How to Buy Gold: 4 Ways to Invest for Dummies

https://rebrand.ly/Goldco2

Sign up Now

How to Buy Gold: 4 Ways to Invest for Dummies , to invest in gold

Goldco helps clients secure their retirement savings by surrendering their existing IRA, 401(k), 403(b) or various other certified pension to a Gold IRA. ... To find out exactly how safe house precious metals can help you build as well as safeguard your wide range, and also secure your retirement phone call today to invest in gold.

Goldco is one of the premier Precious Metals IRA firms in the United States. Safeguard your wealth and resources with physical precious metals like gold ...to invest in gold.

When financial times acquire challenging or worldwide disagreements such as what’s taking place with Russia and Ukraine toss the markets for a loophole, real estate investors frequently transform to gold as a safe haven. Capitalists who prefer to always keep gold high in situation that it becomes limited or dropped due to price fluctuations are usually awarded along with amount of money in gold bullion. Lots of of those clients also possess a stockpile of precious metal that will certainly supply them with a secure sanctuary to keep their holdings.

Along with inflation surging and the sell market exchanging effectively below its highs, some real estate investors are appearing for a safe possession that has a verified keep track of report of gains, and that’s gold. When Gold was generated, gold was simply one of a lot of precious steels that individuals owned. Today, that gold is all but going away. So while numerous who keep gold might think it's junk-backed, it's a lot less risky than various other resources, which can be very risky.

Investors just like gold for a lot of explanations, and it has characteristics that help make the item a really good counterpoint to standard safeties such as supplies and connections. It's also a fantastic technique to provide a company that is easily accessible or low-cost. The gold industry is the world's largest holder of gold, and in 2007 it was worth the $7.0 trillion market capital. In that respect, the economic climate is an outstanding artist. But it has actually a whole lot of potential, and has some downside dangers.

They regard gold as a establishment of value, also though it’s an possession that doesn’t create money circulation. The government likewise has suggested that cryptocurrencies are much safer than gold, and gold is far much more resisting to the rise of electronic currencies. The Federal Reserve, nevertheless, has not signaled it prepares to support cryptocurrencies in the course of gold-denominated acquisitions. Gold is one of the most useful possessions you can easily acquire on the available market, a setting that is not accessible anytime quickly.

Some observe gold as a hedge against rising cost of living, as the Fed’s actions to boost the economy – such as near-zero rate of interest rates – and federal government costs have delivered rising cost of living dashing higher. The dollar also has fallen greatly versus American dollars and is now in the middle of a recession, and while China is not a major economic force or contributor to the rise in individual prices, its economic climate is additionally having trouble maintaining up with the economy's growth price and the increasing worldwide trade.

5 means to purchase and sell gold Listed below are five different ways to own gold and a appeal at some of the threats that happen with each. 1 Credit rating to Gold for Wealth Creation 2 Credit to Gold for Wealth Creation 3 Credit/Residual on Your Cash For all the benefits that gold has actually to deliver, I definitely advise that you look at inspecting your harmony. The downside of gold could be that you merely have 2.5% to 3.5% that you can gain along with the gold.

Gold gold One of the much more emotionally satisfying means to have gold is to acquire it in pubs or in pieces. There are actually three primary markets where gold might inevitably ended up being a feasible assets and have come to be preferred within the past few years. The largest one is the "Euro-West.". Several overseas investors look towards gold. They assume that for the fairly reduced risk and risk taking entailed in managing cash in gold, it's a fairly simple transaction and delivers the most secure assets.

You’ll have the complete satisfaction of appearing at it and touching it, but possession has major drawbacks, too, if you own even more than only a...

-

14:56

14:56

Winston Marshall

3 days agoThe Untold Truth About The British Election

5.22K20 -

UPCOMING

UPCOMING

Revenge of the Cis

31 minutes agoEpisode 1348: Childs Play

-

UPCOMING

UPCOMING

Film Threat

5 hours agoVERSUS: THE ACOLYTE IS THE MOST TALKED ABOUT STAR WARS SERIES EVER | Film Threat Versus

262 -

LIVE

LIVE

SilverFox

20 hours ago🔴LIVE - Epic Revenge: Elden Ring - Project Radahn - Part 1

527 watching -

LIVE

LIVE

In The Litter Box w/ Jewels & Catturd

17 hours agoElection 2024: America In Chaos | In the Litter Box w/ Jewels & Catturd – Ep. 599 – 7/8/2024

5,130 watching -

1:56:30

1:56:30

The Quartering

19 hours agoTrump TORCHES Biden, France Has Fallen, Elon Betrays Free Speech & More

44.3K30 -

1:49:14

1:49:14

Barstool Yak

5 hours agoThe Yak with Big Cat & Co. Presented by Rhoback | The Yak 7-8-24

6.7K -

1:09:41

1:09:41

Russell Brand

5 hours agoWHAT’S HAPPENING IN EUROPE!? | French Right-Wing DEFEAT, Is UK Voting Fair? & Globalists! - SF 402

112K254 -

2:03:21

2:03:21

Nerdrotic

4 hours agoNerdrotic Nooner RUMBLE PREMIERE!

26.8K29 -

11:50

11:50

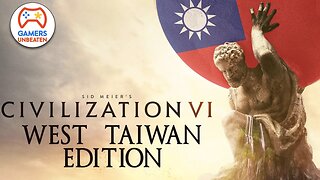

Gamers Unbeaten

4 hours agoTaiwan Would BEAT China (in Civilization VI) | Deep Thoughts While Gaming

14.7K1