Premium Only Content

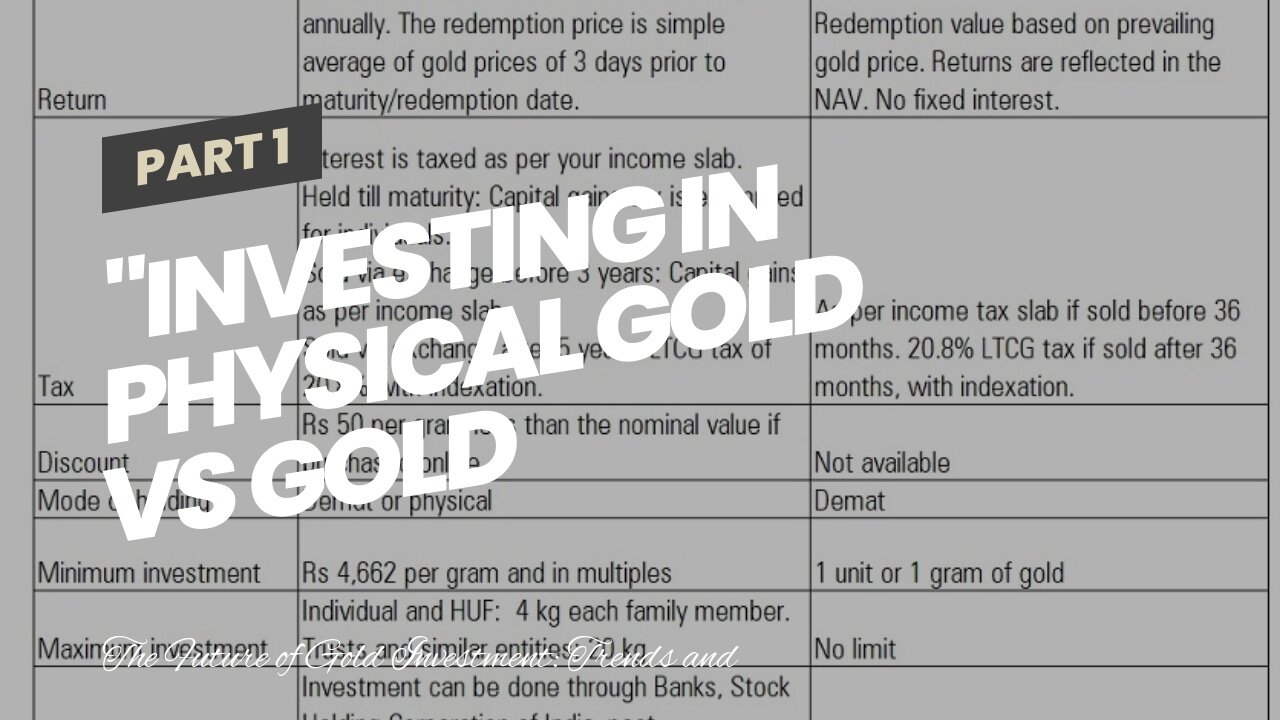

"Investing in Physical Gold vs Gold Stocks and ETFs" for Beginners

https://rebrand.ly/Goldco2

Sign up Now

"Investing in Physical Gold vs Gold Stocks and ETFs" for Beginners , gold and investment

Goldco assists clients protect their retired life financial savings by surrendering their existing IRA, 401(k), 403(b) or various other certified retirement account to a Gold IRA. ... To learn exactly how safe haven rare-earth elements can help you develop and shield your riches, as well as also secure your retirement phone call today gold and investment.

Goldco is among the premier Precious Metals IRA firms in the United States. Shield your wealth and resources with physical precious metals like gold ...gold and investment.

The Future of Gold Investment: Trends and Predictions

Gold is a precious metallic that has been used as a type of money and traded for centuries. In today's present day world, gold stays an essential financial investment property that lots of individuals switch to throughout times of economic unpredictability. As the international economic situation proceeds to grow, lots of real estate investors are pondering what the future keeps for gold expenditure.

In this write-up, we will definitely discover the styles and predictions for the future of gold assets.

