Premium Only Content

Investor loses 3,200 apartment units in foreclosure #shorts

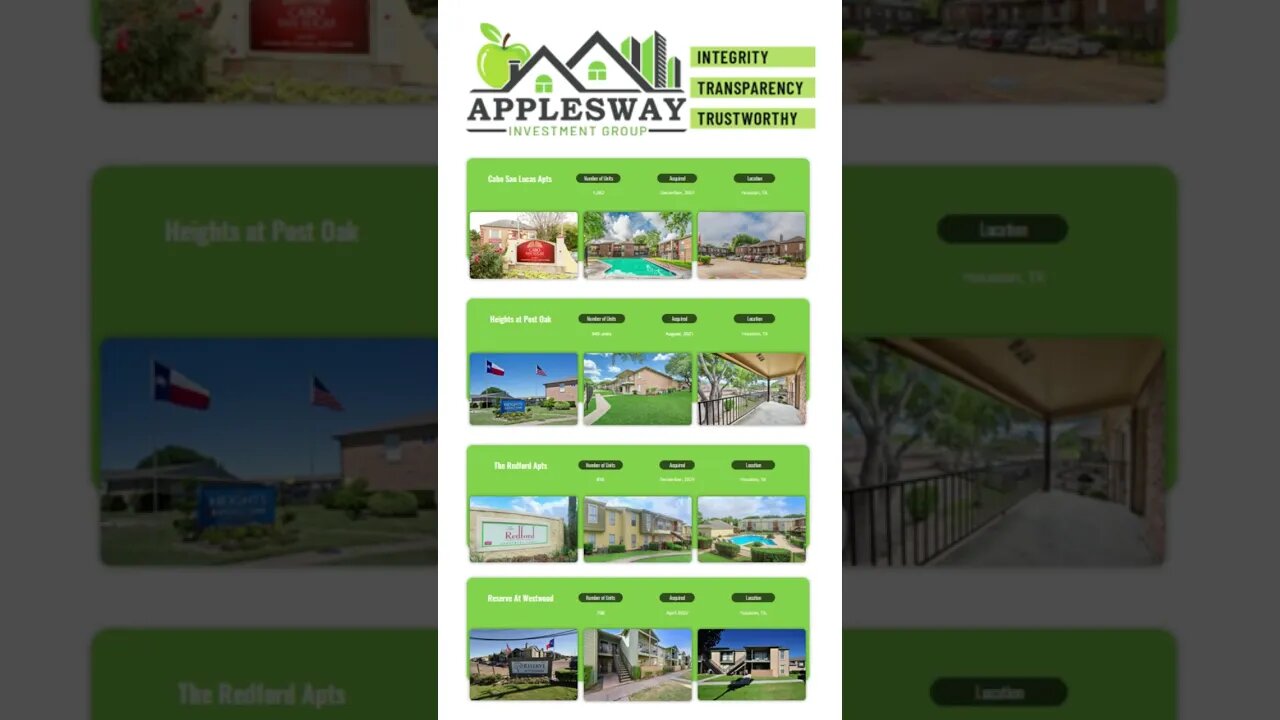

Applesway Investment Group borrowed $230 million to purchase four Houston apartment complexes composed of 3,200 apartments around the second half of 2021 before the Fed rate hikes began. Now, Arbor Realty Trust, which is a publicly traded mortgage company, has foreclosed on the properties because Applesway defaulted on the loan.

Commercial property is taking a tumbling. The financial crisis has spread from urban offices and shopping malls to multifamily housing at this point. I’m wondering if this will cause contagion and perhaps impact single family homes? Multifamily apartment buildings have been considered a safe investment for decades. When home prices exploded, it forced a lot of potential home buyers to keep renting. Some landlords made the wrong call when they assumed rents would continue rising at breakneck speed. What is even worse for some of these investors is they made the mistake of using floating-rate mortgages. Those loans have now reset at higher rates. Appleway’s interest rate went from 3.4% to 8%, so they would have been paying more than double in financing costs.

Works Cited:

https://www.wsj.com/articles/houston-apartment-owner-loses-3-200-units-to-foreclosure-as-multifamily-feels-the-heat-fb3d0e75?mod=hp_lead_pos10

-

4:21

4:21

The Last Capitalist in Chicago

1 year agoWhat is the Hume-Cantillon Effect?

2521 -

2:16:36

2:16:36

Side Scrollers Podcast

15 hours agoStreamer KICKED OUT of Renaissance Fair for Misgendering + Spiderman MELTDOWN | Side Scrollers Live

31.1K3 -

12:29

12:29

The Pascal Show

1 day agoLOCKED IN A DUNGEON?! Parents Arrested After 5 Children Found In 'Dungeon' At Home

782 -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

501 watching -

3:07:24

3:07:24

FreshandFit

7 hours agoPrivileged Nigerian Thinks Women Created Everything: HEATED DEBATE

109K61 -

5:57:27

5:57:27

SpartakusLIVE

8 hours agoNEW Update - BROKEN Attachment || Viewers REJOICE at the long-awaited Return of Their KING

69.5K -

2:06:31

2:06:31

TimcastIRL

7 hours agoTrump To Deploy National Guard To Portland, Antifa Has Been WIPED OUT | Timcast IRL

172K142 -

2:30:00

2:30:00

Laura Loomer

8 hours agoEP142: Loomer Prompts Calls For FBI To Investigate Palestinian Youth Movement

40.9K18 -

1:26:34

1:26:34

Man in America

11 hours agoExposing the Cover-Up That Could Collapse Big Medicine: Parasites

46.1K19 -

4:53:00

4:53:00

CHiLi XDD

7 hours agoTekken Fight Night

24.4K1