

10.2K -

53:58

53:58

Sarah Westall

2 hours agoBlack Pilled vs Learning Reality and Maintaining Perspective, AI Reality w/ Johnny Vedmore

27.2K -

55:01

55:01

LFA TV

1 day agoJan. 6, 2021, vs. Jan. 6, 2025 | TRUMPET DAILY 1.6.25 7pm

19.3K -

1:19:27

1:19:27

The Big Mig™

1 day agoLimitless Health with Calley Means

29K7 -

1:37:26

1:37:26

Redacted News

6 hours agoBREAKING! Trump Effect is Real Justin Trudeau Resigns in Disgrace

145K192 -

49:08

49:08

Kimberly Guilfoyle

6 hours agoEnding Injustice and the 100 Day Agenda, Live with Joseph McBride and Mark Lucas | Ep. 186

43.2K6 -

56:29

56:29

Candace Show Podcast

6 hours agoYes, Internet. I Am Pregnant...AGAIN. | Candace Ep 126

108K235 -

1:08:16

1:08:16

The Amber May Show

9 hours ago $0.57 earnedU.K. Political Prisoner Tommy Robinson | Cyber Truck Explosion | Soros & Clinton Medal Of Freedom

17.9K1