Premium Only Content

Mortgage Rates Jump After First Republic Sale

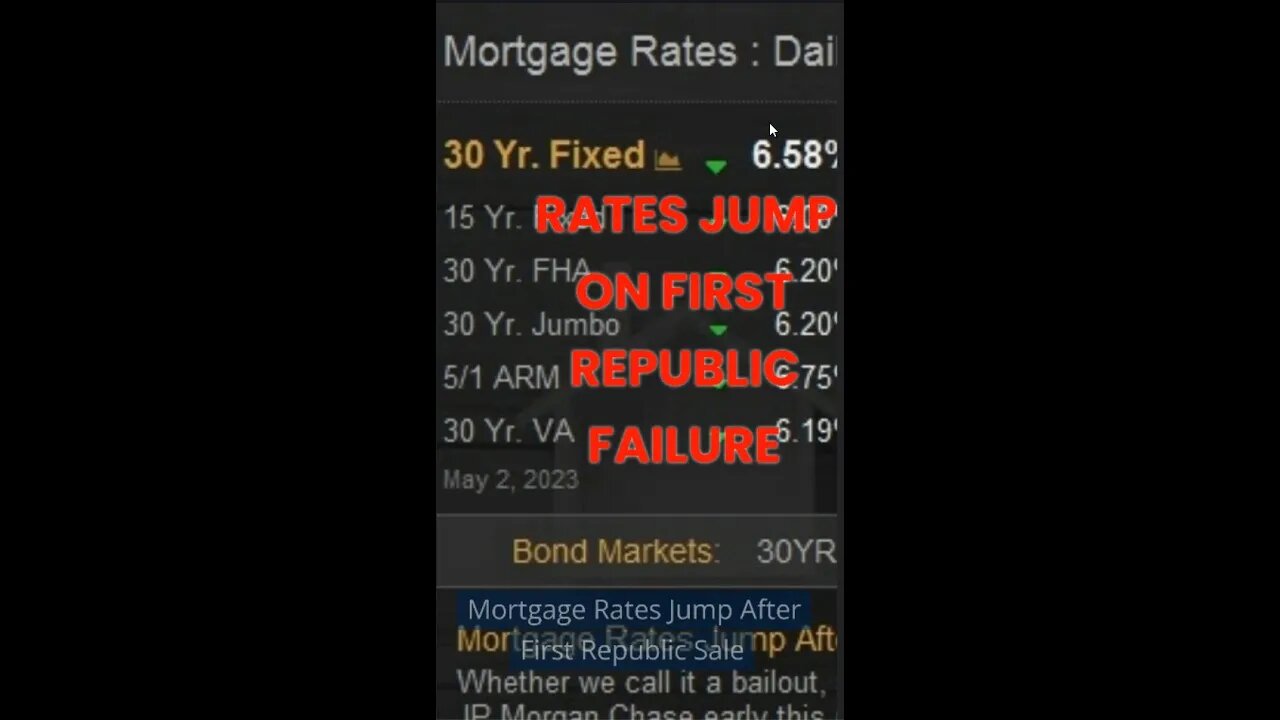

Mortgage Rates Jump After First Republic Sale

Mortgage Rates Jump After First Republic Sale Whether we call it a bailout, a failure, or a fire sale, First Republic Bank was formally absorbed by JP Morgan Chase. Interest rates moved higher in response, and that may be counterintuitive for those who know a thing or two about what motivates rates. Bonds are one such haven and bond yields (aka rates) move lower when more investors want to buy them. So why didn't that dynamic play out this time around? There are different levels of "failure" and the resolution that arrived today is one of the more palatable versions. That was how the day began for rates, but it got worse after a key economic report on the manufacturing sector came in stronger than expected. In general, strong economic data puts upward pressure on rates. The average lender moved at least an eighth of a percent higher for a conventional 30yr fixed.

Start Your Home Search Today!

CALL DIRECT: 407-710-8720

www.HomesInOrlando.ForSale

#mortgages#realestate#mortgage#mortgagetips#firsttimehomebuyer#realtor#homebuying#homeownership#homeloans#mortgagerates#homebuyers#realtors#homebuyer#househunting#preapproval#orlandorealestate#orlandorealtor#orlandorealestateagent#oralandofl#realestatenews

#firstrepublic #firstrepublicbank #firstrepublicfailure

-

14:37

14:37

Colion Noir

4 hours agoCanadian Police Chief Urges Citizens To Comply With Home Invaders And Hide

22.5K29 -

1:18:54

1:18:54

Jeff Ahern

2 hours ago $9.74 earnedThe Sunday Show with Jeff Ahern

39.8K3 -

32:05

32:05

Tactical Advisor

2 hours agoNew Thermal Target for the Military | Vault Room Live Stream 038

23.9K2 -

LIVE

LIVE

GamerGril

2 hours agoThe Evil Within 2 💕 Pulse Check 💕 Still Here

85 watching -

LIVE

LIVE

ttvglamourx

6 hours ago $0.26 earnedPLAYING WITH VIEWERS !DISCORD

104 watching -

LIVE

LIVE

TheManaLord Plays

7 hours agoMANA SUMMIT - DAY 2 ($10,200+) | BANNED PLAYER SMASH MELEE INVITATIONAL

184 watching -

LIVE

LIVE

Jorba4

3 hours ago🔴Live-Jorba4- The Finals

90 watching -

LIVE

LIVE

BBQPenguin_

3 hours agoSOLO Extraction. Looting & PVP

42 watching -

1:57:14

1:57:14

vivafrei

20 hours agoEp. 280: RFK Jr. Senate Hearing! Activist Fed Judges! Epstein Victims DEBACLE! & MORE! Viva & Barnes

72.9K81 -

LIVE

LIVE

GritsGG

3 hours agoTop 250 Ranked Grind! Dubulars!🫡

101 watching