Premium Only Content

Council Tax; final notice and estopple.

This is a public record of my final notice and estopple to the local council in relation to council tax a burden upon all souls and which is being applied illegally to all properties even those that are domestic accommodation as defined in the local government act 1988 and which the councils do not conduct any due process to ensure that the valuation office is applying council tax correctly.

Please share this far and wide, connect with Peace Keepers on their website and learn your British Constitution, learn how to challenged alleged authority and stand on your rights.

Private, domestic property;

17/03/2023

[to]

Sunderland City Council

Council tax Section

City Hall

Plater Way

Sunderland

SR1 3AA

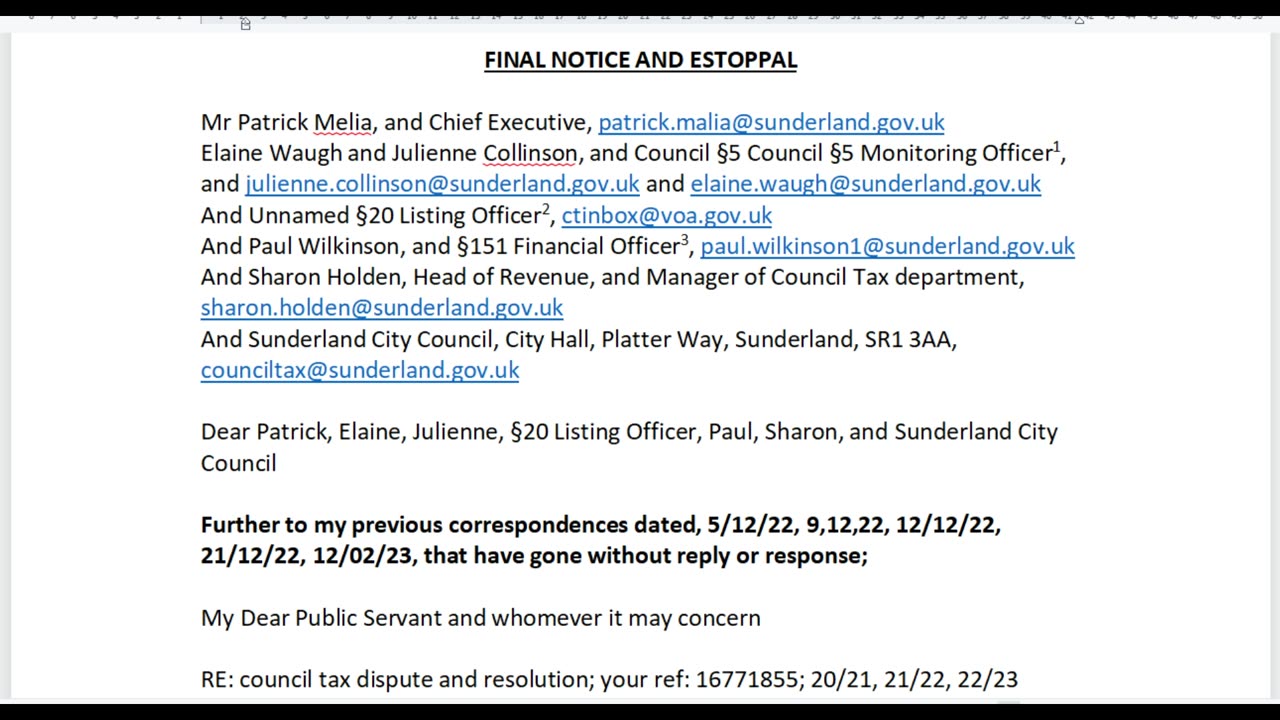

FINAL NOTICE AND ESTOPPAL

Mr Patrick Melia, and Chief Executive, patrick.malia@sunderland.gov.uk

Elaine Waugh and Julienne Collinson, and Council §5 Council §5 Monitoring Officer[https://www.legislation.gov.uk/ukpga/1989/42/section/5], and julienne.collinson@sunderland.gov.uk and elaine.waugh@sunderland.gov.uk

And Unnamed §20 Listing Officer[https://www.legislation.gov.uk/ukpga/1992/14/section/20], ctinbox@voa.gov.uk

And Paul Wilkinson, and §151 Financial Officer[https://www.legislation.gov.uk/ukpga/1972/70/section/151], paul.wilkinson1@sunderland.gov.uk

And Sharon Holden, Head of Revenue, and Manager of Council Tax department, sharon.holden@sunderland.gov.uk

And Sunderland City Council, City Hall, Platter Way, Sunderland, SR1 3AA, counciltax@sunderland.gov.uk

Dear Patrick, Elaine, Julienne, §20 Listing Officer, Paul, Sharon, and Sunderland City Council

Further to my previous correspondences dated, 5/12/22, 9,12,22, 12/12/22, 21/12/22, 12/02/23, that have gone without reply or response;

My Dear Public Servant and whomever it may concern

RE: council tax dispute and resolution; your ref: 16771855; 20/21, 21/22, 22/23

Notice to principal is notice to agent; notice to agent is notice to principal[1]

The 12 Laws of the BAR Guild are rebutted.

