Premium Only Content

The Stock to Flow Ratio - Is this a MASSIVE Bitcoin Loophole?

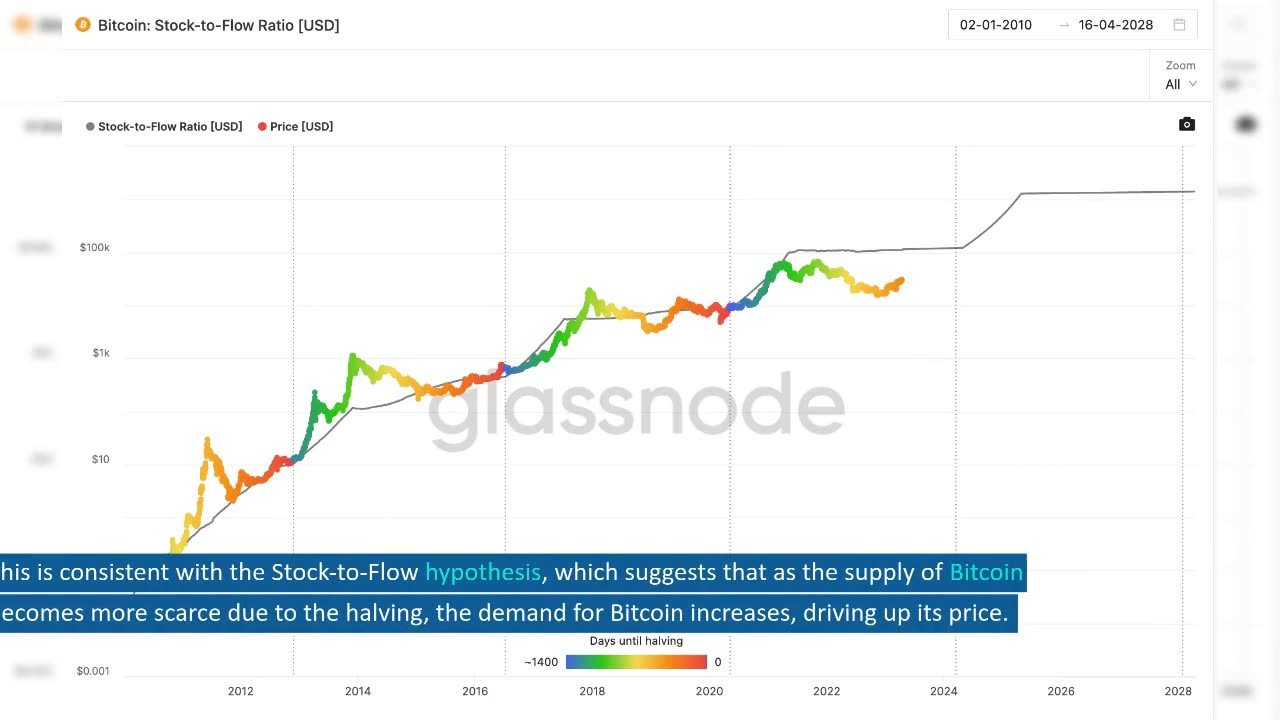

The Stock-to-Flow hypothesis is a theory that suggests scarcity is a significant driver of value. Specifically, the hypothesis argues that when the scarcity of an asset increases, its value should also increase. This hypothesis has been applied to Bitcoin, where it is argued that the Bitcoin halving cycle doubles the scarcity of the asset, leading to a corresponding increase in value.

Data shows that the value of Bitcoin has indeed increased during each halving cycle when the Stock-to-Flow ratio (S2F) has doubled. This is consistent with the Stock-to-Flow hypothesis, which suggests that as the supply of Bitcoin becomes more scarce due to the halving, the demand for Bitcoin increases, driving up its price.

However, if the value of Bitcoin were to decrease post halving, the Stock-to-Flow hypothesis would be rejected. This would suggest that scarcity is not the primary driver of value for Bitcoin, and that other factors such as market sentiment or speculation are more significant.

Interestingly, there is a profitable trading rule based on the Stock-to-Flow hypothesis. The rule suggests that investors should buy Bitcoin six months before each halving and sell 18 months after the halving. This trading rule has been shown to outperform a buy and hold strategy in terms of both risk and return.

Of course, this assumes that the correlation between the Stock-to-Flow ratio and Bitcoin value is not spurious, and that the Stock-to-Flow hypothesis holds true in the future. As with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

In conclusion, the Stock-to-Flow hypothesis suggests that scarcity is a significant driver of value for Bitcoin. Data shows that the value of Bitcoin has increased during each halving cycle when the Stock-to-Flow ratio has doubled. Additionally, there is a profitable trading rule based on the Stock-to-Flow hypothesis. However, as with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

-

15:18

15:18

MetatronHistory

2 days agoThe REAL Origins of the SUMERIANS

21 -

22:43

22:43

Nikko Ortiz

11 hours agoGhost Of Tabor Is Like Fent...

621 -

17:44

17:44

The Pascal Show

11 hours agoNOW LAPD IS LYING?! TMZ Doubles Down On Source's "Celeste Rivas Was FROZEN" Claims

55 -

18:05

18:05

GritsGG

12 hours agoThis Duo Lobby Got a Little Spicy! We Have Over 20,000 Wins Combined!

43 -

LIVE

LIVE

Lofi Girl

3 years agolofi hip hop radio 📚 - beats to relax/study to

1,103 watching -

37:08

37:08

MetatronGaming

2 days agoWarhammer Shadow of The Horned Rat DOS Version is FANTASTIC! 1995

2551 -

2:03:36

2:03:36

FreshandFit

10 hours agoAkaash Replies to FreshandFit w/ Girls

165K16 -

1:07:49

1:07:49

Man in America

10 hours agoBANNED TECH: The Tesla Secrets Rockefeller Crushed to Keep You Sick w/ Linda Olsen

26.7K4 -

4:40:43

4:40:43

Drew Hernandez

22 hours agoCANDACE OWENS ASSASSINATION PLOT?

33.7K12 -

1:05:15

1:05:15

Inverted World Live

8 hours agoOne Big Happy Thanksgiving | Ep. 147

76.6K5