How Should Investors Feel About an Uncertain Fed?

It has been nearly a week since the Federal Reserve's last meeting. On Wednesday, the central bank raised interest rates by 25 basis points (0.25%). And still, the widely anticipated event remains the key driver for stocks and other asset classes. So this episode of Making Money With Matt McCall is all about the Fed. Matt dives into the latest rate-hike decision and examines how other government figures reacted to the news.

Investors are still wary in light of the banking collapse. That's another reason why stocks haven't been able to gain any footing recently. Matt discusses why the indecision we're getting from Washington, D.C. isn't good for the market overall... and shares charts that highlight how specific assets have performed since the Fed's decision. This is a Fed-heavy episode you don't want to miss.

Click here to sign up for Marc's latest event: https://www.chaikinevent2023.com

#federalreserve #investing #inflation

00:00 The Fed’s reactions to the bank run's

8:34 Th performances of bitcoin, gold, and treasury bonds

9:36 Janet Yellen ensured the safety of American deposits

11:55 Fed’s Bullard’s stance on interest rate hikes

14:27 Fed dot plot into 2025

15:08 Effective fed funds rate

15:51 Money market fund assets

17:43 FMS investors most overweight cash

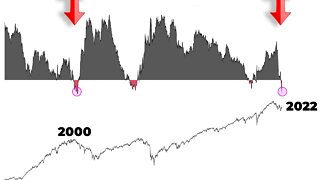

18:36 Historical Trends based on December Lows

➡️ Follow us on Facebook: https://www.facebook.com/StansberryRe...

➡️ Follow us on Twitter: https://twitter.com/stansberry

➡️ Follow us on Instagram: https://www.instagram.com/stansberry_...

➡️ Follow us on LinkedIn: https://www.linkedin.com/company/stan...

-

15:52

15:52

The Money GPS

9 months ago $0.13 earnedThe Fed Just SHOCKED the Economy

395 -

1:53

1:53

Scottsdale Bullion & Coin

1 year agoSurviving the Summer: Overcoming Investor Complacency Amid Economic Threats | The Gold Spot

21 -

3:51

3:51

Lance Roberts' Three Minutes on Markets & Money

2 years agoHow Interest Rates Really Respond to the Fed

10 -

![Navigating Economic Uncertainty While Americans Anticipate Fed's Next Move [Economy This Week]](https://hugh.cdn.rumble.cloud/s/s8/1/U/n/V/o/UnVon.0kob-small-Navigating-Economic-Uncerta.jpg) 4:26

4:26

Augusta Precious Metals

8 months agoNavigating Economic Uncertainty While Americans Anticipate Fed's Next Move [Economy This Week]

-

12:40

12:40

Figuring Out Money

1 year agoInvestors Need To Pay Attention To THIS!

6 -

3:09

3:09

benjaminzmiller

11 months agoWhat are the implications for the Federal Reserve as US stocks hit a 15 month high?

5 -

11:03

11:03

Heresy Financial

1 year agoFed Panic Blitzes Media, Clueless About Inflation

1433 -

3:37

3:37

Lance Roberts' Three Minutes on Markets & Money

1 year agoIs the Fed Worried About Over-tightening?

2 -

0:26

0:26

Wealthion

1 year agoReturns of Investors Will Remain Negative and Uncertain...

33 -

13:31

13:31

The Money GPS

2 years agoThe Fed Just Sent A SHOCKWAVE Through the Financial Markets

5