Premium Only Content

The Facts About "Getting Started with Retirement Investing: A Beginner's Guide" Revealed

https://rebrand.ly/Goldco5

Join Now

The Facts About "Getting Started with Retirement Investing: A Beginner's Guide" Revealed , retirement investing basics

Goldco aids customers safeguard their retirement financial savings by rolling over their existing IRA, 401(k), 403(b) or various other qualified pension to a Gold IRA. ... To discover exactly how safe haven rare-earth elements can help you construct and also safeguard your wealth, and also also secure your retirement telephone call today retirement investing basics.

Goldco is one of the premier Precious Metals IRA business in the United States. Protect your wide range and also source of income with physical rare-earth elements like gold ...retirement investing basics.

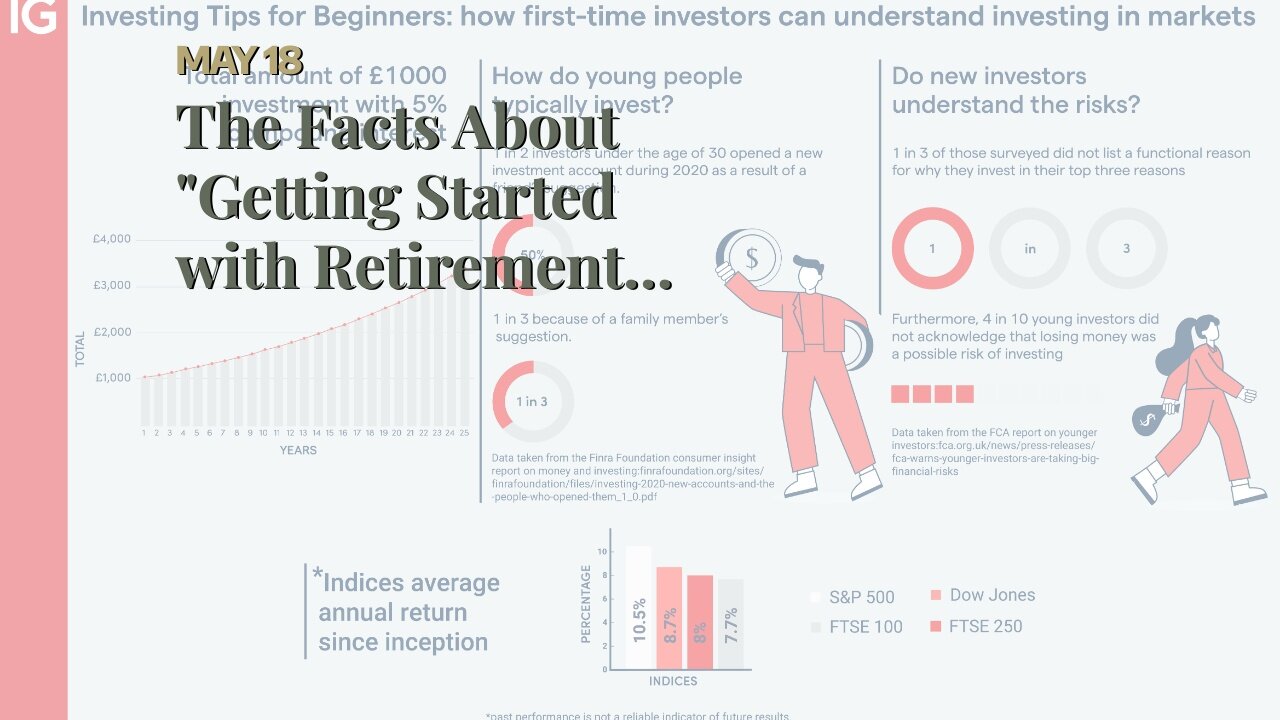

Understanding Risk and Yields in Retirement Investing

Retirement investing is all concerning balancing danger and gains. While everyone yearns for to maximize their yields, investing happens along with risks that must be took care of to guarantee a productive retirement life. In this article, we will definitely discover the principles of risk and come back in retirement investing and deliver some suggestions to help you attain your retirement life targets.

What is Risk?