Pattern #1: Improving Demand for Gold

One of the very most notable trends in the gold market is the raising requirement for bodily gold. According to the World Gold Council, need for gold in Q3 2020 hit 892 tonnes, up 21% coming from Q2 and up 3% coming from Q3 2019. This rise was driven by powerful need in India and China, two nations with a long background of purchasing gold as an financial investment.

Furthermore, main banks around the world have been enhancing their holdings of gold. In recent years, countries such as Russia, China, and Kazakhstan have been actively acquiring large volumes of physical gold. This trend is assumed to carry on as central financial institutions look to transform their books away from standard unit of currencies such as the US buck.

Trend #2: Digital Gold Investments

An additional pattern that is arising in the world of gold investment is electronic assets backed by physical gold. These digital possessions allow entrepreneurs to have fractional amounts of bodily gold without having to store it themselves. Electronic possessions like Paxos Gold and Tether Gold have obtained recognition among entrepreneurs who really want exposure to bodily gold without having to worry concerning storage or transportation expense.

In add-on to digital possessions backed by bodily gold, there are actually likewise brand new systems developing that allow real estate investors to get allotments in mining business or exchange-traded funds (ETFs) that keep physical gold.

Pattern #3: Economic Uncertainty

Economic uncertainty has always been a driving force behind gold investment, and this trend is assumed to continue right into the future. The COVID-19 pandemic has led to substantial economic interruption around the world, with a lot of nations experiencing recession or also anxiety.

As a end result, capitalists are transforming to gold as a safe shelter asset that can easily defend their wealth during the course of opportunities of monetary chaos. In enhancement to the widespread, geopolitical pressures such as business disputes and political weakness are also steering need for gold.

Forecast #1: Gold Costs Will certainly Proceed to Rise

One of the most typical prophecies for the future of gold financial investment is that costs will definitely continue to rise. As demand for bodily gold rise and financial unpredictability persists, numerous experts strongly believe that gold costs will definitely arrive at brand-new highs in the happening years.

In simple fact, some professionals anticipate that gold costs might arrive at $3,000 per oz by 2025. This would represent a significant boost from existing levels, which float around $1,800 every ounce.

Prediction #2: Greater Adoption of Digital Gold

An additional forecast for the future of gold expenditure is that digital properties backed through physical gold will definitely come to be even more prevalent. As even more investors look for methods to spend in bodily assets without having to worry concerning storage space or transit costs, digital properties like Paxos Gold and Tether Gold are probably to get popularity.

Also, brand new platforms that make it possible for clients to purchase portions in mining firms...

-

LIVE

LIVE

Right Side Broadcasting Network

6 hours agoLIVE: President Trump Makes an Announcement - 9/2/25

18,943 watching -

LIVE

LIVE

The Quartering

1 hour agoAlex Jones Goes To WAR With Owen Shroyer, Are All Women Terrible?, Woke Backfire Of The Year!

16,650 watching -

LIVE

LIVE

Awaken With JP

1 hour agoTrans Shooter is the Victim, Vaccines in Trouble, and Greta is Ugly - LIES Ep 106

610 watching -

LIVE

LIVE

The White House

5 hours agoPresident Trump Makes an Announcement, Sep. 2, 2025

1,514 watching -

LIVE

LIVE

MattMorseTV

1 hour ago $2.68 earned🔴Trump's Oval Office BOMBSHELL.🔴

1,857 watching -

18:14

18:14

Real Estate

13 hours agoRising Prices PUSHING AMERICANS OVER THE EDGE

36 -

1:43:35

1:43:35

Russell Brand

2 hours agoTrump Demands Big Pharma PROVE Covid Vaccine Is Safe – Did Pfizer LIE?! - SF626

106K24 -

LIVE

LIVE

Due Dissidence

3 hours agoIsrael THREATENS Greta, InfoWars Host QUITS, FL Losing $200M on EMPTYING Alligator Alcatraz

663 watching -

DVR

DVR

Law&Crime

6 hours ago $0.41 earnedLIVE: Adelson Matriarch Murder Trial — FL v. Donna Adelson — Day 6

2.98K -

1:08:04

1:08:04

Sean Unpaved

2 hours agoGridiron Shocks: Arch's Rough Start, Belichick's Tar Heel Tumble, & NFL Week 1 Buzz

20.3K