Premium Only Content

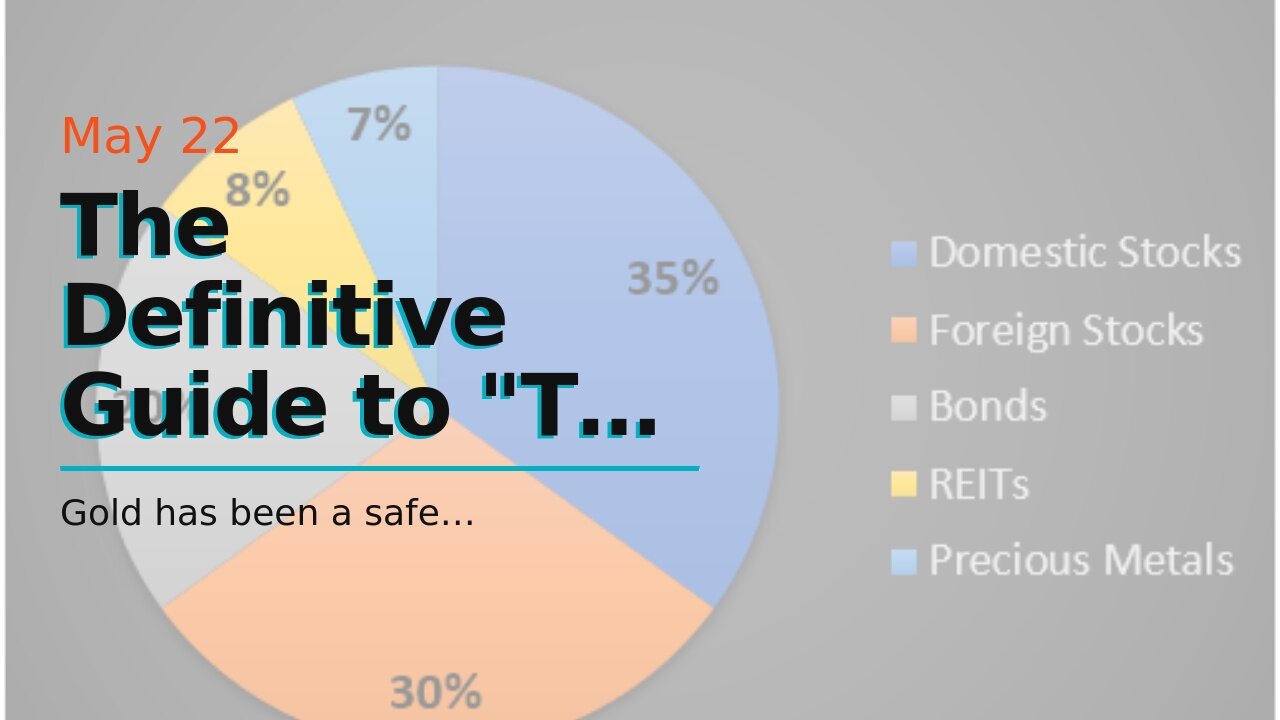

The Definitive Guide to "The Role of Gold in Diversifying Your Investment Portfolio"

https://rebrand.ly/Goldco1

Sign up Now

The Definitive Guide to "The Role of Gold in Diversifying Your Investment Portfolio", to invest in gold

Goldco assists customers safeguard their retirement cost savings by surrendering their existing IRA, 401(k), 403(b) or other professional retirement account to a Gold IRA. ... To find out how safe haven precious metals can help you build and also secure your riches, and also even safeguard your retired life call today to invest in gold.

Goldco is among the premier Precious Metals IRA business in the United States. Secure your wealth and resources with physical rare-earth elements like gold ...to invest in gold.

Gold has been a safe haven expenditure for centuries. It has been utilized as currency and a establishment of value throughout history, and its worth has remained relatively steady over opportunity. During opportunities of economic uncertainty, real estate investors frequently switch to gold as a risk-free sanctuary financial investment due to its one-of-a-kind residential properties.

First and foremost, gold is considered a dependable shop of value as it is not topic to the very same fluctuations that happen along with other assets such as sells and connections. This is because gold is not tied to any sort of particular country or authorities, creating it much less susceptible to geopolitical risks. Furthermore, unlike fiat unit of currencies which may be devalued through core banking companies with inflationary plans, gold retains its intrinsic market value over opportunity.

