Premium Only Content

House prices in west fall while house prices in east boom.

House prices in west fall while house prices in east boom.

After a two-year, pandemic driven housing boom, the housing market in America is diverging into a boom in the east and eroding prices in the west.

In all 12 major house markets west of Texas, home prices fell in January on an annual basis. In the 37 largest metro areas east of Colorado, home prices rose year-over-year.

Some housing markets in the West have had long price runs since the 90’s due to a technology boom. Now that the technology sector is suffering given the high interest rate environment, there have been mass layoffs in tech and cities traditionally associated with tech like San Jose and San Francisco have seen home prices down as much as 10%. Similarly, Seattle house prices are down 7.5%. As I’m doing my analysis here, its apparent that most of the issue is the run up in prices for years and years. Now you are at the point where the average housing prices are so high, they inevitably had to come down. I’m sitting out here in Chicago near O’Hare airport and my house is less than $350k and I have three bedrooms, two bathrooms and a backyard full of hens.

In contrast to the West, the East of America is seeing increasing home prices that seem little affected by interest rate increases. Miami home prices are up 12% and Orlando is up 9.3%. Miami is seeing financial companies relocating from to the city. Hartford, Connecticut and Buffalo, New York are up 8% in January. I’m concerned about the Florida real estate market getting too hot and cooling off. I’m seeing a lot of potential in the Dallas Fort Worth market though.

-

3:29

3:29

The Last Capitalist in Chicago

1 year ago $0.06 earnedAmericans are spending like there is no tomorrow

2152 -

24:58

24:58

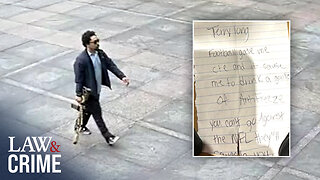

Law&Crime

7 hours ago $1.38 earnedSecond Note Leaves Disturbing Clues in New York City Killings

22.3K5 -

1:36:57

1:36:57

Badlands Media

23 hours agoAltered State S3 Ep. 39: Earthquakes, Energy Games & the Fall of the Narrative

52.6K13 -

2:04:07

2:04:07

Due Dissidence

12 hours agoCharlie Kirk's GAZA LIES, Caitlin Clark Stalker, Palantir Goes Hollywood - w/ Kyle Matovcik | TMWS

27K7 -

I_Came_With_Fire_Podcast

13 hours agoAmerica First, Trump Threatens China, Your Friendly Neighborhood Illegal, EPA Gets a "W"

29.1K4 -

LIVE

LIVE

Geeks + Gamers

4 hours agoGeeks+Gamers Play- MARIO KART WORLD

144 watching -

8:28:19

8:28:19

Dr Disrespect

13 hours ago🔴LIVE - DR DISRESPECT - BATTLEFIELD 1 - FULL GAME

165K7 -

1:39:26

1:39:26

Glenn Greenwald

8 hours agoStephen Miller's False Denials About Trump's Campus "Hate Speech" Codes; Sohrab Ahmari on the MAGA Splits Over Antitrust, Foreign Wars, and More | SYSTEM UPDATE #495

109K59 -

1:57:28

1:57:28

Omar Elattar

9 hours agoThe $300M CEO: "The One Skill That Made Me Rich In 15 Different Countries!"

18.9K -

LIVE

LIVE

xXFadedAngelXx

4 hours ago180 HOURGLASS PULL! Wisdom of Sea and Sky (Pokemon TCG Pocket) Then some RL with Meditayte later

16 watching