Premium Only Content

Blame government for the new banking crisis.

"We have learned over the last few days that many small and mid-sized banks in this country are Zombies," writes Arnold Kling, a senior scholar at the Mercatus Center at George Mason University and former economist for the Federal Reserve system and Freddie Mac.

Following the run on Silicon Valley Bank, former U.S. Treasury Secretary Larry Summers urged the federal government to guarantee the money of all the bank's depositors and warned that "now is not the time for lectures about moral hazard." But Kling insists that "past crises," such as the savings and loan collapse of the 1980s, "were bungled by authorities who were blind to the moral hazard problem."

And Lyn Alden, founder of Lyn Alden Investment Strategies, says "banks are basically highly-leveraged bond funds with payment services attached, and we treat it as normal to keep our savings in them." She argues that the Federal Reserve makes it nearly impossible for banks to hold the bulk of their customers' deposits in cash because "regulators want banks to be reasonably safe, but not 'too safe.' They want all banks to be leveraged bond funds to a certain degree, and won't allow safer ones to exist."

-

8:41

8:41

ARFCOM News

5 hours ago $1.32 earnedWill It Dremel? New V-Series Glock Pics Leaked! + ATF Alters The Deal

4.28K3 -

LIVE

LIVE

LFA TV

20 hours agoLIVE & BREAKING NEWS! | TUESDAY 11/11/25

1,132 watching -

LIVE

LIVE

freecastle

6 hours agoTAKE UP YOUR CROSS- For the Lord is a GOD of justice; BLESSED are all those who wait for him!

140 watching -

2:10:12

2:10:12

Side Scrollers Podcast

7 hours agoMAJOR Hasan Allegations + Arc Raiders Review CONTROVERSY + Craig TRENDS on X + More | Side Scrollers

44.5K7 -

5:43

5:43

Buddy Brown

6 hours ago $6.03 earnedThere's a List of WEF's "Post Trump" Predictions GOING VIRAL! | Buddy Brown

32.5K17 -

1:43:59

1:43:59

The HotSeat With Todd Spears

3 hours agoEP 207: Have YOU earned THEIR Sacrifice??

14.8K4 -

![[Ep 789] Republicans Turn “Clean CR” Into Hemp Ban | 50 Year Mortgage: Game Changer](https://1a-1791.com/video/fwe2/ce/s8/1/E/2/P/y/E2Pyz.0kob-small-Ep-789-Republicans-Turn-Cle.jpg) LIVE

LIVE

The Nunn Report - w/ Dan Nunn

3 hours ago[Ep 789] Republicans Turn “Clean CR” Into Hemp Ban | 50 Year Mortgage: Game Changer

145 watching -

12:56

12:56

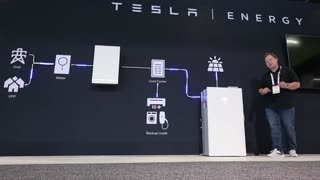

Benjamin Sahlstrom

8 hours ago $0.67 earnedTesla Powerwall 3 vs Anker SOLIX X1

10.2K -

1:02:24

1:02:24

Timcast

6 hours agoBerkeley Goes BALLISTIC Over TPUSA Event, Massive BRAWL ERUPTS

186K145 -

LIVE

LIVE

StoneMountain64

5 hours agoBattlefield REDSEC $100k TOURNAMENT

123 watching