Email service in accordance with precedence PT-2018-000160

Council tax Liability notice under section 16 of the Local Government Finance Act 1992 ("LGFA1992")[2]

1.This is my record as set out, which is a public record; I, Deborah, in my own right, of The Drive, NE37 2LQ, state for and on the record, that after following a sequence of events now issue a final NOTICE AND ESTOPPAL.

2.I am aggrieved under the Local Government Finance Act 1992 and required that you at SECTION16(1)(a) proved my liability as the Billing Authority (SECTION 16(2)) claiming Council Tax from me.

3.Several attempts, by my self, have been made to engage in reconciliation of a dispute, I raised, around your claimed ‘BILL’ sent to me on the 23/11/2022 and my last correspondence dated 03/03/2023, placed a 14 day limit for you to respond.

4.This most recent correspondence from me, dated 03/03/23, had to be sent from an old email address (as is this) as my usual and customary email, TheInhabitant@protonmail.com, seems to have been blocked at your side.

5.I stated in my last correspondence;

“Please note that you are legally obligated to receive correspondence from inhabitants and to respond in a timely manner; blocking email and communications and not responding is a breach of your position as a public servant” and Sunderland City Council has stated ‘It is not a defence to say that you did not receive it’; therefore setting a precedence in substance of this matter.

Estoppal

Today you are informed, that as a Public Servant, you are in contempt of your position to fulfil your obligations, duties and responsibilities, of your position, to engage in dispute resolution and reconciliation, to bring to conclusion, swiftly by your lack of response to questions and queries raised in previous correspondence.

In my previous email dated 3/3/23 it is stated;

“Should there be no correspondence from yourselves, within 14 days of this communication, I will presume that the matter is concluded, that no 'debt' exists, [that no ‘legal tax’ is incumbent] and no claim can be brought and the alleged debt is removed”

And

1.As the fourteen day limit is now reached and

2.No response has been forthcoming whatsoever and

3.You have refused to answers my query/dispute and

4.Failed to provide any evidence your claimed right of a liability and

5.Therefore your claimed ‘BILL’ is null and void ‘ab initio’ and

6.You now cease and desist from any further pursuance of the alleged ‘BILL’ and

7.You now accept, agree and confirm that this matter is now completed and

8.Refrain from any further disturbance of my peace in my private, domestic accommodation as described Local Government Finance Act 1988 at section 66

9.Implied rights of access removed; do not trespass my peace

Kind regards

Under the Grace of King Charles 3rd

Deborah.

-

LIVE

LIVE

BEK TV

2 days agoTrent Loos in the Morning 6/30/2025

163 watching -

10:09

10:09

Forrest Galante

1 day agoWildlife Expert Reacts to Crazy Animal Zoo Attack TikToks

82.9K21 -

46:55

46:55

The Connect: With Johnny Mitchell

1 day ago $19.04 earnedInside A Mexican Sicario Training Camp: How The Jalisco New Generation Cartel Trains It's KILLERS

112K28 -

LIVE

LIVE

PudgeTV

2 hours ago🟠 Gaming on Rumble | Witcher 3: The Wild Hunt | Should I Bring Back the Death Counter?

183 watching -

9:03

9:03

MattMorseTV

1 day ago $8.57 earnedTrump just SHATTERED the RECORD.

55.8K57 -

1:28:30

1:28:30

The Pascal Show

12 hours ago $5.83 earnedBREAKING! AMBUSHED! Multiple Idaho Firefighter s Ambushed By GUNMAN! Suspects AT LARGE?!

31.5K12 -

![This game no longer exists | [6-30-25] | THE CYCLE: FRONTIER](https://1a-1791.com/video/fww1/f0/s8/1/Z/g/4/X/Zg4Xy.0kob-small-This-game-no-longer-exists-.jpg) LIVE

LIVE

HEXIK

5 hours agoThis game no longer exists | [6-30-25] | THE CYCLE: FRONTIER

81 watching -

LIVE

LIVE

ADH Gaming

10 hours agoTasking, Lootin, shootin/ hUNT sHOWDOWN

76 watching -

2:23:35

2:23:35

TheSaltyCracker

12 hours agoSo Much Winning ReeEEeeStream 06-29-25

131K378 -

6:05:51

6:05:51

SpartakusLIVE

14 hours ago#1 Texas FARMBOY Turned World-Wide Gaming SUPERSTAR amasses NERDS in chat from the ENDS OF THE EARTH

99.6K1