Premium Only Content

What Does the Inverted Yield Curve Mean?

What Does the Inverted Yield Curve Mean?

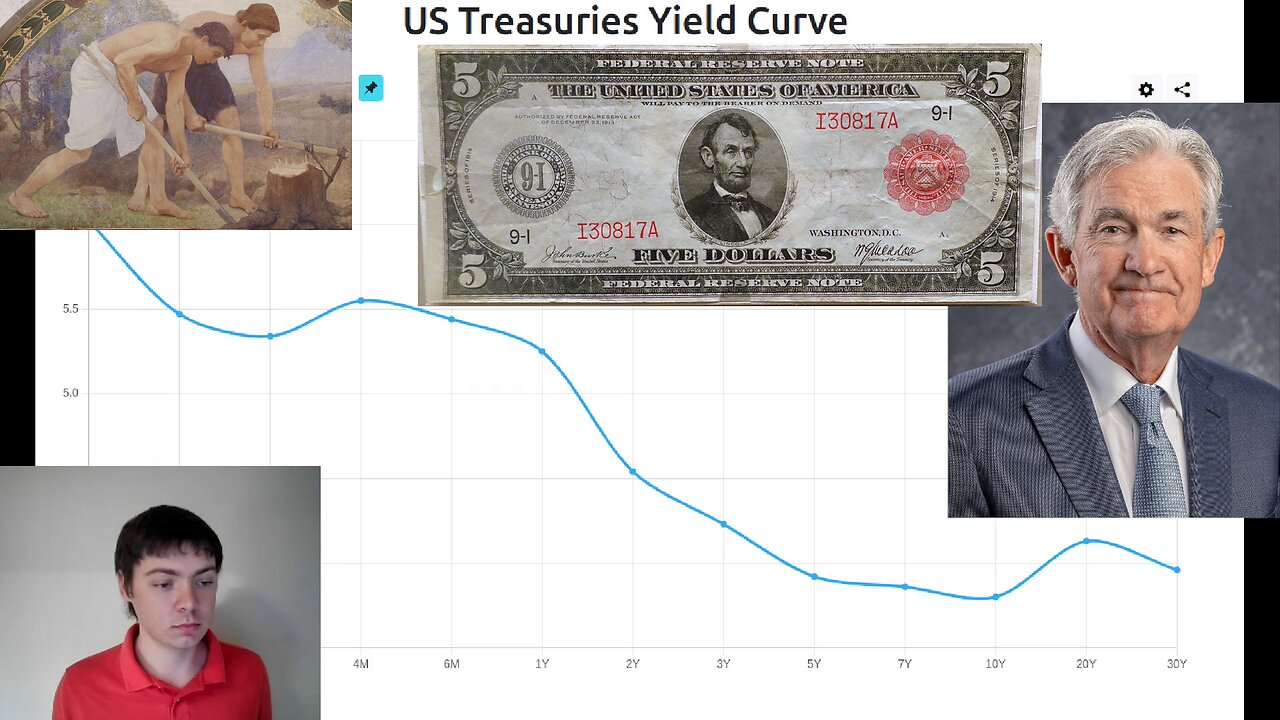

Currently, on May 28th 2023, the yield curve for U.S. Treasury Bonds is inverted. This means that the interest rates for short term debt are higher than the interest rates for long term debt. For example, the interest rates for 1 month bonds are 6.02%, the interest rates for 1 year bonds is 5.25%, and the interest rates for 30 year bonds is 3.96%. In contrast, typically the yield curve slopes the opposite direction with longer duration riskier bonds having higher interest rates than shorter duration bonds. The yield curve being inverted indicates that something unusual is happening in the economy.

Why does this matter? An inverted yield curve implies that the bond market in U.S. Government debt, which is a very large and liquid market, is predicting that interest rates are going to decrease substantially over the coming months and years. Interest rates normally decline when the Federal Reserve, which is the central bank of the U.S., lowers them by buying bonds or using other policy tools. Since the Federal Reserve normally lowers interest rates in response to a recession many people believe that an inverted yield curve is an indicator that a recession is coming.

In fact, an inverted yield curve has historically been an accurate predictor of recessions. The difference between the interest rates on 10 year and 2 year treasury bonds has gone negative before all of the 6 recessions in the last 45 years. And there are no periods in the last 45 years where the yield curve inverted and there wasn’t a recession within 2 years. Yield curve inversions correctly predicted the Dot Com Bust in 2001, the Great Recession in 2008, and the COVID-19 Recession in 2020.

Does this mean that a recession is imminent? A recession in the next few years is likely but may not happen; predicting recessions is extremely difficult so no one knows for certain. However, there are other signs we may be heading in to a time of economic turbulence. For example, so far in 2023 there has been a banking crisis centered on regional banks that have become insolvent as interest rates increased. There is also currently escalating political uncertainty in the U.S. and around the World.

If there is a recession what would it look like? If I had to guess the biggest difference between a recession today and past recessions would be that demand in the labor market will stay stronger now than it has in the past. America currently has an aging population and declining labor force participation rates meaning the supply of labor that the economy needs to run is shrinking. If there was a recession today I think there would still be jobs available but with higher inflation. This trend seems to have already started; over the past year the economy has declined but wages have remained high.

While recessions are painful I think there are some good things that could come out of this one. In particular I think this is an opportunity for wealth to flow to young people. Over the past 10 years there have been very low interest rates, which have benefited asset holders, while wages have stayed stagnant. This meant that if you were a working age person trying to save assets were expensive and putting your savings in a bank would yield -2% real interest rates. If there’s an inflationary recession with expensive labor this gives people who are able to work a lot of leverage to negotiate their wages and conditions of employment.

References:

- https://www.ustreasuryyieldcurve.com/

- https://fred.stlouisfed.org/series/T10Y2Y#

-

18:42

18:42

Navy Media

5 hours agoHouthis ATTACK the Wrong U.S. Fighter Jet – Then THIS Happened…

18.9K26 -

40:24

40:24

MetatronGaming

1 day agoSomething is REALLY Wrong with this apartment...

14.4K2 -

LIVE

LIVE

SpartakusLIVE

4 hours agoHUGE NEW UPDATE - Aim Assist NERF, New META, New MOVEMENT || #1 King of Content

444 watching -

![battlefield 6 with the crew! [RGMT CONTENT Mgr. | RGMT GL | GZW CL]](https://1a-1791.com/video/fwe2/7f/s8/6/w/D/y/F/wDyFz.0kob.18.jpg) 2:32:26

2:32:26

XDDX_HiTower

3 hours ago $1.39 earnedbattlefield 6 with the crew! [RGMT CONTENT Mgr. | RGMT GL | GZW CL]

20.3K -

2:28:57

2:28:57

Nikko Ortiz

4 hours agoVirtual Reality Milsim... | Rumble LIVE

27.9K4 -

LIVE

LIVE

StevieTLIVE

3 hours agoNEW UPDATE Warzone WINS w/ The Fellas

75 watching -

9:00:32

9:00:32

Dr Disrespect

13 hours ago🔴LIVE - DR DISRESPECT - WARZONE x BLACK OPS 7 - SEASON 1 INTEGRATION

147K7 -

1:25:00

1:25:00

Sam Tripoli

5 hours ago $3.14 earnedPunch Drunk Sports LIVE!

20K2 -

55:45

55:45

MattMorseTV

4 hours ago $13.03 earned🔴Trump scores 3 VICTORIES in ONE DAY.🔴

23.6K36 -

2:28:12

2:28:12

Badlands Media

9 hours agoSITREP Ep. 137

22.3K9