Premium Only Content

Everything about "How Political and Economic Uncertainty Affects the Value of Gold"

https://rebrand.ly/Goldco

Sign up Now

Everything about "How Political and Economic Uncertainty Affects the Value of Gold" , gold investor gold

Goldco assists clients safeguard their retired life financial savings by surrendering their existing IRA, 401(k), 403(b) or other competent retirement account to a Gold IRA. ... To learn exactly how safe haven precious metals can aid you develop as well as shield your wealth, as well as even safeguard your retirement phone call today gold investor gold.

Goldco is one of the premier Precious Metals IRA companies in the United States. Shield your wealth and source of income with physical rare-earth elements like gold ...gold investor gold.

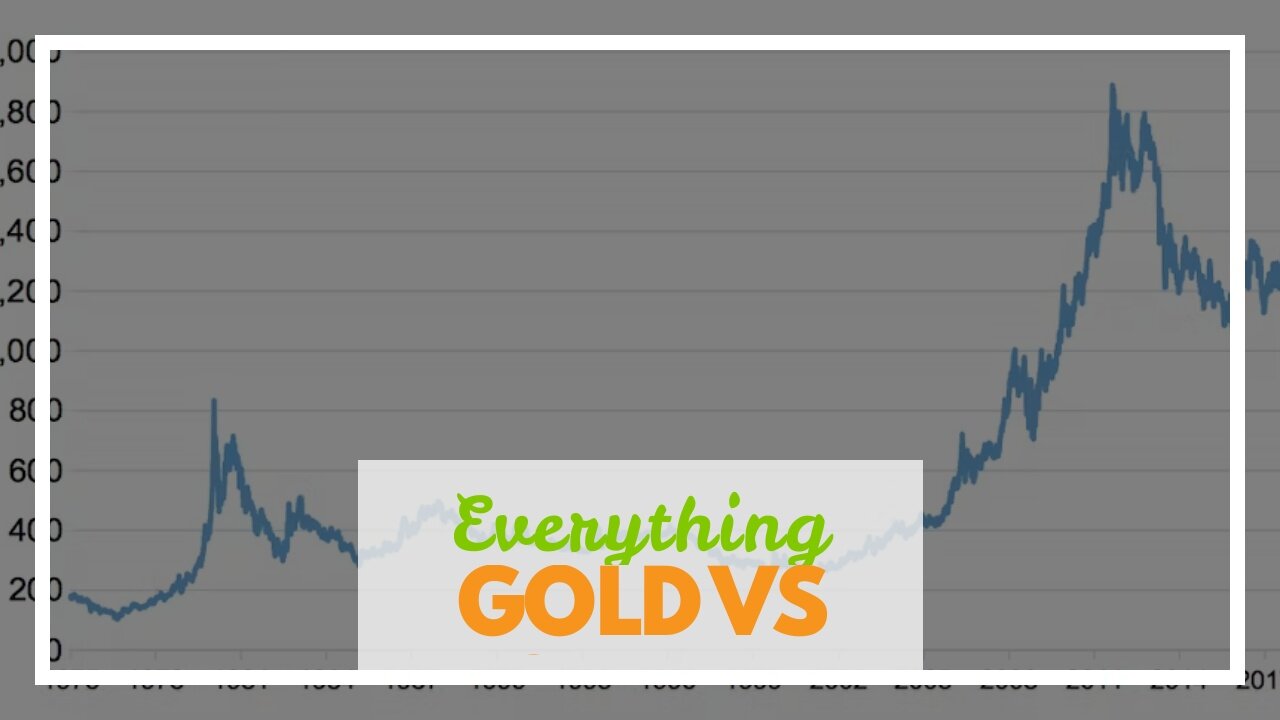

Gold vs Other Investments: Which Gives Far better Profits?

When it comes to investing, there are actually a variety of choices on call. From stocks and connects to genuine property and products, each investment has its very own set of threats and profits. One such assets that has always kept a unique spot in the centers of entrepreneurs is gold.

For centuries, gold has been thought about a hedge against rising cost of living and financial unpredictability. It has always been viewed as a safe shelter for capitalists looking to expand their portfolios or protect their wide range coming from market changes. But does gold definitely provide far better returns contrasted to other financial investments? Let's discover out.

