Premium Only Content

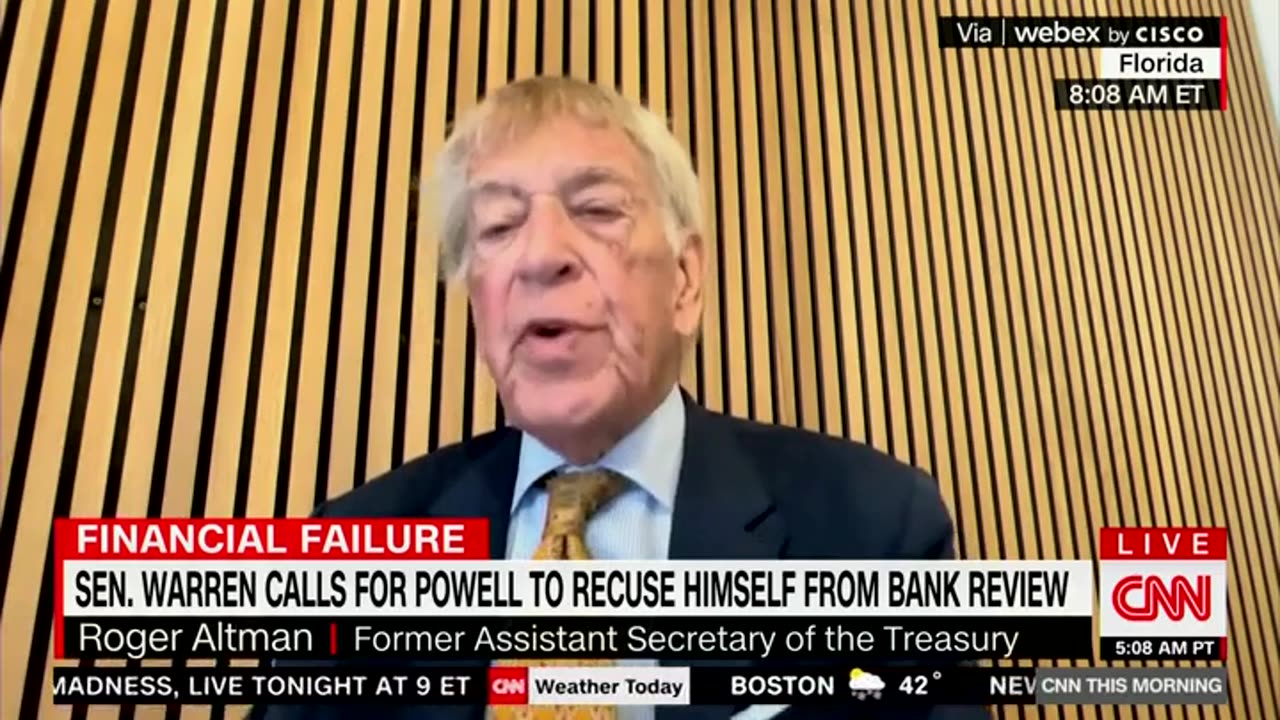

Roger Altman: U.S. Banking System Is on the Verge of Being Nationalized

the term bailout is, obviously, a loaded one. It’s in the eye of the beholder. You know, it’s like one person’s who sees something and thinks it is a kacatastrophe, another thin it’s a small accident. The main point here is that the rescues of 2008 and 2009 which we all remember so vividly became ferociously unpop lore. One of the most unpopular things that the federal government has been in 50 or 100 years. Many people think it led to the growth of the tea party and the growth of the MAGA movement, so forth. And, therefore, the administration today doesn’t want to get 1-1 hundred miles of that term bailout. Now, what the authorities did over the weekend was absolutely profound. They guaranteed the deposits, of them, at Silicon Valley bank. What that really means and they won’t say it, and I’ll come back to that, what that really means is that they have guaranteed the entire deposit base of the U.S. Financial system. The entire deposit base. Why? Because you can’t guarantee all the deposits in Silicon Valley bank and then the next day say to the depositors say at first republic, sorry, yours aren’t guaranteed. Of course they are. So this is a breathtaking step which effectively nationalizes or federalizes the deposit base of the U.S. financial number. You can call it a bailout, you can call it something else, but it’s really absolutely profound. Now, the authorities, including the White House, are not going to say that because what I just said of course implies that they have nationalized the banking system. Technically speaking, they haven’t. But in a broad sense, they are verging on that. By the way, the shareholders in Silicon Valley bank, obviously, lost all their money. Therefore, if you are a shareholder at first republic or the other banks you showed on the screen a few minutes ago, you are concerned because you saw that Silicon Valley bank the shareholders were wiped out. But the depositors at those institutions have nothing to worry about because they have just been guaranteed.

>> It is a remarkable statement to hear you say you believe the U.S. banking system has been nationalized because of this.

>> Well, no. I didn’t say it has been nationalized. I said they are verging on that because they have guaranteed the entire deposit base. Usually the terminationization means that the takes over the institution and runs it and the government owns it. That would be the type of nationalization we have seen in many other countries throughout the world. Obviously, that did not happen here. When you guarantee the entire deposit base, you have put the federal government and the taxpayer in a much different place in terms of protection than we were in a week ago.

-

2:02

2:02

Tony Katz

3 months agoIndianapolis Amazon Delivery Driver Rips Pro-Israel Sign Out of Lawn

348 -

2:16:19

2:16:19

vivafrei

12 hours agoEp. 273: Russia Hoax CONFIRMED! Will ARRESTS Follow? Trump SUES WSJ! Epstein Docs Release? & MORE!

98.4K108 -

DVR

DVR

EricJohnPizzaArtist

6 days agoAwesome Sauce PIZZA ART LIVE Ep. #55: Wendy Wild!

21.2K1 -

11:54

11:54

Tundra Tactical

5 hours ago $2.11 earnedIf You Laugh at These Gun Memes, the ATF Gets Your Dog – Tundy Meme Review

26.8K1 -

LIVE

LIVE

Cewpins

2 hours agoSunday Sesh🍃weed💨420🔥!Giveaway !mj

71 watching -

2:05:32

2:05:32

Nerdrotic

4 hours ago $2.02 earnedForbidden Inventions and Shadow Cover-ups | Forbidden Frontier #109

27.5K1 -

LIVE

LIVE

JahBlessGames

1 hour ago🎉THPS w/ Cheap | Variety Ting | Music too??

24 watching -

3:21:46

3:21:46

Barry Cunningham

11 hours agoPRESIDENT TRUMP HAS EXPOSED BARACK OBAMA AS A TRAITOR! AND MORE NEWS!

47.9K79 -

LIVE

LIVE

THOUGHTCAST With Jeff D.

1 hour agoLATE NIGHT FORTNITE. Game & News Chat with Jeff D.

23 watching -

LIVE

LIVE

Cancel This Podcast

2 hours agoDRAGON QUEST X ONLINE VERSION 5.1: SUPER DEMON WORLD WAR! - CTP Gaming!

74 watching