Premium Only Content

Shocking Facts About Money #shorts #1million

In this video, we are talking about Shocking Facts About Money #shorts #1million #video #youtubevideo #viral #viralvideo

Money is one of the most powerful forces in the world today. It can be used to purchase goods, invest in stocks, and allow us to travel around the world. But what a lot of people don’t know is that money comes with a lot of shocking facts. In this YouTube Shorts video, we’ll reveal some of the most shocking facts about money that you won’t believe.

Did you know that the most expensive banknote in the world is made of solid gold? It’s the $1 million Canadian Gold Maple Leaf coin, which is worth more than $2 million!

Did you also know that the world’s first paper money was issued in China during the Tang Dynasty? It was made out of mulberry bark and was used as a form of currency for over 800 years.

Another shocking fact about money is that the smallest banknote in the world is the Samoan Tala. It’s worth just one-hundredth of a U.S. dollar and is only 8mm x 13mm in size.

Finally, did you know that the most valuable coin in the world is the 1794 Flowing Hair Silver Dollar? It was sold for a whopping $10 million in 2013, making it the most expensive coin ever sold.

These are just some of the shocking facts about money that will blow your mind. For more amazing facts about money, watch our YouTube Shorts video now.

facts about money,facts,money facts,shocking facts about money,shocking facts about money plant,interesting facts,money,shocking facts about scientology,40 facts about money,30 facts about money,20 facts about money,interesting facts about money,mind blowing facts about money,101 facts about money,20 interesting facts about money,psychology facts about money,random facts about money,amazing facts about money - neovideo,unknown facts about money

