Premium Only Content

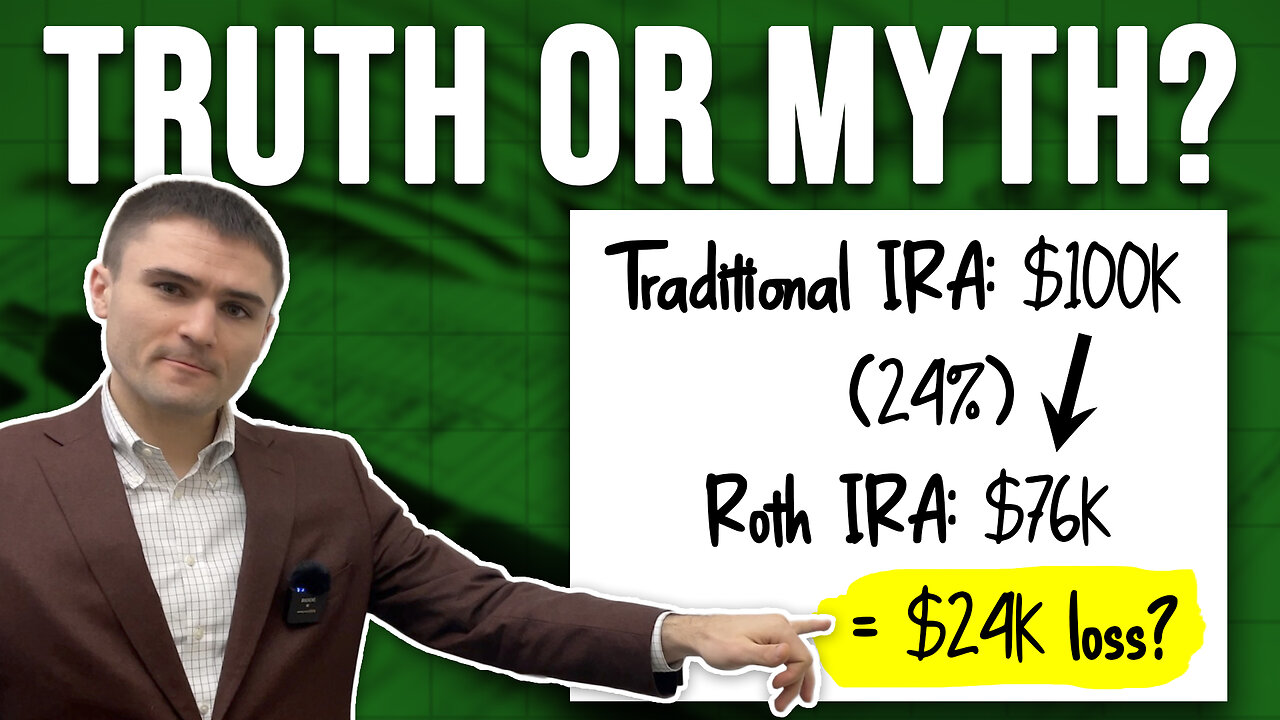

Do You Lose Money If You Do A Roth Conversion?

When you Roth convert, it may seem like you're losing money on your investments. After all, if you pay taxes on your $100k investment now at a 24% rate, you'll only be left with $76k. But as we explain in this video, what you pay in converting now may actually save you money down the line.

Are you interested in receiving expert help in planning for your financial future?

If so, give us a call at (614)500-4121 or visit us at https://peakretirementplanning.com/schedule-a-meeting/

🟥 I Love Roth IRAs and Roth Conversions! 🟥

https://www.kiplinger.com/retirement/retirement-plans/roth-iras/604539/i-love-roth-iras-and-roth-conversions

🎥 Subscribe to our channel:

https://bit.ly/430T9Lv

🤝 Join our Insider's List:

https://peakretirementplanning.com/resources/

📞 Talk with us:

https://peakretirementplanning.com/schedule-a-meeting/

#retirement #retirementplanning #rothira

Disclaimer: Since we do not know your specific situation, none of this information can serve as tax, legal, financial, insurance, or financial advice, and may be outdated or inaccurate. The information comes from sources believed to be reliable but cannot be guaranteed. This content is prepared for educational purposes only. If you need advice, please contact a qualified CPA, attorney, insurance agent, financial advisor, or the appropriate professional for the subject you would like help with. Peak Retirement Planning, Inc. is an Ohio based registered investment adviser and able to offer advisory services in Ohio and in other states where registered or exempt from registration.

-

LIVE

LIVE

Benny Johnson

33 minutes ago🚨Woman Beat By Cincinnati Mob SPEAKS Exclusively For First Time | This Will BREAK Your Heart…😢

3,509 watching -

LIVE

LIVE

Badlands Media

3 hours agoBadlands Daily: August 6, 2025

3,113 watching -

12:31

12:31

The Kevin Trudeau Show Limitless

29 minutes agoKevin Trudeau Classified - File 1 | Recruited At 6: Inside A Real Secret Society

2 -

LIVE

LIVE

Wendy Bell Radio

5 hours agoINVESTIGATIONS, SUBPOENAS, AND A GRAND JURY...OH MY!

5,457 watching -

DVR

DVR

JuicyJohns

1 hour ago🟢#1 REBIRTH PLAYER 10.2+ KD🟢$500 GIVEAWAY SATURDAY!

1.56K -

LIVE

LIVE

Matt Kohrs

11 hours agoEarnings Crash, Pump & Dump Scams, and Breaking Market News || Live Trading

599 watching -

54:00

54:00

SGT Report

14 hours agoONLINE TROLLS & SURVIVING VAX-INDUCED CANCER -- Dr Len Horowitz

15.8K8 -

LIVE

LIVE

LFA TV

14 hours agoLFA TV ALL DAY STREAM - WEDNESDAY 8/6/25

4,670 watching -

1:33:10

1:33:10

Chicks On The Right

4 hours agoCandace goes after Megyn, Big Balls attacked, Trump on the roof, & Liz goes full socialist

14.9K15 -

4:03:39

4:03:39

The Bubba Army

1 day agoDiddy Asks Trump For Pardon- Bubba the Love Sponge® Show | 8/06/25

45.3K6