Premium Only Content

The Stock to Flow Ratio - Is this a MASSIVE Bitcoin Loophole?

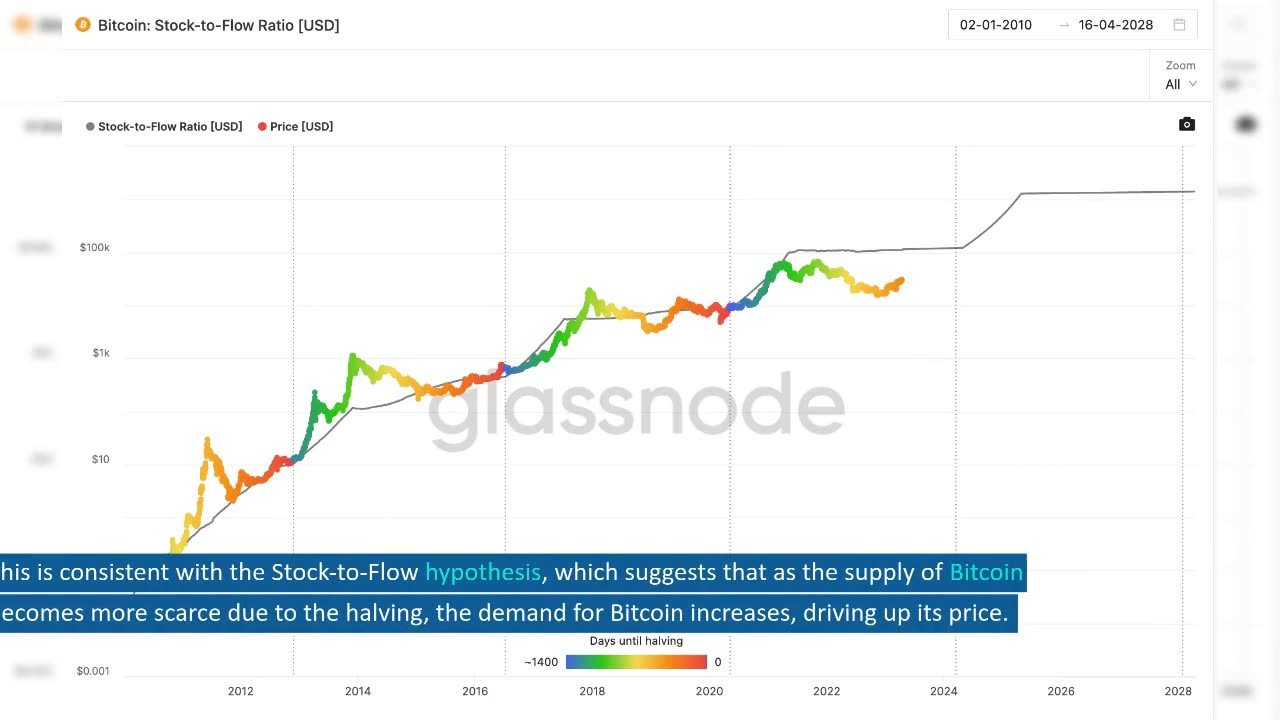

The Stock-to-Flow hypothesis is a theory that suggests scarcity is a significant driver of value. Specifically, the hypothesis argues that when the scarcity of an asset increases, its value should also increase. This hypothesis has been applied to Bitcoin, where it is argued that the Bitcoin halving cycle doubles the scarcity of the asset, leading to a corresponding increase in value.

Data shows that the value of Bitcoin has indeed increased during each halving cycle when the Stock-to-Flow ratio (S2F) has doubled. This is consistent with the Stock-to-Flow hypothesis, which suggests that as the supply of Bitcoin becomes more scarce due to the halving, the demand for Bitcoin increases, driving up its price.

However, if the value of Bitcoin were to decrease post halving, the Stock-to-Flow hypothesis would be rejected. This would suggest that scarcity is not the primary driver of value for Bitcoin, and that other factors such as market sentiment or speculation are more significant.

Interestingly, there is a profitable trading rule based on the Stock-to-Flow hypothesis. The rule suggests that investors should buy Bitcoin six months before each halving and sell 18 months after the halving. This trading rule has been shown to outperform a buy and hold strategy in terms of both risk and return.

Of course, this assumes that the correlation between the Stock-to-Flow ratio and Bitcoin value is not spurious, and that the Stock-to-Flow hypothesis holds true in the future. As with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

In conclusion, the Stock-to-Flow hypothesis suggests that scarcity is a significant driver of value for Bitcoin. Data shows that the value of Bitcoin has increased during each halving cycle when the Stock-to-Flow ratio has doubled. Additionally, there is a profitable trading rule based on the Stock-to-Flow hypothesis. However, as with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

-

LIVE

LIVE

vivafrei

3 hours agoPam Bondi War on “Hate Speech”? Kash Patel Grilled by Senate & More!

18,493 watching -

LIVE

LIVE

The Quartering

1 hour agoCharlie Kirk Assassination Appears In Court!

21,452 watching -

LIVE

LIVE

Awaken With JP

52 minutes agoAmerica Rocked by Charlie Kirk Death - LIES Ep 108

1,486 watching -

1:05:13

1:05:13

Russell Brand

2 hours agoReporting From Tommy Robinson’s ‘Unite the Kingdom’ March - SF634

65.3K41 -

5:56

5:56

Buddy Brown

2 hours agoThis is Why Everyone's Googling September 23rd! | Buddy Brown

2.17K10 -

DVR

DVR

Human Events Daily with Jack Posobiec

1 hour agoHUMAN EVENTS DAILY WITH JACK POSOBIEC

3.07K1 -

Michael Heaver

2 hours agoGermany’s Seismic Result Serves WARNING

11 -

1:02:14

1:02:14

SGT Report

16 hours agoGOD'S ORDER VS. SATAN'S CHAOS -- Dr. Henry Ealy

21K30 -

2:03:13

2:03:13

The Charlie Kirk Show

3 hours agoMichael Knowles, Matt Walsh, and Ben Shapiro Remember Charlie Kirk | 9.16.2025

383K338 -

2:11:49

2:11:49

Steven Crowder

5 hours agoThe Lies are Sick: Charlie Kirk's Legacy Separating Fact from Fiction

487K417