Premium Only Content

The Stock to Flow Ratio - Is this a MASSIVE Bitcoin Loophole?

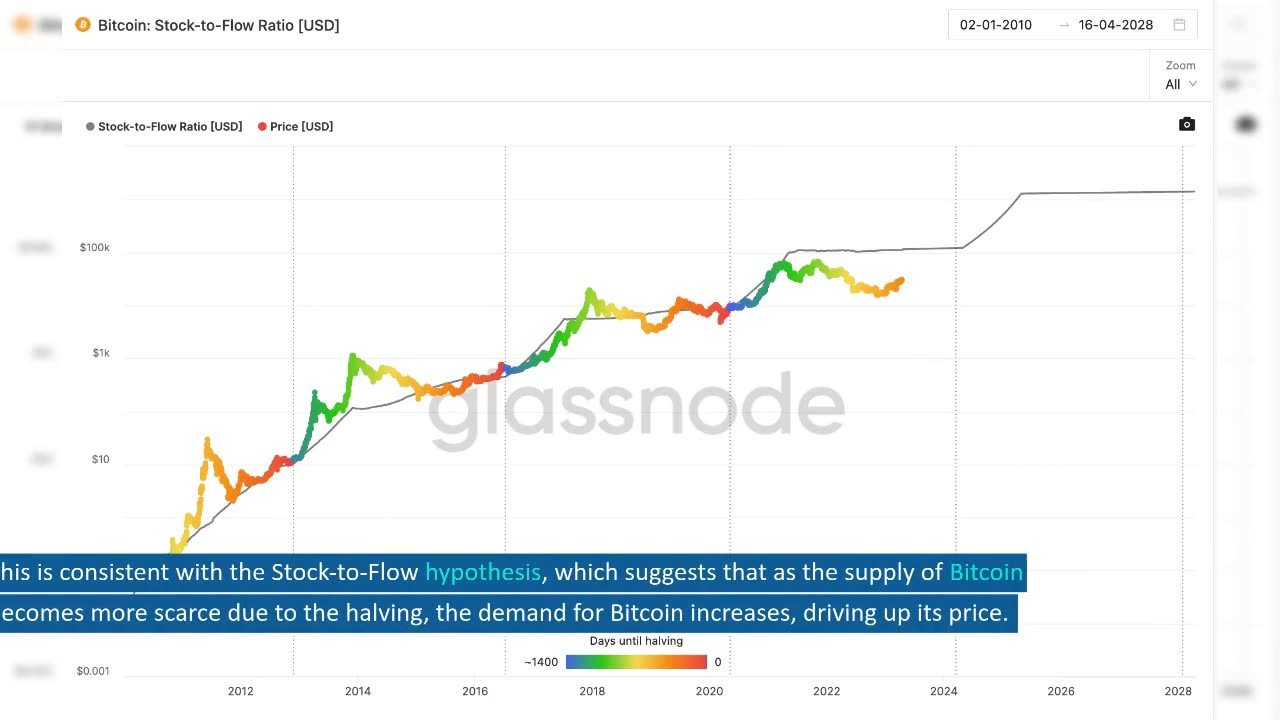

The Stock-to-Flow hypothesis is a theory that suggests scarcity is a significant driver of value. Specifically, the hypothesis argues that when the scarcity of an asset increases, its value should also increase. This hypothesis has been applied to Bitcoin, where it is argued that the Bitcoin halving cycle doubles the scarcity of the asset, leading to a corresponding increase in value.

Data shows that the value of Bitcoin has indeed increased during each halving cycle when the Stock-to-Flow ratio (S2F) has doubled. This is consistent with the Stock-to-Flow hypothesis, which suggests that as the supply of Bitcoin becomes more scarce due to the halving, the demand for Bitcoin increases, driving up its price.

However, if the value of Bitcoin were to decrease post halving, the Stock-to-Flow hypothesis would be rejected. This would suggest that scarcity is not the primary driver of value for Bitcoin, and that other factors such as market sentiment or speculation are more significant.

Interestingly, there is a profitable trading rule based on the Stock-to-Flow hypothesis. The rule suggests that investors should buy Bitcoin six months before each halving and sell 18 months after the halving. This trading rule has been shown to outperform a buy and hold strategy in terms of both risk and return.

Of course, this assumes that the correlation between the Stock-to-Flow ratio and Bitcoin value is not spurious, and that the Stock-to-Flow hypothesis holds true in the future. As with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

In conclusion, the Stock-to-Flow hypothesis suggests that scarcity is a significant driver of value for Bitcoin. Data shows that the value of Bitcoin has increased during each halving cycle when the Stock-to-Flow ratio has doubled. Additionally, there is a profitable trading rule based on the Stock-to-Flow hypothesis. However, as with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

-

LIVE

LIVE

TimcastIRL

2 hours agoNew DOCS PROVE Obama Hillary CONSPIRACY To SABOTAGE Trump Admin | Timcast IRL

19,428 watching -

LIVE

LIVE

Laura Loomer

3 hours agoEP136: YOU'RE FIRED! White House Vetting Crisis Continues

742 watching -

LIVE

LIVE

SpartakusLIVE

3 hours agoDuos w/ @GloryJean || #1 Masculine Muscle MASS sears YOUR retinas with MIND BENDING content

540 watching -

8:07

8:07

MattMorseTV

3 hours ago $0.13 earnedTrump just LOWERED PRICES by 75 PERCENT.

43110 -

LIVE

LIVE

Misfit Electronic Gaming

5 hours ago"LIVE" "Blind Descent' +"Dollhouse of Dead" Playtest 10 Followers till we hit 1000! We CAN do this!

51 watching -

21:53

21:53

Glenn Greenwald

5 hours agoMichael Tracey on the Street: What Do People Think of the Epstein Case?

82.6K52 -

LIVE

LIVE

megimu32

2 hours agoOTS: Board Games Gone Wild! The Loud, Weird & Chaotic Games That Raised Us

147 watching -

LIVE

LIVE

DamnDanieI

2 hours agoKill First, Loot Later – OTG Live

220 watching -

56:41

56:41

Donald Trump Jr.

6 hours agoLies, Leaks, and Lawfare: Censorship Corruption Exposed | TRIGGERED Ep.263

112K105 -

LIVE

LIVE

Precision Rifle Network

3 hours agoS4E25 Guns & Grub - Rex Is Back, I shot the 6.5PRC finally...

38 watching