#MoneyCanBuyYouHappiness

#MoneyDoesntGrowOnTrees

#Richest1PercentOwnHalfTheWorldsWealth

#AmericansHaveMoreDebtThanSavings

#MoneyTalks

#YouCanGetAReturnOnInvestment

#TheAverageUSFamilyIsInDebt

#FinancialEqualityIsAProblem

#YouCanSaveMoneyByShoppingSmart

#TheAverageAmericanSpendsMoreThanTheyMake

#TheWealthGapIsGrowing

#AmericansAreLivingLongerButSavingLess

#TheRichAreGettingRicher

#ThePoorAreGettingPoorer

#TheCostOfLivingIsRising

#TheAverageAmericanDoesntHaveEnoughSavings

#TheAverageUSFamilyIsInFinancialTrouble

#TheDebtCrisisIsReal

#TheAverageRetireeIsInDebt

#TheGlobalWealthGapIsIncreasing

#TheCostOfHousingIsRising

#TheAverageCreditScoreIsDeclining

#TheAverageAmericanCreditCardDebtIsHigh

#TheAverageUSStudentLoanDebtIsRising

#TheCostOfHealthcareIsRising

#YouCanCutYourTaxesByInvesting

#TheAverageUSFamilyIsInCreditCardDebt

#TheAverageAmericanIsLivingPaycheckToPaycheck

#TheAverageAmericanDoesntHaveEmergencySavings

#TheCostOfHigherEducationIsRising

#TheUSGovernmentIsInDebt

#TheAverageAmericanIsNotPreparingForRetirement

#TheAverageAmericanIsLivingBeyondTheirMeans

#TheAverageAmericanIsNotSavingForTheFuture

#TheAverageAmericanIsNotInvesting

#TheAverageAmericanIsStrugglingWithDebt

#TheAverageAmericanIsNotGettingOutOfDebt

#TheAverageAmericanIsNotMakingSmartFinancialDecisions

#TheAverageAmericanIsNotSavingEnough

#TheAverageAmericanIsNotUsingCreditWisely

#TheAverageAmericanIsNotPlanningForRetirement

#TheAverageAmericanIsNotGettingOutOfDebtFastEnough

#ThereAreDifferentTypesOfInvestmentRisks

#TheAverageAmericanIsNotMakingTheMostOfTheirMoney

#TheAverageAmericanIsNotMaximizingTheirSavings

#TheAverageAmericanIsNotTakingAdvantageOfInvestmentOpportunities

#TheAverageAmericanIsNotGettingTheBestReturnOnInvestment

#TheAverageAmericanIsNotProtectingTheirAssets

#TheAverageAmericanIsNotMaximizingTheirTaxReturns

#TheAverageAmericanIsNotTrackingTheirFinances

#TheAverageAmericanIsNotEducatingThemselvesOnFinances

#TheAverageAmericanIsNotTakingCareOfTheirFinancialHealth

#TheAverageAmericanIsNotProtectingTheirIdentity

#TheAverageAmericanIsNotGettingTheBestInterestRates

#TheAverageAmericanIsNotTakingAdvantageOfTaxDeductions

#TheAverageAmericanIsNotAdequatelyInsuringTheirAssets

#TheAverageAmericanIsNotCreatingABudget

#TheAverageAmericanIsNotUsingPersonalFinanceSoftware

#TheAverageAmericanIsNotManagingTheirMoney

#TheAverageAmericanIsNotMakingSmartFinancialMoves

#TheAverageAmericanIsNotSavingForRetirement

#TheAverageAmericanIsNotManagingTheirDebt

#TheAverageAmericanIsNotTakingAdvantageOfEmployerBenefits

#TheAverageAmericanIsNotSecuringTheirFinancialFuture

#TheAverageAmericanIsNotPlanningForCollege

#TheAverageAmericanIsNotTakingRisksWithTheirMoney

#TheAverageAmericanIsNotGettingComprehensiveFinancialAdvice

#TheAverageAmericanIsNotLearningAboutInvestmentOptions

#TheAverageAmericanIsNotMakingTheMostOfTheirIncome

#TheAverageAmericanIsNotCreatingWealthForTheFuture

#TheAverageAmericanIsNotBuildingAnEmergencyFund

#TheAverageAmericanIsNotGettingSupportForFinancialDecisions

#TheAverageAmericanIsNotGettingTheBestBankingOptions

#TheAverageAmericanIsNotMakingTheMostOfTheirCredit

-

LIVE

LIVE

I_Came_With_Fire_Podcast

7 hours agoNEW JERSEY UAP/DRONES—What are they!?

221 watching -

DVR

DVR

Flyover Conservatives

21 hours ago5 Ways to Participate in America’s Financial Revival - Clay Clark | FOC Show

20.5K -

![GrayZone Warfare: NightOp [GAME GIVEAWAY!] - #RumbleGaming](https://1a-1791.com/video/s8/1/s/1/R/D/s1RDv.0kob-small-GrayZone-Warfare-NightOp-GA.jpg) 2:40:46

2:40:46

LumpyPotatoX2

4 hours agoGrayZone Warfare: NightOp [GAME GIVEAWAY!] - #RumbleGaming

37.9K5 -

2:25:44

2:25:44

WeAreChange

5 hours agoAliens?! Pentagon Shoots Down Iranian Mothership Drone Narrative

73.9K21 -

59:34

59:34

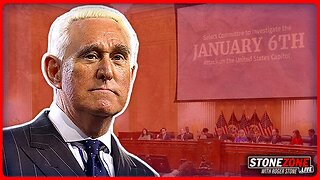

The StoneZONE with Roger Stone

4 hours agoShould the January 6th Committee be Investigated? | The StoneZONE w/ Roger Stone

31.2K5 -

44:34

44:34

PMG

4 hours ago $0.23 earned"Caitlin Clark Says She Has “White Privilege” Why Caitlin WHY???"

20.2K2 -

1:06:50

1:06:50

Dr. Drew

11 hours agoRoger Ver, Jan 6ers, Ross Ulbricht: Who Should Trump Pardon First? w/ Robert Barnes & Aaron Day – Ask Dr. Drew

46.3K6 -

11:56

11:56

Tundra Tactical

5 hours ago $0.64 earnedWas the UnitedHealthcare CEO Assassination a PSYOP?

22.9K10 -

52:46

52:46

Sarah Westall

4 hours agoPower of Nocebo and Placebo in Health & Politics. Quantum Energy Advancements w/ Ian and Philipp

30.5K5 -

54:59

54:59

LFA TV

1 day agoLee Smith Discusses ‘Disappearing the President’ | Trumpet Daily 12.11.24 7PM EST

25.3K2