Premium Only Content

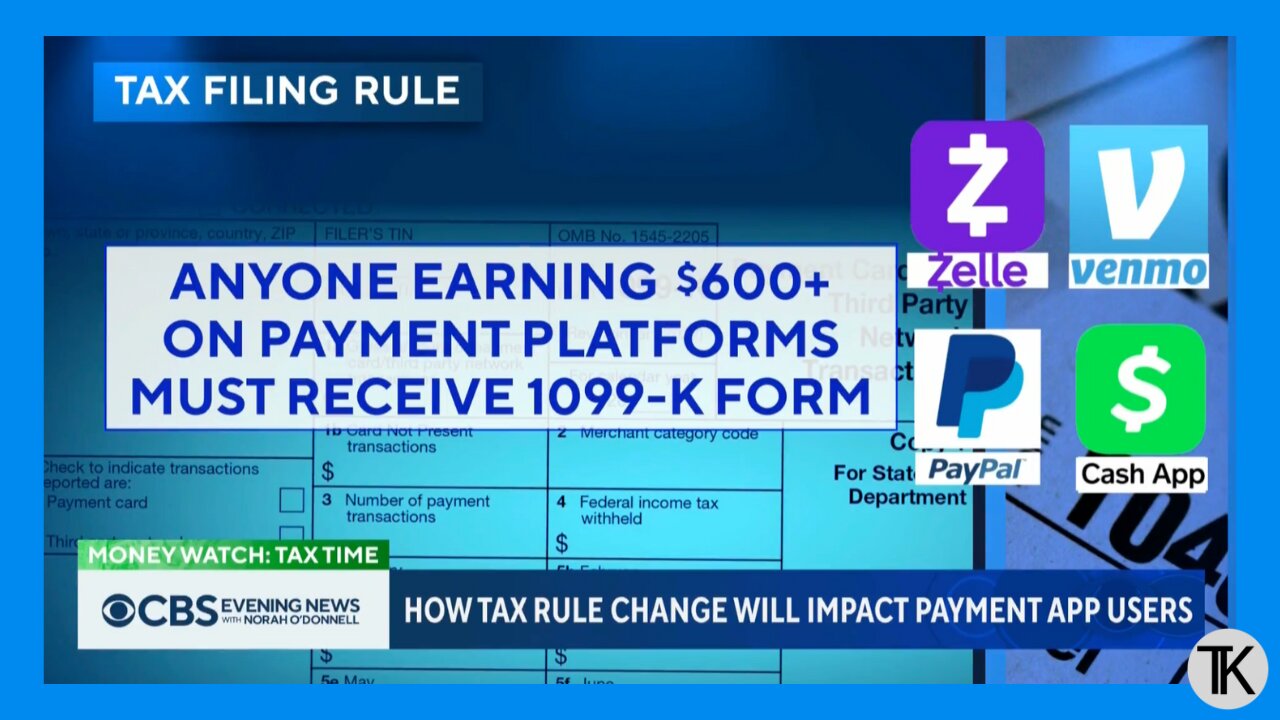

CBS News: Next Year, Anyone Earning Over $600 on Payment Apps, will Receive a 1099-K Form

COLBURN: “I was supposed to have a house call today.”

MACFARLANE (voice-over): “Monica Colburn helps run a Virginia hair salon. But like a growing number of Americans, she uses the flexible hours to earn some extra cash.”

MACFARLANE (on camera): “How many different side hustles do you have?”

COLBURN: “I think last year I had eight 1099s.”

MACFARLANE (voice-over): “She works weddings and promotes musicians collecting most of her income through payment apps like Venmo.”

COLBURN: “If I didn’t have multiple ways that somebody could pay me, I feel like I would lose business.

MACFARLANE: “The apps are easy to use. But starting next year, filing taxes for millions of people could become trickier. A new IRS rule will require anyone earning more than $600 on payment apps in 2023 to receive a 1099-K form. The old threshold was earning $20,000 over 200 transactions.”

Greene-LEWIS: “This is not a tax law change. This is just a reporting requirement for those third parties like Venmo, PayPal and the credit card companies.”

MACFARLANE: “The IRS expects an initial surge of 4 million of these forms next year, which it says it can handle.”

MACFARLANE (on camera): “But there are businesses concern handling all the paperwork from this change could be like taking on a whole another job in and of itself.”

MACFARLANE (voice-over): “Businesses like Dennis Turbeville, a Maryland furniture maker takes nearly all of his payments through apps and worries they’ll make a mistake when the government is asking for its cut.”

TUBERVILLE: “A $2,500 penalty for a business that’s doing $2 million a year, not a big deal. For somebody like me, that’s a big deal.”

MACFARLANE: “The IRS says money exchanged between friends shouldn’t be taxed and warns users to classify those transactions as personal, not goods and services. Scott MacFarlane, CBS News Alexandria, Virginia.”

-

2:02

2:02

Tony Katz

4 months agoIndianapolis Amazon Delivery Driver Rips Pro-Israel Sign Out of Lawn

353 -

23:58

23:58

Stephen Gardner

6 hours ago🔥Obama THROWS Adam Schiff under the bus to obstruct Trump!

17.5K99 -

38:44

38:44

The Why Files

4 days agoProject Ancient Arrow | The NSA's Secret War Against Our Future

52.1K72 -

2:36:06

2:36:06

Barry Cunningham

8 hours agoPRESIDENT TRUMP IS TRULY USHERING IN THE GOLDEN AGE OF AMERICA! CAN YOU FEEL IT?

105K44 -

3:47:25

3:47:25

SynthTrax & DJ Cheezus Livestreams

3 days agoFriday Night Synthwave 80s 90s Electronica and more DJ MIX Livestream 2K Celebration SPECIAL EDITION 530pm PST / 830pm EST

46.8K5 -

2:21:54

2:21:54

VapinGamers

4 hours ago $2.97 earnedDestiny 2 - Edge of Fate Legendary Run Part 3 - !rumbot !music

24.9K -

2:04:25

2:04:25

TimcastIRL

7 hours agoTrump DOJ Gives Ghislaine Maxwell Limited IMMUNITY As She Rats On 100+ People | Timcast IRL

227K165 -

1:09:09

1:09:09

Omar Elattar

9 hours agoThe Brain Experts: Your Brain Can Rewire Itself At Any Age & Here's How!

22.5K4 -

4:30:37

4:30:37

IcyFPS

5 hours agoLIVE - Wuchang Fallen Feathers x Borderlands w/ pope!

29.4K2 -

29:24

29:24

Afshin Rattansi's Going Underground

19 hours agoWas Epstein a Mossad Agent? Will Obama go to Prison? (Afshin Rattansi vs Alan Dershowitz)

30.8K23