Also, the demand for gold usually tends to raise during the course of opportunities of financial uncertainty. When there are worries concerning rising cost of living or depreciation, political vulnerability or market dryness, clients often tend to gather towards safe place resources such as gold. This increased need may drive up the rate of gold also further.

Thirdly, gold has shown itself in crisis situations in the past. Throughout the worldwide monetary problems in 2008-2009, when several various other possessions were experiencing substantial losses, the cost of gold continued to increase continuously. This was due to its standing as a safe sanctuary asset that clients can turn to throughout uncertain times.

Fourthly, spending in physical gold makes it possible for for greater control over one's investments matched up along with financial possessions like sells and connections which are topic to market power beyond an person's control. Physical ownership additionally delivers security against cyber risks that might impact digital forms of financial investment.

Lastly, having physical gold delivers variation benefits within an entrepreneur's portfolio by lowering general risk exposure via lower correlation with various other possession classes like capitals and taken care of earnings safety and securities.

In conclusion, gold continues to be a preferred option for entrepreneurs finding a secure shelter throughout times of financial unpredictability due to its dependability as a retail store of value and its ability to keep particular worth throughout past history despite altering economic ailments over opportunity. As such, it is an possession class that delivers protection against market volatility, inflationary policies and geopolitical threats. Having said that, it ought to be noted that putting in in gold brings its own threats and capitalists need to perform complete due carefulness just before making any expenditure decisions.

It is also crucial to note that spending in gold does not assure gains and its market value may still change over the quick term. As with any kind of financial investment, it is vital to have a well-diversified portfolio that consists of a range of possession lessons.

Moreover, financiers have numerous possibilities when it happens to committing in gold. Bodily ownership of gold may be performed by means of obtaining gold pieces or bars, while secondary ownership may be achieved with exchange-traded funds (ETFs) or shared funds that invest in gold-related properties.

While possessing physical gold might deliver greater control over one's expenditures, it also comes with added price such as storage space and insurance fees. On the other palm, ETFs and mutual funds deliver visibility to the price of gold without the incorporated expense of physical ownership.

In conclusion, while there are dangers linked with investing in...

-

2:54:08

2:54:08

TimcastIRL

3 hours agoJ6 Pipe Bomb Suspect ARRESTED, Worked With BLM, Aided Illegal Immigrants | Timcast IRL

208K91 -

LIVE

LIVE

Alex Zedra

2 hours agoLIVE! Bo7 Warzone

479 watching -

LIVE

LIVE

Drew Hernandez

20 hours agoCANDACE OWENS / TPUSA STALEMATE & DC PIPE BOMBER CAPTURED?!

879 watching -

12:31

12:31

Robbi On The Record

4 hours ago $0.23 earnedWhy Nothing Feels Real Anymore | The Science, Culture, and Spiritual War Behind the Fog

18.6K7 -

18:42

18:42

Navy Media

4 hours agoHouthis ATTACK the Wrong U.S. Fighter Jet – Then THIS Happened…

11.1K24 -

40:24

40:24

MetatronGaming

1 day agoSomething is REALLY Wrong with this apartment...

5.75K2 -

LIVE

LIVE

SpartakusLIVE

4 hours agoHUGE NEW UPDATE - Aim Assist NERF, New META, New MOVEMENT || #1 King of Content

363 watching -

![battlefield 6 with the crew! [RGMT CONTENT Mgr. | RGMT GL | GZW CL]](https://1a-1791.com/video/fwe2/7f/s8/6/w/D/y/F/wDyFz.0kob.18.jpg) 2:32:26

2:32:26

XDDX_HiTower

2 hours agobattlefield 6 with the crew! [RGMT CONTENT Mgr. | RGMT GL | GZW CL]

9.21K -

2:28:57

2:28:57

Nikko Ortiz

4 hours agoVirtual Reality Milsim... | Rumble LIVE

27.9K4 -

LIVE

LIVE

StevieTLIVE

3 hours agoNEW UPDATE Warzone WINS w/ The Fellas

64 watching