Premium Only Content

The Week On-Chain: Bitcoin Rallies Back Over $30k, Driven by Spot, or Leverage? (Bitcoin Analysis)

🚀 Start your Glassnode Advanced free trial today: https://glassno.de/3QFXu0S

📟 Spotting Cycle Tops and Bottoms Dashboard: https://glassno.de/cycleextreme

🐻 Recovering From a Bitcoin Bear Dashboard: https://glassno.de/recoveringbear

♟️ Mastering MVRV Dashboard: https://glassno.de/3IRQB9k

🏦 Exchanges Dashboard: https://glassno.de/3RimWJY

💸 Realized Profit Loss Dashboard: https://glassno.de/3H6c8dz

💵 Pricing Models Dashboard: https://glassno.de/3J9hVkW

🌊 HODL Wave Dynamics: https://glassno.de/3xzSmTn

📈 Bitcoin Price Performance Dashboard: https://glassno.de/3UwBRCf

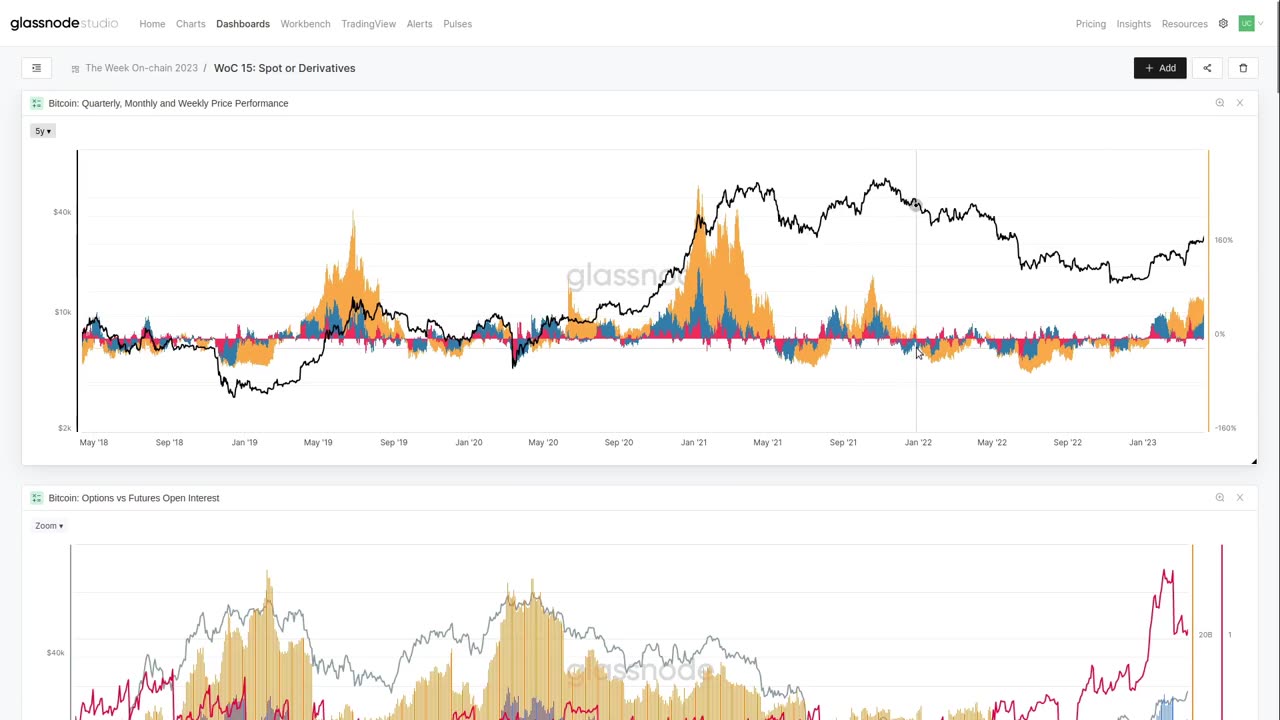

Bitcoin has rallied above the $30k level this week, posting the strongest YTD returns since the Nov 2021 ATH. In this weeks report, we analyse whether this move was driven by leverage in derivatives markets, or spot demand.

