Premium Only Content

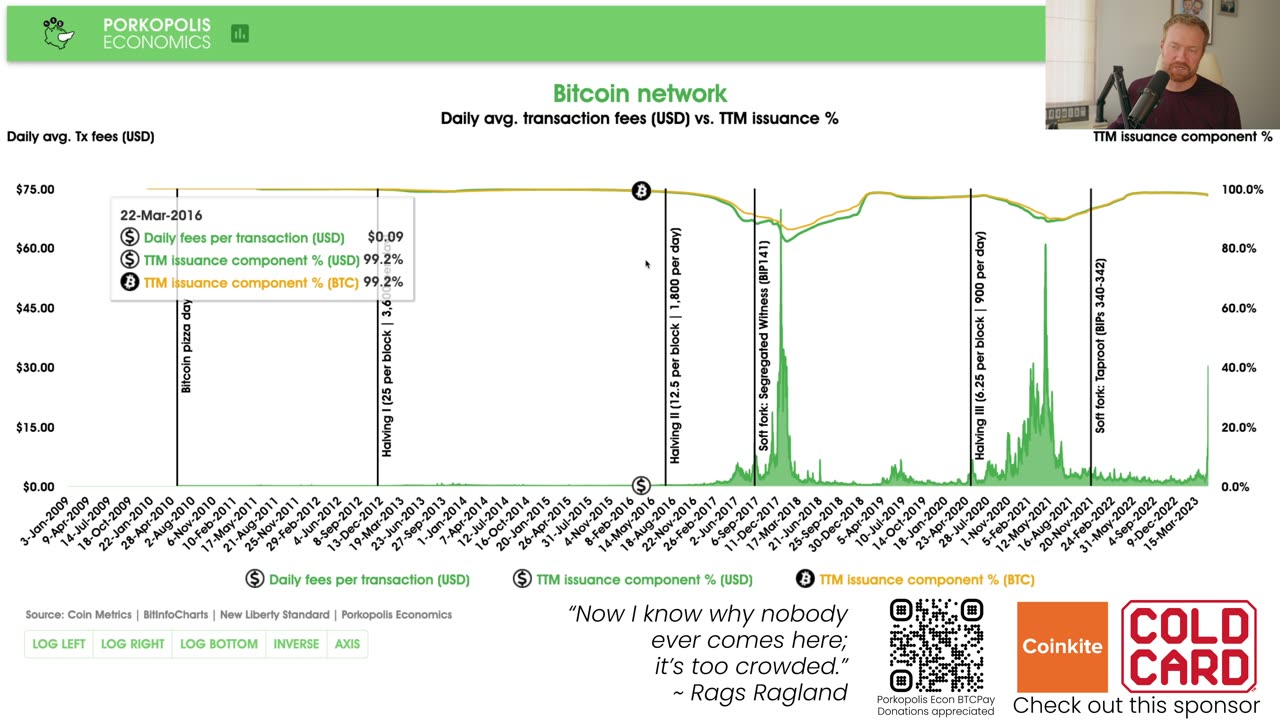

PE65: Ordinals & FEES: Macro Bitcoin Perspective

Check out show sponsor Coinkite: https://coinkite.com/

Donations to Porkopolis Economics via BTCPay appreciated: https://donations.porkopolis.io/

This is the sixty-fifth video installment from Porkopolis Economics, covering macro and money, from the creator of the Crypto Voices podcast, Matthew Mezinskis.

Contents

00:00 Intro

00:53 Latest daily average Tx fees (in dollars)

02:00 Non-base money use cases?

02:33 Use trailing twelve months!

07:40 TTM issuance % (in USD)

14:35 Other base money fees

19:13 BTC's fee % component will be more

20:10 TTM issuance % (in BTC)

Here I look at the average daily transaction fees, in US-dollar terms, for the Bitcoin protocol over its lifetime. Even with the explosion of Ordinals onto the scene these days and the demand for transaction-inclusion (block space) increasing, it does not change the fact that on-chain, mainnet bitcoins - UTXOs - are base money!

In addition, we will roll these transaction fees, over an entire year (trailing 12-months or trailing-365 days), and see how much of a % these fees make up of total miner revenue. Remember, the other (much larger, at present) component of mining revenue is the block reward, or the issuance of new coins.

Prior videos with further info:

TTM fees: https://www.youtube.com/watch?v=a06LVI-BrSU

TTM issuance: https://www.youtube.com/watch?v=nXQIi3JWrcc

Total TTM revenue (BTC): https://www.youtube.com/watch?v=IOmdRTWO6fo

Total TTM revenue (USD): https://www.youtube.com/watch?v=E_FZSRGPb3w

Host: Matthew Mezinskis

https://porkopolis.io

https://twitter.com/crypto_voices

Show content is not investment or financial advice in any way.

-

5:44

5:44

Porkopolis Economics

7 months ago $0.01 earnedParsing Through the Bitcoin Data

2501 -

LIVE

LIVE

Steven Crowder

2 hours agoAI Celebs Just Scammed Women out of Millions & Premium Interview w/ Patrick Christys

18,931 watching -

LIVE

LIVE

Lara Logan

13 hours agoINSIDE THE MAR-A-LAGO RAID with Trump Attorney Christina Bobb | Episode 33

521 watching -

LIVE

LIVE

The Mel K Show

1 hour agoMORNINGS WITH MEL K -This Labor Day Celebrate Liberty, Freedom & Family! 8-29-25

410 watching -

LIVE

LIVE

The Shannon Joy Show

2 hours ago🔥🔥The Butchers At Hilo Benioff Hospital Hawaii - Mom Subjected To Forced C-Section & Abuse🔥🔥

319 watching -

LIVE

LIVE

LFA TV

5 hours agoLFA TV ALL DAY STREAM - FRIDAY 8/29/25

4,529 watching -

LIVE

LIVE

Grant Stinchfield

18 hours agoEven DC’s Homeless Beg for Trump’s Law & Order — While Wacky White Liberal Women Scream NO!

125 watching -

1:02:30

1:02:30

VINCE

3 hours agoGavin Newsom Is A Major Trump Fan | Episode 114 - 08/29/25

141K92 -

1:32:10

1:32:10

Nikko Ortiz

2 hours agoPainful Life Experiences

17.2K7 -

1:42:16

1:42:16

Dear America

4 hours agoThe Left Chooses TRANS Over Christianity!! WOKE Mayor Is Doubling Down!!

88.1K53