Are Single Family Homes an Inflation Hedge Asset?

Are Single-Family Homes an Inflation Hedge Asset? Overview by Chris at Hauseit® (https://www.hauseit.com).

Save money when buying, selling and renting real estate in New York and Florida with Hauseit. Available in NYC, Long Island, the Hudson Valley and South Florida. Established 2014.

.

No, not necessarily. It's not the same as buying land or forest in Sweden, where property taxes are de minimus. In that case, sure buying land would be akin to buying a commodity, and thus be a pure inflation hedge asset.

However, a single-family house in the US comes with property taxes levied by your local jurisdiction, and as costs increase you can be your property taxes will increase with inflation if not more, depending on how well the local government is managed.

Furthermore, the cost of all repair, replacement and maintenance for your house will go up with inflation, and often times more than the overall inflation index.

Lastly, don't forget that the cost of home insurance will go up as replacement costs go up. This can be a significant cost especially in areas like South Florida where flood insurance is required and quite expensive. For example, all in insurance for a single-family house in Miami can cost well over 1.2% of the market value, per year!

We explore this mystery and explain further in the following video.

.

Hauseit Group LLC, Licensed Real Estate Broker

Tel: +1 (888) 494-8258

Email: team@hauseit.com

_

#hauseit #hauseitnyc #hauseitmiami #hauseitsouthflorida #hauseitlongisland #hauseithudsonvalley #hauseitwestchester #hauseitrealestate #realestate #realestateinvesting #home #propertyinvesting #realestatetips #realestatemarket #realestateinvestor

-

2:47

2:47

hauseit

2 years agoWhy Is Real Estate an Inflation Hedge Asset?

17 -

0:41

0:41

jburgos5

1 year agoHome Ownership is a Hedge Against Inflation

1 -

0:41

0:41

Corey Frith Realtor

1 year agoHomeownership Is a Hedge Against Inflation

5 -

0:58

0:58

Homes In Orlando For Sale

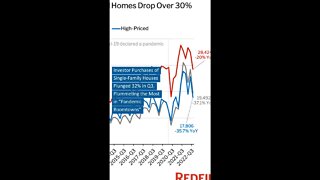

1 year agoInvestor Purchases of Single-Family Houses Plunges

-

4:28

4:28

Selling Boston & the Burbs by Jeffrey Chubb

6 months ago $0.01 earnedNo Bubble to Burst: The Inflation-Driven Rise in Home Prices

413 -

6:44

6:44

Gorman Residential

1 year agoIs the Housing Market Safe? Analyzing the Impact of the Fed and Inflation

1 -

0:41

0:41

MVHomes

1 year agoHomeownership Is a Hedge Against Inflation

-

![Is A Single Family Home An Asset Or A Liability? [Finally Explained]](https://hugh.cdn.rumble.cloud/s/s8/1/v/V/H/O/vVHOi.0kob-small-Is-A-Single-Family-Home-An-.jpg) 18:36

18:36

Elijah Alexander Dash

1 year agoIs A Single Family Home An Asset Or A Liability? [Finally Explained]

-

0:22

0:22

idahorealestate

1 year agoReal Estate is still one of the best hedges against runaway inflation. #investing #realtor

6 -

6:44

6:44

Gorman Residential

1 year agoIs the Housing Market Safe? Analyzing the Impact of the Fed and Inflation

1