Premium Only Content

Getting The "The Historical Performance of Gold as an Investment Asset" To Work

https://rebrand.ly/Goldco6

Join Now

Getting The "The Historical Performance of Gold as an Investment Asset" To Work , to invest in gold

Goldco aids customers secure their retired life financial savings by rolling over their existing IRA, 401(k), 403(b) or other qualified retirement account to a Gold IRA. ... To learn just how safe haven rare-earth elements can help you construct and shield your wealth, as well as also safeguard your retired life phone call today to invest in gold.

Goldco is just one of the premier Precious Metals IRA firms in the United States. Secure your wealth and source of income with physical precious metals like gold ...to invest in gold.

Spending in gold has been a well-liked option for clients for centuries. Gold is a precious metal that has been utilized as currency and a outlet of value for manies thousand of years. Today, gold may be got in many different kinds, consisting of coins, pubs, and exchange-traded funds (ETFs). In this post, we will discover the benefits and drawbacks of committing in gold.

Perks of Investing in Gold

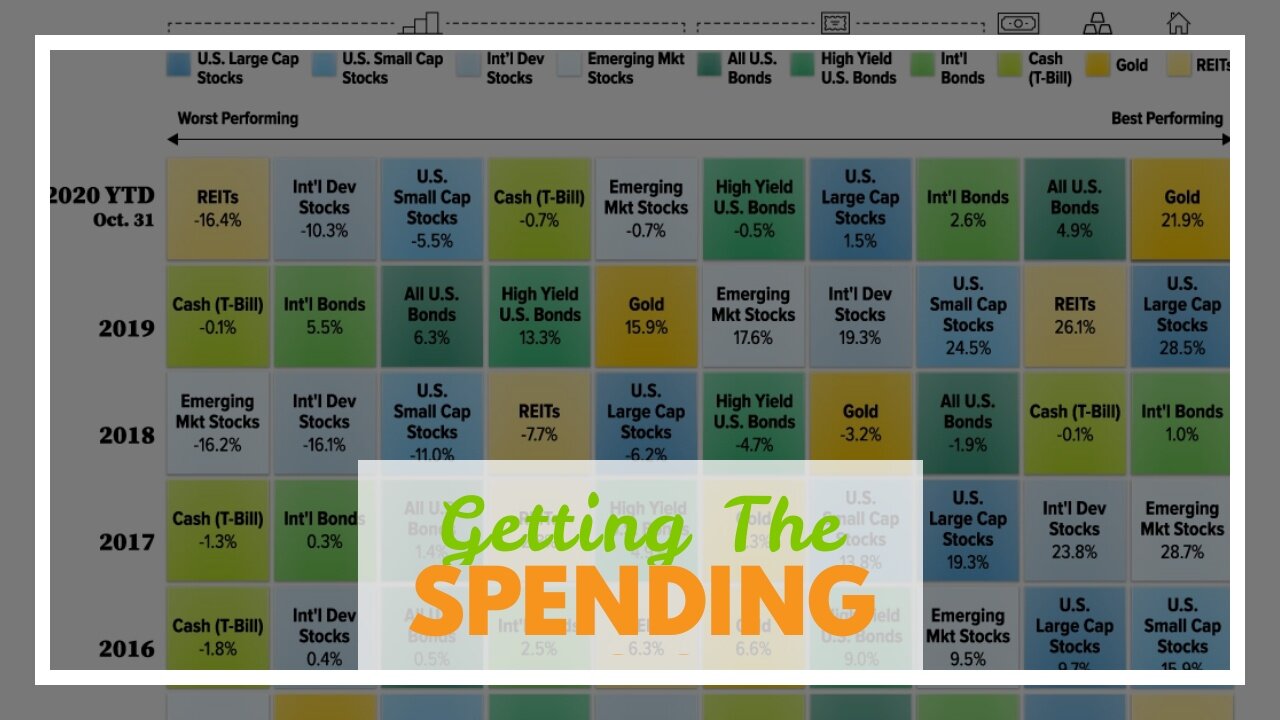

1. Diversity: One of the main explanations financiers opt for to commit in gold is variation. Gold has commonly possessed a reduced relationship along with various other possession courses such as sells and connections. This means that when the stock market is performing inadequately, gold costs may climb. This can help to lessen overall portfolio threat and increase gains.

