The History of Gold as an Investment: What You Need to Know - The Facts

https://rebrand.ly/Goldco4

Get More Info Now

The History of Gold as an Investment: What You Need to Know - The Facts , gold and investment

Goldco aids customers secure their retired life financial savings by surrendering their existing IRA, 401(k), 403(b) or various other competent retirement account to a Gold IRA. ... To find out just how safe haven rare-earth elements can assist you construct as well as shield your wealth, and also protect your retired life telephone call today gold and investment.

Goldco is just one of the premier Precious Metals IRA business in the United States. Protect your wealth and also livelihood with physical precious metals like gold ...gold and investment.

Committing in gold has been a prominent choice for real estate investors looking for a safe-haven asset. Nonetheless, when it comes to putting in in gold, there are actually various possibilities available such as bodily gold, gold ETFs (Exchange Traded Funds), or exploration supplies. Each choice has its pros and cons that should be taken into consideration before committing.

Physical Gold

Bodily gold recommends to getting and owning true gold coins, pubs or precious jewelry. One of the most significant perks of physical gold is that it is a tangible resource that you can easily store in your palm. This produces it much easier to know and experience self-assured concerning its market value.

An additional perk of physical gold is that it does not count on any type of third-party financial institution or supply market mark for its market value. Its price is found out by the global source and demand for the steel.

Nevertheless, owning bodily gold also comes with many negative aspects. To start with, saving physical gold can be challenging as it requires unique safety action to ensure it's risk-free coming from theft or damage.

The second thing is, acquiring and offering physical gold can easily be costly due to transaction fees affiliated with buying coming from or marketing to suppliers. In addition, calculating the pureness and authenticity of the metallic may demand professional aid which includes additional expense.

Last but not least, while owning physical gold can easily deliver a sense of safety throughout times of economic situation such as inflation or unit of currency decline; it may not consistently ensure assets since finding customers for large amounts might take opportunity.

Gold ETFs

Gold ETFs are investment funds traded on inventory substitutions standing for possession in an underlying volume of bodily gold kept by the fund's custodian banking company. The major perk of committing in Gold ETFs is their assets and comfort since they may be purchased or marketed like stocks on an swap during trading hrs.

Additionally, Gold ETFs provide very easy accessibility for retail capitalists who can easilynot manage to buy huge amounts of actual bullion because portions embody shared possession rather than needing complete payment upfront like buying bodily bullion would call for.

Nonetheless, investing in Gold ETFs likewise comes with downsides. First of all, the worth of Gold ETFs may be influenced by market variations and improvements in the rate of gold as properly as monitoring fees associated with operating the fund.

Furthermore ,, having Gold ETFs does not offer any sort of bodily ownership of the steel itself which may be a drawback for real estate investors who choose to keep their assets actually.

Lastly, since Gold ETFs are traded on inventory markets, they are subject to counterparty threat - implying if the financial institution that owns the underlying bullion goes insolvent or nonpayments, it can influence the worth of your investment.

Exploration Supplies

Spending in exploration inventories offers indirect direct exposure to gold costs through getting portions in providers that unearth gold. The key perk of spending in mining sells is that they deliver possibility for much higher returns than physical gold or Gold ETFs because they are subject to supply and need mechanics as well as earnings growth and rewards spent out through companies.

Also, investing in mining sells permits entrepreneurs to get exposure to other priceless metallics such as silver and copper which may diversify their profile.

However, spending in exploration stocks likewise has its drawbacks. First of all, exploration stocks are topic to working dangers such as effort strikes and manufacturi...

-

5:50

5:50

Website with WordPress

1 year agoThe Only Guide to "The historical performance of gold as an investment over time"

15 -

7:33

7:33

Website with WordPress

1 year ago5 Easy Facts About "The History of Gold as an Investment: Past, Present, and Future" Shown

26 -

25:09

25:09

Midas Gold Group

11 months agoThe Mentality of Owning Gold | The Gold Standard 2329

175 -

25:05

25:05

Midas Gold Group

1 year agoThe Basics of Gold: Protecting Your Wealth and Spending Power | The Gold Standard 2323

393 -

25:00

25:00

Midas Gold Group

1 year agoGuide to Investing in Gold (part 2) | The Gold Standard 2235

2741 -

25:00

25:00

Midas Gold Group

1 year agoHow to Build Your Gold Portfolio | The Gold Standard 2301

57 -

25:05

25:05

Midas Gold Group

10 months agoOur Dying Financial System | The Gold Standard 2332

61 -

25:01

25:01

Midas Gold Group

1 year agoHow to Buy Gold to Protect Your Wealth | The Gold Standard 2308

115 -

15:52

15:52

MAGA Lion HAT

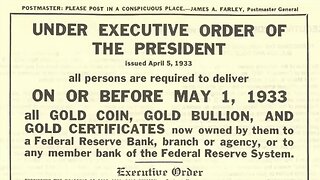

1 year agoHow much Gold was Confiscated in 1933? | Gold Confiscation History | Executive Order 6102 📜

100 -

11:53

11:53

ProvenAndProbable

8 months agoThe Best Silver Stock and Precious Metals Investments Right Now

1526