Threat is the possibility that an investment are going to drop worth or not conduct as anticipated. It can come from a lot of resources featuring market volatility, economic problems, geopolitical occasions, or company-specific variables like unsatisfactory management or economic health and wellness. The amount of danger varies depending on the investment kind, with supplies generally being more volatile than bonds or cash matchings.

Financiers commonly utilize standard discrepancy as a step of danger for an investment. Typical variance evaluates how a lot an financial investment’s profit rises and fall over time matched up to its average profit. The much higher the basic deviation, the greater the danger.

While some clients are comfy taking on higher degrees of threat in order to likely make higher profits, others favor lower-risk expenditures that are less inconsistent but offer lower yields. This choice relies on a number of elements including an entrepreneur’s age, financial targets, and endurance for risk.

What is Profit?

Yield recommends to the volume of funds acquired or shed on an investment over a period of time. It can easily be conveyed as a amount of the first expenditure volume or in dollar phrases. Yields are determined through several factors consisting of market ailments, inflation rates, enthusiasm rates, rewards paid through providers and various other elements.

Financiers ought to look at both short-term profits (such as daily changes) and long-term gains (such as annualized ordinary yield over a number of years) when examining investments.

Understanding Risk-Return Tradeoff

The partnership between threats and yields is main to understanding retired life investing. Generally communicating, higher-risk investments usually tend to generate much higher yields over time while lower-risk expenditures make lesser returns but additionally have much less possible for reduction.

This relationship between threat and yield is understood as the risk-return tradeoff. It indicates that investors should choose how much risk they are eager to take on to potentially earn greater gains. While some may choose high-risk expenditures, others might favor lower-risk expenditures that provide additional reliability.

Real estate investors need to also take into consideration their investment time perspective when reviewing the risk-return tradeoff. Those with long-term investment horizons can easily manage to take on even more threat because they possess more time to recover from any sort of possible reductions. Those along with briefer investment perspectives must commonly stay clear of high-risk financial investments because they might not have sufficient time to make back reductions.

Ideas for Managing Risk and Returns in Retirement Investing

To obtain your retirement life objectives, you need a well-balanced collection that takes right into account both risks and returns. Listed below are some suggestions for taking care of your assets collection:

1. Expand Your Investments: Variation is essential to handling risk in retirement investing. Through spreading out your expenditures throughout different asset classes such as sells, connects, and cash money matchings, you can minimize the e...

-

LIVE

LIVE

Camhigby

4 hours agoLIVE - Riot Watch Portland, DC, NC

274 watching -

2:54:58

2:54:58

CAMELOT331

6 hours agoYouTube Just Told Me I OWE THOUSANDS $ TO THEM... update

26.8K5 -

2:00:53

2:00:53

Tundra Tactical

13 hours ago $0.89 earned🛑LIVE AT 9PM CST!! Your Government Hates Your Guns : DOJ Holds Firm On National FIREARMS ACT

18.2K -

DVR

DVR

DLDAfterDark

4 hours ago $3.20 earnedAre YOU The Guy That Ruins Thanksgiving?? - God Guns & Gear

19.9K -

2:58:31

2:58:31

NewsTreason

5 hours agoDECLAS w/ Rambo & Dave: Nuremberg 2.0 | MTG Exits Stage Left | Mamdani Psyop Confirmed, 8pm EST

68.5K63 -

LIVE

LIVE

meleegames

5 hours agoSONG REQUESTS CLOSED - Melee Music - Beat Hazard 3 - Devil Inside

168 watching -

2:13:31

2:13:31

The Connect: With Johnny Mitchell

12 hours ago $3.28 earnedIs Garth Brooks A Serial Killer? Exposing The Dark Secrets Of Country Music's Biggest Star

13.3K4 -

1:00:49

1:00:49

MattMorseTV

6 hours ago $89.26 earned🔴Massive VICTORY in the SUPREME COURT.🔴

103K137 -

4:08:14

4:08:14

GritsGG

5 hours ago#1 Most Warzone Wins 4015+!

14K -

4:20:08

4:20:08

Biscotti-B23

8 hours ago $1.07 earned🔴 LIVE STREAM ENDS WHEN I GET 100 WINS 🥵 INVINCIBLE VS CLOSED ALPHA

12.5K3