2. Outlet of Value: Gold has historically been found as a store of market value because it stores its worth over time. Unlike paper money or stocks, which can easily shed their value due to rising cost of living or market dryness, gold often tends to store its value also throughout economic declines.

3. Hedge Versus Rising cost of living: An additional advantage of committing in gold is that it can easily act as a bush against inflation. When rising cost of living rises, the investment energy of newspaper money minimize. Nonetheless, since the source of gold is minimal and relatively secure over opportunity, it often tends to hold its worth in the course of times when paper unit of currency drops its investment electrical power.

4. Safe Haven Asset: During the course of times of economic anxiety or geopolitical agitation, capitalists typically turn to safe place resources such as gold for security against possible losses in other expenditures.

Drawbacks of Investing in Gold

1. No Profit Generation: Unlike stocks or connections which produce earnings with dividends or interest remittances respectively; having bodily gold does not produce revenue for investors.

2. Dryness: While variation might assist lessen general collection threat when investing in gold; it need to be kept in mind that the rate dryness linked with this priceless metallic may be considerable at opportunities.

3. Storage space Costs: Owning bodily gold requires storing which can be pricey. In addition, there is actually always the danger of reduction or theft when keeping gold at home.

4. Limited Liquidity: Contrasted to various other investments like supplies or connections, the assets of gold can easily be limited. It might take longer to market bodily gold and costs might vary between purchasers.

Verdict

Investing in gold has both perks and disadvantages. While it can easily give variation, act as a hedge versus inflation and use defense in the course of times of economic anxiety, it is vital for investors to think about the potential setbacks such as dryness, storage space expense and minimal liquidity. Essentially, whether spending in gold is a sensible selection depends on an person's particular economic circumstance and assets targets.

Clients should perform their due carefulness and properly think about all the pros and disadvantages just before helping make any sort of expenditure selections. Those who wish to spend in gold ought to likewise look for assistance coming from a economic consultant or financial investment specialist to guarantee that their expenditure method lines up along with their general economic objectives.

In recap, putting in in gold can easily be a important addition to an financier's collection when performed the right way. It uses variation, functions as a bush against rising cost of living, and behaves as a risk-free sanctuary asset in the course of times of market uncertainty. Nonetheless, it is crucial to don't forget that committing in gold come...

-

LIVE

LIVE

cosmicvandenim

4 hours agoCOSMIC VAN DENIM | OFF CHARACTER | WARZONE PRACTICE

49 watching -

The Robert Scott Bell Show

4 hours agoMike Adams, Brian Hooker, Live From Brighteon Studios in Austin Texas, Kids Triple Vaccinated, Blood Sugar and Autism, Candy Fed to Cows, Nutrition Reform - The RSB Show 11-7-25

20.4K -

LIVE

LIVE

GritsGG

3 hours ago#1 Most Warzone Wins 3943+!

27 watching -

1:15:58

1:15:58

DeVory Darkins

4 hours agoLIVE NOW: Democrats SABOTAGE GOP effort to reopen Government

99.9K52 -

1:21:21

1:21:21

Tucker Carlson

4 hours agoThe Global War on Christianity Just Got a Whole Lot Worse, and Ted Cruz Doesn’t Care

52.9K246 -

10:50

10:50

Dr. Nick Zyrowski

2 days agoDoctors Got It Wrong! This LOWERS CORTISOL In Minutes!

20K3 -

24:14

24:14

Verified Investing

2 days agoBiggest Trade As AI Bubble Begins To Burst, Bitcoin Flushes Through 100K And Gold Set To Fall

17.9K -

1:12:28

1:12:28

Sean Unpaved

4 hours agoAB's Dubai Drama: Extradited & Exposed + NFL Week 10 Locks & CFB Week 11 Upsets

26.4K -

2:06:08

2:06:08

The Culture War with Tim Pool

6 hours agoDemocrats Elect Man Who Wants To Kill Conservatives, Time For An Exorcism | The Culture War Podcast

129K113 -

1:36:52

1:36:52

Steven Crowder

8 hours agoMamdani's Anti-White Victory Must Be America's Wake Up Call

345K406