Premium Only Content

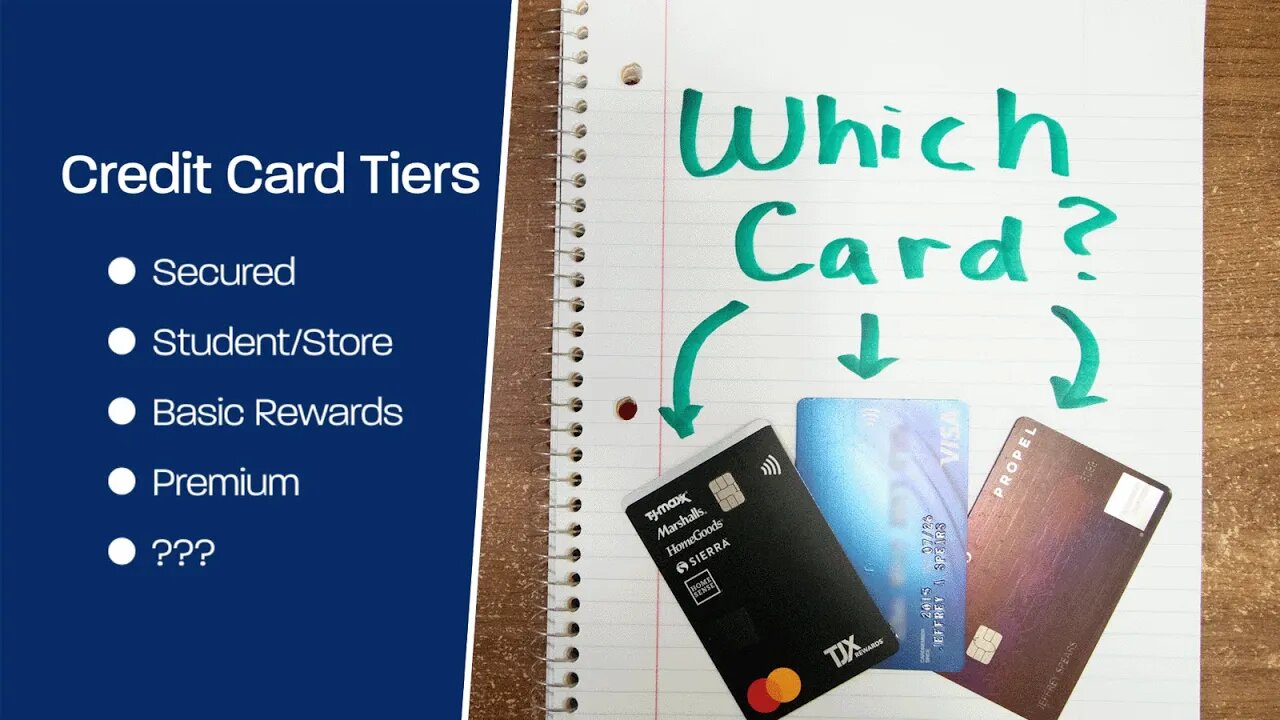

Credit Card Tiers Explained (How To Pick the Best Card for YOU)

If you're wonder which credit card you should apply for, I discuss the different credit card tiers and the score ranges recommended to qualify. The five tiers are the secured card, student or store cards, basic rewards cards, premium cards, and the ultimate exclusive tier. I've left links to some cards below if you're interested in applying. If you like the video be sure to leave a like to let me know! Comment with any video ideas you'd like to see from me, and I will see you next week! Thanks for watching! :)

Where I check my credit score and get card recommendations:

https://www.creditkarma.com/ or https://mint.intuit.com/

Chase Freedom Card (Recommended above 690):

Earn $200 cash back with Chase Freedom Unlimited or Chase Freedom Flex credit card: https://www.referyourchasecard.com/18p/XEFPLWWYCN

Citi Double Cash Credit Card (Recommended above 690):

https://www.citi.com/credit-cards/compare/view-all-credit-cards

Credit One Platinum Visa (Recommended below 690):

https://www.creditonebank.com/credit-cards/platinum

Get up to $200 in FREE stocks when you sign up to Robinhood using my link:

https://join.robinhood.com/jeffres826

Tags:

#credit #creditscore #creditcard #buildcredit #investing #finance #personalfinance #whichcreditcard #howtopickcreditcard #bestcreditcard #bestcreditcards #creditcardtiers #creditcardtips #tipsforgettingcreditcard #whatcreditcardcaniget #creditbuilding #whichcreditcardisbestforbeginners #studentcreditcard

-

LIVE

LIVE

TimcastIRL

3 hours agoTrans Shooter Targets Catholic Kids In Mass Shooting, Leftists Reject Prayers | Timcast IRL

6,511 watching -

LIVE

LIVE

SpartakusLIVE

4 hours ago#1 Birthday Boy Celebrates with MASSIVE and HUGE 4.8-Hour Stream

360 watching -

LIVE

LIVE

Man in America

6 hours agoFrom Oil Barons to Pill Pushers: The Rockefeller War on Health w/ Jeff Adam

623 watching -

Barry Cunningham

3 hours agoBREAKING NEWS: PRESIDENT TRUMP THIS INSANITY MUST END NOW!

53.7K88 -

LIVE

LIVE

StevieTLIVE

2 hours agoWednesday Warzone Solo HYPE #1 Mullet on Rumble

102 watching -

5:58

5:58

Mrgunsngear

3 hours ago $0.78 earnedBreaking: The New Republican Party Chairman Is Anti 2nd Amendment

4.46K5 -

LIVE

LIVE

Geeks + Gamers

3 hours agoGeeks+Gamers Play- MARIO KART WORLD

236 watching -

![(8/27/2025) | SG Sits Down Again w/ Sam Anthony of [Your]News: Progress Reports on Securing "We The People" Citizen Journalism](https://1a-1791.com/video/fww1/d1/s8/6/G/L/3/c/GL3cz.0kob.1.jpg) 29:34

29:34

QNewsPatriot

3 hours ago(8/27/2025) | SG Sits Down Again w/ Sam Anthony of [Your]News: Progress Reports on Securing "We The People" Citizen Journalism

6.93K1 -

25:12

25:12

Jasmin Laine

8 hours agoDanielle Smith’s EPIC Mic Drop Fact Check Leaves Crowd FROZEN—Poilievre FINISHES the Job

13.6K19 -

ZWOGs

12 hours ago🔴LIVE IN 1440p! - SoT w/ Pudge & SBL, Ranch Sim w/ Maam & MadHouse, Warzone & More - Come Hang Out!

6.94K