Grab Your Tax Back before it's too Late

The Employee Retention Tax Credit (ERTC) is a tax incentive offered by the United States government to encourage businesses to retain their employees during the COVID-19 pandemic. The credit was introduced as part of the CARES Act in March 2020 and has since been extended and expanded under subsequent legislation.

Under the ERTC, eligible employers can receive a tax credit of up to $7,000 per employee per quarter, or up to $28,000 per employee for the full year. To be eligible, the employer must have experienced a significant decline in gross receipts or been subject to a full or partial government shutdown due to COVID-19.

USA employers can benefit from the ERTC if they meet the eligibility criteria. The credit can be used to offset the employer's share of Social Security taxes or can be claimed as a refund if the credit exceeds the employer's payroll tax liability.

It's important to note that employers cannot claim for Family Members , also the limit for 2021 was max 100 employees and 500 employees 2022

Overall, the ERTC is designed to help employers retain their employees and provide financial support during these challenging times. If Your Company meets the eligibility criteria, they should consider taking advantage of this tax credit to reduce their tax liability and maintain their workforce.

-

LIVE

LIVE

The Charlie Kirk Show

6 hours agoDonald Trump is BACK: Live at the Republican National Convention, Day 4

21,108 watching -

26:54

26:54

Breaking Points

3 hours ago7/18/24 BREAKING: Biden Out THIS WEEKEND Per Report

52.6K5 -

LIVE

LIVE

Alex Zedra

3 hours agoLIVE! Another night of Scary Games

930 watching -

38:40

38:40

The Dan Bongino Show

7 hours agoBongino x Russell Brand - LIVE at the RNC

343K392 -

1:07:15

1:07:15

Glenn Greenwald

7 hours agoMichael Tracey Reports from the RNC in Milwaukee | SYSTEM UPDATE #300

124K69 -

1:11:53

1:11:53

Havoc

8 hours agoWhat's a Classic | Stuck Off the Realness Ep. 5

91.1K5 -

49:35

49:35

Donald Trump Jr.

8 hours agoHULK HOGAN LIVE FROM THE RNC

201K168 -

DVR

DVR

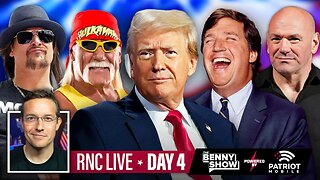

Benny Johnson

9 hours ago🚨Donald Trump, Tucker, Kid Rock, Dana White, Hulk Hogan Bring Down the House at RNC | LEGENDS 🔥

234K122 -

5:42:34

5:42:34

Akademiks

10 hours agoCardi B Goes Crazy on Joe Budden. Schoolboy Q Declares War on OVO. Big Sean goes at Kendrick/Haters?

190K34 -

Drew Hernandez

11 hours agoPRESIDENT DONALD J. TRUMP SPEAKS: RNC NIGHT 4

134K55