📰 Shanghai Sell-Side Report: https://glassno.de/3Gvg5bV

🪟 Live Dashboard: https://glassno.de/414zrgC

🦐 Shrimp Supply Sink Report: https://glassno.de/41hmhgp

💬 Forum Market Pulses: https://glassno.de/3D0uqfC

🗜️ Visit Workbench Pre-sets: https://glassno.de/3e7ngMv

Topics for Discussion:

- Analysis of futures and options open interest and leverage.

- Monitoring funding rates, and options speculative premium.

- Observations regarding the uptick in on-chain activity.

- Measuring balance change for Shrimp, Whales and Exchanges.

Getting Started with Glassnode:

📈 Navigating Tops and Bottoms: https://glassno.de/3OpgSgA

⛓️ On-chain Activity: https://glassno.de/3xXM13Q

⛏️ Mining Fundamentals: https://glassno.de/3nnfL5m

🪙 Supply Dynamics: https://glassno.de/3NyhPlK

🕰️ Introduction to Lifespan: https://glassno.de/3ehCmzn

💸 Realized and Unrealized Value: https://glassno.de/3ExnCa1

👴 Long and Short-Term Holders: https://glassno.de/3QLUzCt

Timestamps

0:00 Introduction

2:20 Shanghai Sell-Side Report

4:34 Quarterly Price Perfromance

6:00 Futures and Options Open Interest

8:35 Options Open Interest by Strike Price

10:45 Futures Funding Rates

12:25 Futures Liquidations

13:27 New Address and Volume Momentum

15:08 Transaction Counts

16:12 Exchange Volume Momentum

16:46 aSOPR

19:20 Realized P/L Ratio

21:17 Entity Yearly Absorption Rates

24:20 Accumulation Trend Score

25:30 Summary and Conclusions

Follow us and reach out on Twitter 🐦: https://twitter.com/glassnode

Join our Telegram channel: https://t.me/glassnode

For on-chain metrics and charts, visit Glassnode Studio: https://glassno.de/3oRNXaf

Join the discussion on Glassnode Forum: https://glassno.de/3y1lCl5

About:

The Glassnode video report provides a weekly analysis update of the trends, performance, and onchain metrics for Bitcoin and the crypto market.

Disclaimer:

This report does not provide any investment advice. All data is provided for information purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

-

1:12:11

1:12:11

DeVory Darkins

3 hours agoKamala STUNNED after brutal question from reporter as Trump DOMINATES CHINA MEETING

92.2K43 -

LIVE

LIVE

Dr Disrespect

4 hours ago🔴LIVE - DR DISRESPECT - ARC RAIDERS - SOLO RAIDING THE GALAXY

1,603 watching -

LIVE

LIVE

Due Dissidence

5 hours agoMegyn Kelly GASLIGHTS Candace Fan, Tucker TORCHES Christian Zionism, Israel BREAKS CEASEFIRE AGAIN

787 watching -

59:52

59:52

Mark Kaye

3 hours ago🔴 5 Reasons JD Vance WILL Be The Next President

7.97K3 -

21:08

21:08

Professor Nez

1 hour agoTrump Just BROKE the ENTIRE Democrat Party with one Line!

6.46K15 -

1:00:22

1:00:22

Timcast

3 hours agoPentagon To Test NUKES, Russia Warns Of WW3

111K60 -

2:07:00

2:07:00

Steven Crowder

5 hours agoTrump vs. Xi: Who Won The US - China Trade Meeting & Who is Lying

330K353 -

49:47

49:47

Sean Unpaved

3 hours agoYesavage's 12-K Masterclass Clinches Jays Game 5, Ravens-Dolphins TNF Clash, CFB Hot Seat Inferno

10.1K -

2:12:48

2:12:48

Side Scrollers Podcast

4 hours agoSydney Sweeney’s VIRAL “Assets” + DHS Lord of the Rings Meme MELTDOWN + More | Side Scrollers

24.4K7 -

LIVE

LIVE

StoneMountain64

3 hours agoArc Raiders is FINALLY Out for Everyone #ad !ark !arktips

90 watching