Gold versus Stocks

The supply market is one of the most well-known financial investment possibilities offered in today's world. It offers real estate investors an chance to invest in providers that have strong development capacity and earn yields by purchasing and offering allotments. Nevertheless, the profits on supplies can be highly inconsistent.

In the past, the common annual return on US inventories has been about 10%. In comparison, gold has supplied an common annual yield of around 5%. While this might appear like a substantial distinction, it's necessary to keep in mind that gold has a tendency to carry out effectively during the course of times of economic unpredictability or problems when supply prices are falling.

Furthermore, investing in specific supplies may be high-risk as it entails choosing the correct firm at the appropriate time. On the other hand, investing in gold can easily be relatively stable as it is not topic to the very same degree of volatility as inventories.

Gold vs Connects

Bonds are commonly observed as a safer choice to sells. They provide real estate investors a fixed earnings flow over a time period of time and are usually less risky than capitals. Nonetheless, they additionally usually tend to supply reduced yields than supplies or products like gold.

The average yearly return on US connections has been around 4% traditionally. In comparison, gold delivers an normal annual yield of about 5%. While this may not seem to be like considerably originally, over time these little distinctions may include up and produce a notable impact on an entrepreneur's portfolio.

Gold vs Real Estate

Genuine estate has long been viewed as a sound assets option due to its ability for resources gratitude and rental profit. Nevertheless, committing in actual estate needs a notable amount of funding upfront and happens with its personal collection of threats.

Traditionally, the common yearly profit on US non commercial real property has been around 4%. In evaluation, gold supplies an average yearly yield of all around 5%. While real real estate can easily deliver real estate investors along with a stable stream of rental earnings over time, it additionally involves handling with renters, keeping residential or commercial properties, and the danger of a recession in the real estate market.

Gold versus Cryptocurrencies

Cryptocurrencies like Bitcoin have gained level of popularity in latest years as an substitute financial investment option. They provide clients the possibility for higher gains but happen along with their personal collection of threats.

While Bitcoin has experienced substantial cost gains over the past few years, it is still highly unpredictable and topic to quick fluctuations. In comparison, gold is reasonably steady and has kept its worth over centuries.

Additionally, cryptocurrencies are not backed by any sort of bodily commodity or possession like gold. This indicates that their value is entirely dependent on market sentiment and requirement which can...

-

3:36:03

3:36:03

Mally_Mouse

23 hours ago🌶️ 🥵Spicy BITE Saturday!! 🥵🌶️- Let's Play: Tower Unite!

22.5K1 -

58:59

58:59

MattMorseTV

4 hours ago $0.76 earned🔴Trump just BROKE Newsom.🔴

42.3K37 -

18:14

18:14

Her Patriot Voice

4 hours agoWho Is WORSE for NYC: Trump Girl or Socialist?

15.7K23 -

DVR

DVR

SavageJayGatsby

3 hours agoSpicy Saturday with Mally! | Road to 100 | $300 Weekly Goal for Spicy Bites!

24.6K -

LIVE

LIVE

FomoTV

5 hours ago🚨 Swamp Theater: FBI Raids Bolton 🕵 Still NO Epstein Files, Trump's Troops & the Red Heifer Hoax 🐂 | Fomocast 08.23.25

78 watching -

6:04:40

6:04:40

Akademiks

9 hours agoRoc Nation & Meg Thee Stallion did a 7 HOUR Deposition with me. Drake Secret Kid Finally Revealed.

45.1K1 -

24:19

24:19

Stephen Gardner

5 hours ago🚨BREAKING: FBI Raid of John Bolton’s House Reveals THIS!

47.4K115 -

8:31

8:31

MattMorseTV

7 hours ago $1.02 earnedTexas just did the IMPOSSIBLE.

43.2K58 -

24:39

24:39

MYLUNCHBREAK CHANNEL PAGE

1 day agoInterdimensional Beings at Borobudur

52.2K27 -

12:42

12:42

Scammer Payback

1 day agoCalling Scammers who were Raided

24.2K11